Uncategorized

Remote workers are living increasingly further from their main offices, study finds

Minneapolis mayor Jacob Frey joked during a council meeting about the toll on the economy because of remote work. (Credit: FOX 9)

Employees are living increasingly further from their offices, a new study found, as the average distance between an employees’ home and their company offices has increased compared to before the COVID pandemic.

A study by economists at Stanford and Gusto looked at the home addresses of workers vs. the addresses of their offices and found that the average distance between their homes and office increased to 27 miles in 2023.

The New York Times reported Monday it was part of a larger “zip code shift,” as the number of people who live over 50 miles away from their company offices increased by more than five times, from 0.8% to 5.5%.

Millennial workers, employees ages 30-39, are living the furthest away from their employers, the study found. The distance between their homes and company offices rose the most in 2023.

A person works from home in an arranged photograph taken in Tiskilwa, Illinois, U.S., on Tuesday, Sept. 8, 2020. Photographer: Daniel Acker/Bloomberg via Getty Images (Photographer: Daniel Acker/Bloomberg via Getty Images)

REMOTE WORK FOR THE WIN: HOW IN-OFFICE REQUIREMENTS ARE HURTING COMPANIES

The study also found that employees with the highest earnings were the ones driving the increased distances between offices and employee homes.

“In 2018, workers earning $10,000 to $50,000 lived on average 11 miles from work, compared to 12 miles for workers earning more than $250,000 per year. By December 2023, the distance for those making $10,000-$50,000 rose to 18 miles, while the highest earners increased to 42 miles,” the study’s key findings said.

The study said that remote and hybrid workers are one of the most “long-lasting” legacies of the pandemic, and despite some major companies requiring their employees to return to the office, the trend of living further from company offices remains consistent for smaller and medium sized businesses as well.

Another February study from ResumeBuilder.com found that over half of employees that have been told to return to the office for work were currently looking for or planning to look for new jobs.

A woman works at a desktop computer alongside an Apple Inc. laptop in a home office in this arranged photograph taken in Bern, Switzerland, on Saturday, Aug. 22, 2020. (Stefan Wermuth/Bloomberg via Getty Images / Getty Images)

“Eighteen percent of workers forced to [return to the office] say they are currently looking for a new job” and “36% plan to look this year,” ResumeBuilder.com found in a February survey conducted via SurveyMonkey.

“Many of those who are currently seeking out a new job are doing so actively,” the report explained. “In fact, 11% are applying to more than 10 positions per week, while 28% are applying to six to 10 positions, and 60% are applying to one to five jobs.”

The New York Times reported that just 12% of the workforce is able to work fully remote. Others who were required to return to the office and work on a hybrid schedule have accepted longer commutes as they still chose to leave expensive housing markets like New York City.

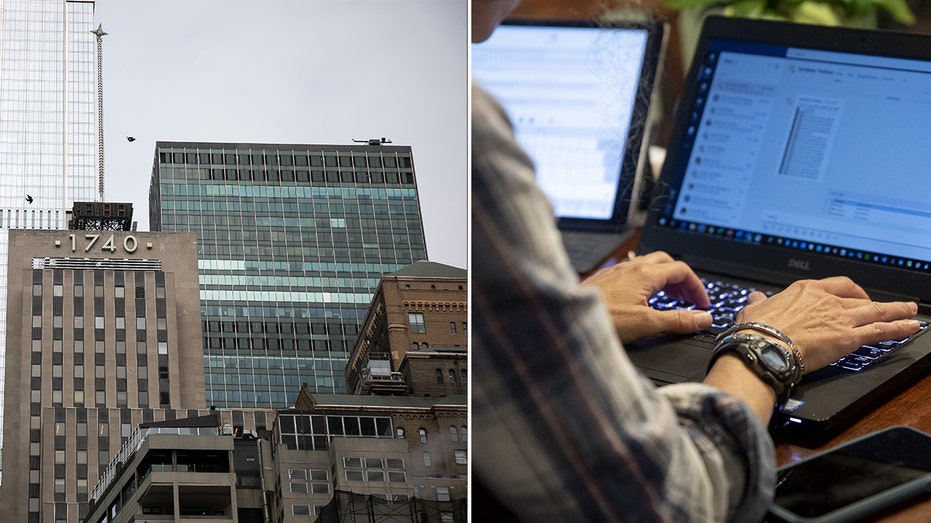

Remote workers are living increasingly further from their company offices, a new study found. (Left: Michael Nagle/Bloomberg via Getty Images, Right: Photographer: Daniel Acker/Bloomberg via Getty Images) ((Left: Michael Nagle/Bloomberg via Getty Images, Right: Photographer: Daniel Acker/Bloomberg via Getty Images))

CLICK HERE TO GET THE FOX NEWS APP

One, Verna Coleman, purchased a house in Cincinatti in 2020 after she began working remotely. She previously lived in Brooklyn and commuted into New York five days a week for her job.

The Times reported Coleman now commutes to New York City for three days every other week and rents an apartment in Harlem for when she’s in town.

“It’s only an hour-and-a-half flight, so I frequently cite to people it’s a shorter flight than driving across the George Washington Bridge and sitting in traffic for two and a half hours,” she said. “I take a 6 a.m. flight from Cincinnati, and I’m normally at my desk before 9.”

Uncategorized

Urgent Money Miracle – $2+ EPC! Get Instant 90% Commission Bump

Product Name: Urgent Money Miracle – $2+ EPC! Get Instant 90% Commission Bump

All orders are protected by SSL encryption – the highest industry standard for online security from trusted vendors.

Urgent Money Miracle – $2+ EPC! Get Instant 90% Commission Bump is backed with a 60 Day No Questions Asked Money Back Guarantee. If within the first 60 days of receipt you are not satisfied with Wake Up Lean™, you can request a refund by sending an email to the address given inside the product and we will immediately refund your entire purchase price, with no questions asked.

Uncategorized

NEW! Christian Wealth Manifestation – Highly Targeted For Christians!

Product Name: NEW! Christian Wealth Manifestation – Highly Targeted For Christians!

All orders are protected by SSL encryption – the highest industry standard for online security from trusted vendors.

NEW! Christian Wealth Manifestation – Highly Targeted For Christians! is backed with a 60 Day No Questions Asked Money Back Guarantee. If within the first 60 days of receipt you are not satisfied with Wake Up Lean™, you can request a refund by sending an email to the address given inside the product and we will immediately refund your entire purchase price, with no questions asked.

Uncategorized

Predictions for Mortgage Rates in 2024: What to Expect

As we look ahead to 2024, many homeowners and prospective buyers are wondering what to expect when it comes to mortgage rates. The landscape of the housing market is constantly changing, so it’s important to stay informed about trends and predictions. In this blog post, we will discuss some factors that could impact mortgage rates in 2024 and what homeowners and buyers can expect.

One factor that could impact mortgage rates in 2024 is the overall state of the economy. If the economy is strong and growing, we may see higher mortgage rates as the Federal Reserve looks to combat inflation. On the other hand, if the economy is stagnant or in a recession, we may see lower mortgage rates as the Fed looks to stimulate growth. It’s important to keep an eye on economic indicators such as GDP growth, unemployment rates, and inflation to get a sense of where mortgage rates may be heading.

Another factor that could impact mortgage rates in 2024 is Federal Reserve policy. The Fed plays a key role in setting interest rates, and their decisions can have a ripple effect on mortgage rates. If the Fed decides to raise interest rates in response to inflation, we may see an increase in mortgage rates. Conversely, if the Fed decides to lower interest rates to stimulate growth, we may see a decrease in mortgage rates. Keeping up with the latest news and announcements from the Fed can give homeowners and buyers a sense of where mortgage rates may be heading.

In terms of specific cities and local mortgage companies, it’s important to note that mortgage rates can vary depending on location and lender. For example, in a city like New York City, where real estate prices are high, mortgage rates may be higher compared to a city like Indianapolis, where real estate prices are lower. Additionally, local mortgage companies may offer competitive rates and terms compared to national lenders. For example, in New York City, local lenders like Quontic Bank and CrossCountry Mortgage may offer specialized products and services tailored to the needs of local buyers.

It’s important for homeowners and buyers to shop around and compare rates from multiple lenders to ensure they are getting the best deal. Websites like Bankrate and LendingTree can be helpful resources for comparing rates and terms from multiple lenders. Homeowners and buyers should also consider working with a mortgage broker who can help them navigate the lending process and find the best mortgage product for their needs.

In conclusion, predicting mortgage rates in 2024 is not an exact science, but there are several factors that could impact rates. By staying informed about economic indicators, Federal Reserve policy, and local market trends, homeowners and buyers can make informed decisions about their mortgage. Shopping around and comparing rates from multiple lenders is key to ensuring you are getting the best deal on your mortgage. Whether you’re looking to refinance your existing mortgage or buy a new home, it’s important to stay informed and be proactive in managing your mortgage.

-

Reverse Mortgage1 year ago

Reverse Mortgage1 year agoHow Reverse Loans Can Provide Financial Relief in Retirement

-

Mortgage Rates1 year ago

Mortgage Rates1 year agoComo puedo comprar una casa a crédito si no se nada?

-

Mortgage Rates1 year ago

Mortgage Rates1 year agoNiro Loan App 2024 || Niro App Se Loan Kaise Le || New Loan App Best Instant Loan App Without Cibi

-

Reverse Mortgage1 year ago

Reverse Mortgage1 year agoExploring the Myths and Realities of Reverse Mortgages for Seniors in 2024

-

Reverse Mortgage1 year ago

Reverse Mortgage1 year agoThe Pros and Cons of Using a Reverse Mortgage for Retirement Planning

-

Reverse Mortgage8 months ago

Reverse Mortgage8 months agoThe Benefits of a HECM Loan for Seniors: Financial Freedom in Retirement

-

USDA Mortgage1 year ago

USDA Mortgage1 year agoMaking Your Dream of Country Living a Reality: FMHA Rural Home Loans in Focus

-

Auto Loans6 months ago

Auto Loans6 months agoDrive Away in Your Dream Chevy with Chevrolet’s Hassle-Free Lending Process