Uncategorized

QVC apologizes to Asian community, vows increased DEI work after ‘offensive’ email to customers

Campus Reform higher education fellow Nicholas Giordano discusses whether students should comply with DEI guidelines to get into college on ‘Varney & Co.’

Home shopping company QVC issued an apology to its customers — Asian female customers in particular — and vowed to work more closely with its DEI team after sending a marketing email containing “offensive” language.

“You’ll love this bag longtime,” an email subject line sent to QVC customers Friday morning said.

Fox News Digital reviewed the email, which was advertising a handbag as the company’s “Today’s Special Value” item.

QVC President Mike Fitzharris soon followed with an apology to customers later Friday, noting such language is “offensive,” especially to the Asian community.

Email subject line sent by QVC to customers. (Fox News Digital / Fox News)

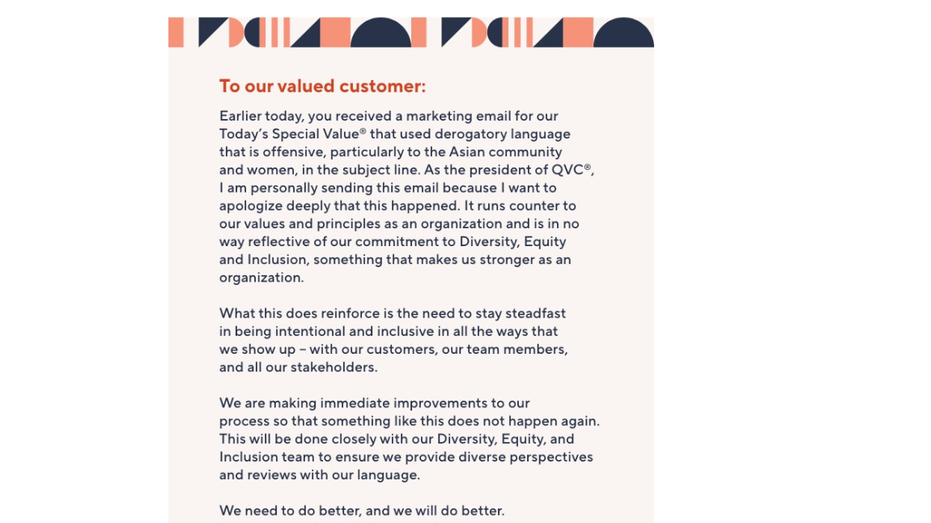

“Earlier today, you received a marketing email for our Today’s Special Value® that used derogatory language that is offensive, particularly to the Asian community and women, in the subject line. As the president of QVC®, I am personally sending this email because I want to apologize deeply that this happened,” Fitzharris wrote.

The email advertising the handbag and the apology were sent on International Women’s Day, billed as a global celebration of women.

AIRLINE APOLOGIZES AFTER PLACING INNOCENT MAN ON NO-FLY LIST, TATTLING ON HIM TO BOSS

Mike Fitzharris and Mike George attend the New Qurate Retail Group opening bell ceremony at NASDAQ MarketSite June 12, 2018, in New York City. (Ben Gabbe/Getty Images for Qurate Retail Group / Getty Images)

The subject line is apparently in reference to the phrase “me love you longtime,” which has long been considered offensive to Asian women and carries sexual connotations. The phrase was popularized in the 1987 movie “Full Metal Jacket,” when an actress portraying a Vietnamese prostitute said the line while trying to attract American johns during the Vietnam War.

“It’s a weaponized phrase deployed to put down Asian diaspora women, to make us the joke. It’s used to reduce Asian and Asian-American women to sex objects,” Esquire wrote in 2021 of the phrase.

Fitzharris added that the use of the phrase by QVC “runs counter to our values and principles as an organization and is in no way reflective of our commitment to Diversity, Equity and Inclusion.”

QVC homepage (Uwe Zucchi/picture alliance via Getty Images / Getty Images)

QVC is owned by Qurate Retail Group, which outlines on its website that “cultivating inclusive environments is both a human issue and a business issue.” Qurate Retail Group has won a handful of DEI-focused recognitions, including being listed “two years in a row as one of Forbes America’s Best Employers for Diversity,” and as “Best Place to Work for Disability Inclusion” on the 2022 Disability Equality Index (DEI), according to the company’s website.

TECH RECRUITING FIRM APOLOGIZES FOR JOB AD SEEKING ‘PREFERABLY CAUCASIAN’ EMPLOYEE

Following the marketing email, QVC’s chief said the company will work closely with its DEI team to ensure it doesn’t happen again.

QVC apology to customers following an email on the company’s Today’s Special Value. (Fox News Digital / Fox News)

“We are making immediate improvements to our process so that something like this does not happen again. This will be done closely with our Diversity, Equity, and Inclusion team to ensure we provide diverse perspectives and reviews with our language,” Fitzharris added.

RED-FACED GOOGLE APOLOGIZES AFTER WOKE AI BOT GIVES ‘APPALLING’ ANSWERS ABOUT PEDOPHILIA, STALIN

In this photo illustration, the QVC logo is displayed on a smartphone. (Photo Illustration by Rafael Henrique/SOPA Images/LightRocket via Getty Images / Getty Images)

QVC was founded in 1986 and emerged as a premier home shopping station, selling goods from housewares to clothing to makeup.

CLICK HERE TO READ MORE FROM FOX BUSINESS

Fox News Digital repeatedly reached out to the organization for additional comment about the email and apology but did not receive a reply.

Uncategorized

Urgent Money Miracle – $2+ EPC! Get Instant 90% Commission Bump

Product Name: Urgent Money Miracle – $2+ EPC! Get Instant 90% Commission Bump

All orders are protected by SSL encryption – the highest industry standard for online security from trusted vendors.

Urgent Money Miracle – $2+ EPC! Get Instant 90% Commission Bump is backed with a 60 Day No Questions Asked Money Back Guarantee. If within the first 60 days of receipt you are not satisfied with Wake Up Lean™, you can request a refund by sending an email to the address given inside the product and we will immediately refund your entire purchase price, with no questions asked.

Uncategorized

NEW! Christian Wealth Manifestation – Highly Targeted For Christians!

Product Name: NEW! Christian Wealth Manifestation – Highly Targeted For Christians!

All orders are protected by SSL encryption – the highest industry standard for online security from trusted vendors.

NEW! Christian Wealth Manifestation – Highly Targeted For Christians! is backed with a 60 Day No Questions Asked Money Back Guarantee. If within the first 60 days of receipt you are not satisfied with Wake Up Lean™, you can request a refund by sending an email to the address given inside the product and we will immediately refund your entire purchase price, with no questions asked.

Uncategorized

Predictions for Mortgage Rates in 2024: What to Expect

As we look ahead to 2024, many homeowners and prospective buyers are wondering what to expect when it comes to mortgage rates. The landscape of the housing market is constantly changing, so it’s important to stay informed about trends and predictions. In this blog post, we will discuss some factors that could impact mortgage rates in 2024 and what homeowners and buyers can expect.

One factor that could impact mortgage rates in 2024 is the overall state of the economy. If the economy is strong and growing, we may see higher mortgage rates as the Federal Reserve looks to combat inflation. On the other hand, if the economy is stagnant or in a recession, we may see lower mortgage rates as the Fed looks to stimulate growth. It’s important to keep an eye on economic indicators such as GDP growth, unemployment rates, and inflation to get a sense of where mortgage rates may be heading.

Another factor that could impact mortgage rates in 2024 is Federal Reserve policy. The Fed plays a key role in setting interest rates, and their decisions can have a ripple effect on mortgage rates. If the Fed decides to raise interest rates in response to inflation, we may see an increase in mortgage rates. Conversely, if the Fed decides to lower interest rates to stimulate growth, we may see a decrease in mortgage rates. Keeping up with the latest news and announcements from the Fed can give homeowners and buyers a sense of where mortgage rates may be heading.

In terms of specific cities and local mortgage companies, it’s important to note that mortgage rates can vary depending on location and lender. For example, in a city like New York City, where real estate prices are high, mortgage rates may be higher compared to a city like Indianapolis, where real estate prices are lower. Additionally, local mortgage companies may offer competitive rates and terms compared to national lenders. For example, in New York City, local lenders like Quontic Bank and CrossCountry Mortgage may offer specialized products and services tailored to the needs of local buyers.

It’s important for homeowners and buyers to shop around and compare rates from multiple lenders to ensure they are getting the best deal. Websites like Bankrate and LendingTree can be helpful resources for comparing rates and terms from multiple lenders. Homeowners and buyers should also consider working with a mortgage broker who can help them navigate the lending process and find the best mortgage product for their needs.

In conclusion, predicting mortgage rates in 2024 is not an exact science, but there are several factors that could impact rates. By staying informed about economic indicators, Federal Reserve policy, and local market trends, homeowners and buyers can make informed decisions about their mortgage. Shopping around and comparing rates from multiple lenders is key to ensuring you are getting the best deal on your mortgage. Whether you’re looking to refinance your existing mortgage or buy a new home, it’s important to stay informed and be proactive in managing your mortgage.

-

Reverse Mortgage1 year ago

Reverse Mortgage1 year agoHow Reverse Loans Can Provide Financial Relief in Retirement

-

Mortgage Rates1 year ago

Mortgage Rates1 year agoComo puedo comprar una casa a crédito si no se nada?

-

Mortgage Rates1 year ago

Mortgage Rates1 year agoNiro Loan App 2024 || Niro App Se Loan Kaise Le || New Loan App Best Instant Loan App Without Cibi

-

Reverse Mortgage1 year ago

Reverse Mortgage1 year agoExploring the Myths and Realities of Reverse Mortgages for Seniors in 2024

-

Reverse Mortgage1 year ago

Reverse Mortgage1 year agoThe Pros and Cons of Using a Reverse Mortgage for Retirement Planning

-

Reverse Mortgage8 months ago

Reverse Mortgage8 months agoThe Benefits of a HECM Loan for Seniors: Financial Freedom in Retirement

-

USDA Mortgage1 year ago

USDA Mortgage1 year agoMaking Your Dream of Country Living a Reality: FMHA Rural Home Loans in Focus

-

Auto Loans6 months ago

Auto Loans6 months agoDrive Away in Your Dream Chevy with Chevrolet’s Hassle-Free Lending Process