Uncategorized

Paul Giamatti is the son of a baseball commissioner. He might win an Oscar.

Movie chain CEO Sean Gamble discusses his predictions ahead of the awards show this Sunday on ‘The Claman Countdown.’

Seven years before his Academy Award-nominated performance as a curmudgeonly teacher at a New England boarding school in “The Holdovers,” Paul Giamatti starred in a small indie drama called “The Phenom.” He played a sports psychologist tasked with trying to help a troubled young pitcher overcome a sudden inability to throw the ball anywhere near the plate.

The little-seen film is a footnote in an acting career that has spanned more than three decades and could reach a new pinnacle with a win at the Oscars on Sunday. But it holds a special distinction on Giamatti’s résumé: It’s the only time the son of a baseball commissioner has appeared in a baseball movie.

“I’m sure we could analyze it in a Freudian way, like why did he do a baseball movie?” said Noah Buschel, who wrote and directed “The Phenom.” “The baseball movie he ended up doing was actually not a baseball movie. It was about fathers and sons.”

ADAM SANDLER, ‘BARBIE’ STARS MARGOT ROBBIE AND RYAN GOSLING TOP FORBES’ HIGHEST-PAID ACTORS LIST

Bart Giamatti, Paul’s father, was perhaps the least likely person in baseball history to serve as commissioner. He wasn’t a bulldog labor lawyer like Rob Manfred, an influential team owner like Bud Selig or a high-powered executive like Fay Vincent. He was a respected scholar and professor of English Renaissance literature whose passion for the arts might only have been surpassed by his love for baseball.

When Bart Giamatti’s name surfaced as a candidate to become president of Yale—a position he held from 1978-1986—he responded, “The only thing I ever wanted to be president of was the American League.” (His wish nearly came true; Giamatti spent two years as president of the National League.)

Giamatti’s tenure as commissioner was memorable. He is the man who banned Pete Rose from baseball for life, one of the sport’s single most consequential decisions of the past 35 years.

Baseball commissioner Bart Giamatti in 1989 announcing the lifetime banishment of Pete Rose from baseball. (Getty Images / Getty Images)

But his time in the job was also brief, which could explain why his relationship to a beloved Hollywood star remains largely unknown to the public. A week after Giamatti banished Rose—and just five months after he assumed office—he died of a heart attack at the age of 51.

Paul Giamatti was 22 at the time, still several years away from earning his master’s degree from Yale’s drama school and even further from his breakout part as Kenny “Pig Vomit” Rushton in 1997’s “Private Parts.” As a result, Bart Giamatti never saw either of his two sons achieve success in a famously ruthless business. Paul’s older brother, Marcus, is also an actor, known best for his regular role on the CBS series “Judging Amy” from 1999-2005.

“He was really worried because he knew how hard it was,” Marcus Giamatti said. “He probably wished that we had done something that wasn’t such a struggle.”

EXPLORING OSCAR-NOMINATED JACK FISK’S LEGENDARY PRODUCTION DESIGNS: ‘I LIKE TO BUILD’

Though Bart Giamatti supported Paul’s aspirations and believed he had a chance to make it in his chosen profession, there were times when he harbored doubts.

Vincent, Giamatti’s successor as commissioner and a close friend, recalled Giamatti once coming to him to seek some advice. Instructors at Yale were saying that Paul was unusually gifted, but Bart wanted to know if Vincent, a former chairman of Columbia Pictures, thought he really was that talented.

“I said, ‘Well, if he is, it’s like baseball,’” Vincent said. “If he is a really good baseball player, there’s no way he can hide it. It will come out. And when it does, people will go after him for his skills.”

Paul Giamatti really was that talented. To those who knew Bart, that didn’t come as a surprise.

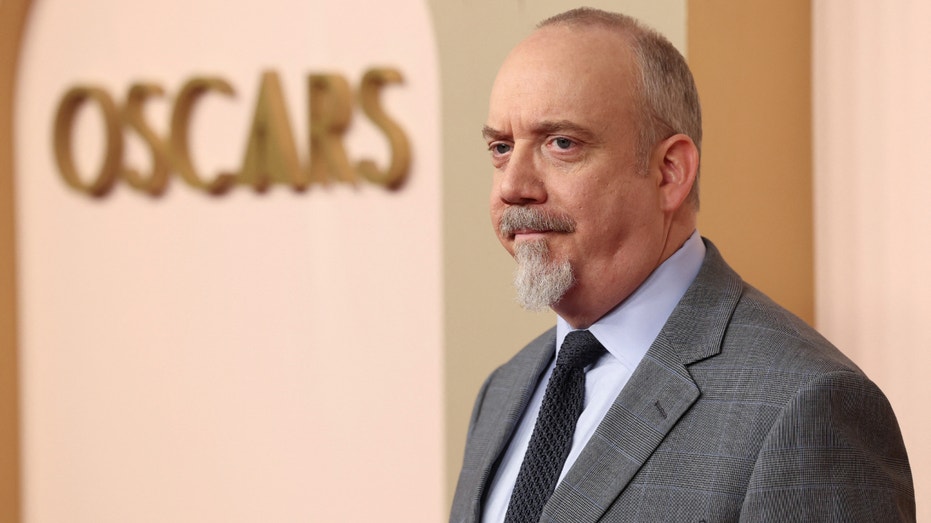

Paul Giamatti, nominated for Best Actor in a Leading Role, for “The Holdovers,” attends the Nominees Luncheon for the 96th Oscars in Beverly Hills, California, on Feb. 12, 2024. (Reuters/Mario Anzuoni / Reuters Photos)

Bart Giamatti had the acting bug too, even meeting his future wife, Toni, when they were castmates in plays at Yale. Marcus Giamatti said he believes it was a musical adaptation of “Cyrano de Bergerac” that sealed their romance. Bart had a small role. Toni was the lead.

Marcus Giamatti said he never discussed with his father why he never pursued acting professionally, though by all accounts he could have. Instead, Bart Giamatti focused on his academic interests, particularly the work of the English poet Edmund Spenser.

His ability as an actor manifested in other ways. Vincent said Giamatti’s strength as commissioner was his ability to connect with people with whom he seemingly had little in common, like baseball’s umpires. Vincent called him “a born actor.”

SALLY FIELD REALIZED BURT REYNOLDS ROMANCE ‘WOULDN’T LAST’ AFTER THIS OSCAR MOMENT, AUTHOR CLAIMS

“Bart could play any role that he wanted to play,” he said. “Paul’s genius is to some extent genetic.”

When the major-league owners were searching for a new commissioner in 1984, a friend suggested to Selig that he speak with Giamatti. By then Giamatti had already written “The Green Fields of the Mind,” an essay about the romance of baseball that begins, “It breaks your heart. It is designed to break your heart.”

Selig and Giamatti met for dinner in New York, replaying in excruciating detail the summer of 1949, when their favorite childhood teams—the Yankees for Selig, the Red Sox for Giamatti—battled for the AL pennant. Selig came away convinced Giamatti belonged in baseball. In 1986, he arrived.

“He wrote and spoke as eloquently about baseball as any human being ever has,” Selig said.

(L-R) Dominic Sessa, Da’Vine Joy Randolph, Paul Giamatti, David Hemingson and director Alexander Payne of “The Holdovers” with moderator Taylor Hackford at The London West Hollywood at Beverly Hills on Nov. 17, 2023. ((Photo by Stewart Cook/Getty Images for Focus Features) / Getty Images)

Paul Giamatti has said he isn’t much of a baseball fan these days, but Bart passed on his love of baseball to Marcus, who says the game was the way he connected with his dad.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

In “The Holdovers,” however, Giamatti channels his father—in a way. His character, Paul Hunham, teaches classics in the same sort of academic environment that he grew up in. The film’s director, Alexander Payne, has said that the part was written for Giamatti. It has garnered him the second Oscar nomination of his career and the first in the best actor category.

But while Paul Hunham and Bart Giamatti shared a passion for history and literature, they differ in at least one key way: Bart Giamatti wasn’t nearly as grumpy as the character his son portrayed.

“Who’s going to be like my father?” Marcus Giamatti said. “Nobody.”

Uncategorized

Urgent Money Miracle – $2+ EPC! Get Instant 90% Commission Bump

Product Name: Urgent Money Miracle – $2+ EPC! Get Instant 90% Commission Bump

All orders are protected by SSL encryption – the highest industry standard for online security from trusted vendors.

Urgent Money Miracle – $2+ EPC! Get Instant 90% Commission Bump is backed with a 60 Day No Questions Asked Money Back Guarantee. If within the first 60 days of receipt you are not satisfied with Wake Up Lean™, you can request a refund by sending an email to the address given inside the product and we will immediately refund your entire purchase price, with no questions asked.

Uncategorized

NEW! Christian Wealth Manifestation – Highly Targeted For Christians!

Product Name: NEW! Christian Wealth Manifestation – Highly Targeted For Christians!

All orders are protected by SSL encryption – the highest industry standard for online security from trusted vendors.

NEW! Christian Wealth Manifestation – Highly Targeted For Christians! is backed with a 60 Day No Questions Asked Money Back Guarantee. If within the first 60 days of receipt you are not satisfied with Wake Up Lean™, you can request a refund by sending an email to the address given inside the product and we will immediately refund your entire purchase price, with no questions asked.

Uncategorized

Predictions for Mortgage Rates in 2024: What to Expect

As we look ahead to 2024, many homeowners and prospective buyers are wondering what to expect when it comes to mortgage rates. The landscape of the housing market is constantly changing, so it’s important to stay informed about trends and predictions. In this blog post, we will discuss some factors that could impact mortgage rates in 2024 and what homeowners and buyers can expect.

One factor that could impact mortgage rates in 2024 is the overall state of the economy. If the economy is strong and growing, we may see higher mortgage rates as the Federal Reserve looks to combat inflation. On the other hand, if the economy is stagnant or in a recession, we may see lower mortgage rates as the Fed looks to stimulate growth. It’s important to keep an eye on economic indicators such as GDP growth, unemployment rates, and inflation to get a sense of where mortgage rates may be heading.

Another factor that could impact mortgage rates in 2024 is Federal Reserve policy. The Fed plays a key role in setting interest rates, and their decisions can have a ripple effect on mortgage rates. If the Fed decides to raise interest rates in response to inflation, we may see an increase in mortgage rates. Conversely, if the Fed decides to lower interest rates to stimulate growth, we may see a decrease in mortgage rates. Keeping up with the latest news and announcements from the Fed can give homeowners and buyers a sense of where mortgage rates may be heading.

In terms of specific cities and local mortgage companies, it’s important to note that mortgage rates can vary depending on location and lender. For example, in a city like New York City, where real estate prices are high, mortgage rates may be higher compared to a city like Indianapolis, where real estate prices are lower. Additionally, local mortgage companies may offer competitive rates and terms compared to national lenders. For example, in New York City, local lenders like Quontic Bank and CrossCountry Mortgage may offer specialized products and services tailored to the needs of local buyers.

It’s important for homeowners and buyers to shop around and compare rates from multiple lenders to ensure they are getting the best deal. Websites like Bankrate and LendingTree can be helpful resources for comparing rates and terms from multiple lenders. Homeowners and buyers should also consider working with a mortgage broker who can help them navigate the lending process and find the best mortgage product for their needs.

In conclusion, predicting mortgage rates in 2024 is not an exact science, but there are several factors that could impact rates. By staying informed about economic indicators, Federal Reserve policy, and local market trends, homeowners and buyers can make informed decisions about their mortgage. Shopping around and comparing rates from multiple lenders is key to ensuring you are getting the best deal on your mortgage. Whether you’re looking to refinance your existing mortgage or buy a new home, it’s important to stay informed and be proactive in managing your mortgage.

-

Reverse Mortgage1 year ago

Reverse Mortgage1 year agoHow Reverse Loans Can Provide Financial Relief in Retirement

-

Mortgage Rates1 year ago

Mortgage Rates1 year agoComo puedo comprar una casa a crédito si no se nada?

-

Mortgage Rates1 year ago

Mortgage Rates1 year agoNiro Loan App 2024 || Niro App Se Loan Kaise Le || New Loan App Best Instant Loan App Without Cibi

-

Reverse Mortgage1 year ago

Reverse Mortgage1 year agoExploring the Myths and Realities of Reverse Mortgages for Seniors in 2024

-

Reverse Mortgage1 year ago

Reverse Mortgage1 year agoThe Pros and Cons of Using a Reverse Mortgage for Retirement Planning

-

Reverse Mortgage8 months ago

Reverse Mortgage8 months agoThe Benefits of a HECM Loan for Seniors: Financial Freedom in Retirement

-

USDA Mortgage1 year ago

USDA Mortgage1 year agoMaking Your Dream of Country Living a Reality: FMHA Rural Home Loans in Focus

-

Auto Loans6 months ago

Auto Loans6 months agoDrive Away in Your Dream Chevy with Chevrolet’s Hassle-Free Lending Process