Uncategorized

Walgreens, CVS slammed by pro-life groups over ‘dangerous’ decision to sell abortion pill

Kudlow’ panelists Steve Hilton and Mollie Hemingway break down liberal campaign strategy.

Pro-life groups are slamming Walgreens and CVS stores’ decision to begin selling the abortion pill mifepristone in states where it’s legal starting this month, calling it “shameful.”

“As two of the world’s largest, most trusted ‘health’ brands, the decision by CVS and Walgreens to sell dangerous abortion drugs is shameful, and the harm to unborn babies and their mothers incalculable,” Katie Daniel, state policy director for Susan B. Anthony (SBA) Pro-Life America. “This reckless policy was made possible by the Biden administration, which is pushing to turn every pharmacy and post office in America into an abortion center for the sake of abortion industry greed.”

Daniel added, “Even when used under the strongest safeguards, abortion drugs send roughly one in 25 women to the emergency room, according to the FDA’s own label. Yet under Democrat presidents, the FDA has illegally rolled back basic safety standards, like in-person doctor visits, even allowing these deadly drugs to be sent through the mail.”

Friday’s announcement comes as a legal challenge to the pill, brought in Texas by pro-life groups and doctors, was due to be heard by the U.S. Supreme Court this month.

PRO-LIFE STATES CONSIDER ABORTION EXCEPTIONS IN CASES OF FATAL FETAL ANOMALIES

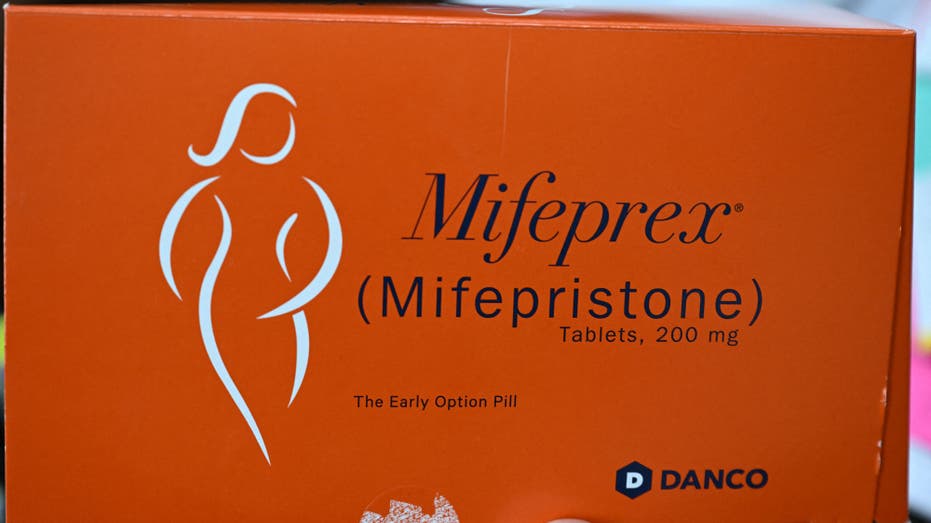

The abortin pill Mifepristone. (Robyn Beck / AFP via Getty Images / File / Getty Images)

Ingrid Skop, a board-certified OB-GYN who serves as vice president and director of medical affairs at the Charlotte Lozier Institute, a pro-life think tank, said in a statement: “Pharmacists, who do not receive clinical training, should not be distributing these dangerous drugs. By pushing these medically unsupervised abortions, the FDA and abortion advocates continue down the slippery slope of chipping away at medical standards for women seeking abortion.”

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| CVS | CVS HEALTH CORP. | 73.84 | -0.53 | -0.71% |

| WBA | WALGREENS BOOTS ALLIANCE INC. | 21.49 | +0.23 | +1.08% |

She continued, “This is not health care. This is an ideology that prioritizes destruction of unborn human life and does not care that the women injured by these abortions, whom I see in the ER on a regular basis, are collateral damage.”

President Biden praised the decision on Friday for giving women more access to health care.

In a statement he said, “With major retail pharmacy chains now certified to dispense mifepristone, many women will soon have a new option for accessing prescribed FDA-approved medication abortion. I encourage all pharmacies that want to pursue this option to seek certification and help ensure that women can access the health care they need.”

Walgreens will begin selling the abortion pill mifepristone in states where it’s legal starting this month. (Lindsey Nicholson / UCG / Universal Images Group via Getty Images / File / Getty Images)

He also accused Republican officials of “relentless attacks on reproductive freedom.”

The pharmacies had previously said they would start selling the drug last year, but later agreed they would not provide it in stores in states where Republican attorneys general had threatened to sue, prompting a backlash from pro-choice advocates.

“We will begin dispensing the pill in select locations in New York, Pennsylvania, Massachusetts, California, and Illinois,” Walgreens said on Friday.

CVS will begin filling prescriptions for the medication in Massachusetts and Rhode Island in the weeks ahead and expand to additional states, where allowed by law, on a rolling basis.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Fox Business has reached out to Walgreens and CVS for comment.

CVS told Fox Business: “We have a long history of supporting women’s health and are focused on meeting their unique health needs. This includes providing access to safe, legal, and evidence-based reproductive health services, information, and FDA-approved products like mifepristone.”

Reuters contributed to this report.

Uncategorized

Urgent Money Miracle – $2+ EPC! Get Instant 90% Commission Bump

Product Name: Urgent Money Miracle – $2+ EPC! Get Instant 90% Commission Bump

All orders are protected by SSL encryption – the highest industry standard for online security from trusted vendors.

Urgent Money Miracle – $2+ EPC! Get Instant 90% Commission Bump is backed with a 60 Day No Questions Asked Money Back Guarantee. If within the first 60 days of receipt you are not satisfied with Wake Up Lean™, you can request a refund by sending an email to the address given inside the product and we will immediately refund your entire purchase price, with no questions asked.

Uncategorized

NEW! Christian Wealth Manifestation – Highly Targeted For Christians!

Product Name: NEW! Christian Wealth Manifestation – Highly Targeted For Christians!

All orders are protected by SSL encryption – the highest industry standard for online security from trusted vendors.

NEW! Christian Wealth Manifestation – Highly Targeted For Christians! is backed with a 60 Day No Questions Asked Money Back Guarantee. If within the first 60 days of receipt you are not satisfied with Wake Up Lean™, you can request a refund by sending an email to the address given inside the product and we will immediately refund your entire purchase price, with no questions asked.

Uncategorized

Predictions for Mortgage Rates in 2024: What to Expect

As we look ahead to 2024, many homeowners and prospective buyers are wondering what to expect when it comes to mortgage rates. The landscape of the housing market is constantly changing, so it’s important to stay informed about trends and predictions. In this blog post, we will discuss some factors that could impact mortgage rates in 2024 and what homeowners and buyers can expect.

One factor that could impact mortgage rates in 2024 is the overall state of the economy. If the economy is strong and growing, we may see higher mortgage rates as the Federal Reserve looks to combat inflation. On the other hand, if the economy is stagnant or in a recession, we may see lower mortgage rates as the Fed looks to stimulate growth. It’s important to keep an eye on economic indicators such as GDP growth, unemployment rates, and inflation to get a sense of where mortgage rates may be heading.

Another factor that could impact mortgage rates in 2024 is Federal Reserve policy. The Fed plays a key role in setting interest rates, and their decisions can have a ripple effect on mortgage rates. If the Fed decides to raise interest rates in response to inflation, we may see an increase in mortgage rates. Conversely, if the Fed decides to lower interest rates to stimulate growth, we may see a decrease in mortgage rates. Keeping up with the latest news and announcements from the Fed can give homeowners and buyers a sense of where mortgage rates may be heading.

In terms of specific cities and local mortgage companies, it’s important to note that mortgage rates can vary depending on location and lender. For example, in a city like New York City, where real estate prices are high, mortgage rates may be higher compared to a city like Indianapolis, where real estate prices are lower. Additionally, local mortgage companies may offer competitive rates and terms compared to national lenders. For example, in New York City, local lenders like Quontic Bank and CrossCountry Mortgage may offer specialized products and services tailored to the needs of local buyers.

It’s important for homeowners and buyers to shop around and compare rates from multiple lenders to ensure they are getting the best deal. Websites like Bankrate and LendingTree can be helpful resources for comparing rates and terms from multiple lenders. Homeowners and buyers should also consider working with a mortgage broker who can help them navigate the lending process and find the best mortgage product for their needs.

In conclusion, predicting mortgage rates in 2024 is not an exact science, but there are several factors that could impact rates. By staying informed about economic indicators, Federal Reserve policy, and local market trends, homeowners and buyers can make informed decisions about their mortgage. Shopping around and comparing rates from multiple lenders is key to ensuring you are getting the best deal on your mortgage. Whether you’re looking to refinance your existing mortgage or buy a new home, it’s important to stay informed and be proactive in managing your mortgage.

-

Reverse Mortgage1 year ago

Reverse Mortgage1 year agoHow Reverse Loans Can Provide Financial Relief in Retirement

-

Mortgage Rates1 year ago

Mortgage Rates1 year agoComo puedo comprar una casa a crédito si no se nada?

-

Mortgage Rates1 year ago

Mortgage Rates1 year agoNiro Loan App 2024 || Niro App Se Loan Kaise Le || New Loan App Best Instant Loan App Without Cibi

-

Reverse Mortgage1 year ago

Reverse Mortgage1 year agoExploring the Myths and Realities of Reverse Mortgages for Seniors in 2024

-

Reverse Mortgage1 year ago

Reverse Mortgage1 year agoThe Pros and Cons of Using a Reverse Mortgage for Retirement Planning

-

Reverse Mortgage8 months ago

Reverse Mortgage8 months agoThe Benefits of a HECM Loan for Seniors: Financial Freedom in Retirement

-

USDA Mortgage1 year ago

USDA Mortgage1 year agoMaking Your Dream of Country Living a Reality: FMHA Rural Home Loans in Focus

-

Auto Loans6 months ago

Auto Loans6 months agoDrive Away in Your Dream Chevy with Chevrolet’s Hassle-Free Lending Process