Uncategorized

Nvidia CEO Jensen Huang says AI could pass most human tests in 5 years

Satori Fund senior portfolio manager Dan Niles analyzes the performance of the ‘Magnificent 7’ stocks and reveals some upcoming investment opportunities on ‘Making Money.’

Nvidia CEO Jensen Huang said Friday that artificial general intelligence (AGI) could, by some definitions, arrive in as little as five years.

Huang, who leads the world’s leading maker of artificial intelligence chips used to create systems like OpenAI’s ChatGPT, appeared at an economic forum held at Stanford University where he was asked about how long it would take to achieve AGI with computers capable of thinking like humans.

He responded that the answer largely depends on how the goal of AGI is defined. If the definition is the ability to pass human tests, Huang said that AGI will arrive soon.

“If I gave an AI… every single test that you can possibly imagine, you make that list of tests and put it in front of the computer science industry, and I’m guessing in five years time, we’ll do well on every single one,” Huang said.

NVIDIA CEO IS $9.6B RICHER AS AI CHIPMAKER’S STOCK SOARS

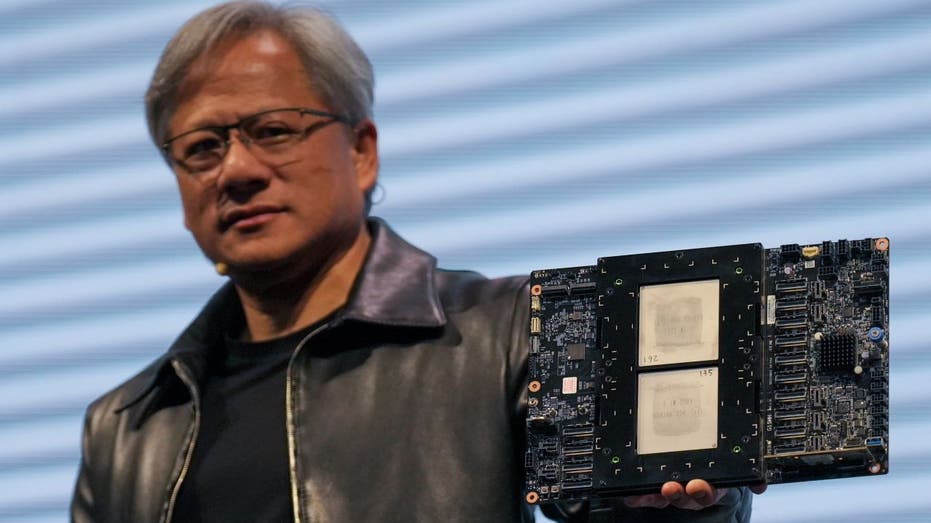

Jensen Huang, President of NVIDIA holding the Grace hopper superchip CPU used for generative AI at supermicro keynote presentation during the COMPUTEX 2023. The COMPUTEX 2023 runs from 30 May to 02 June 2023 and gathers over 1,000 exhibitors from 26 (Photo by Walid Berrazeg/SOPA Images/LightRocket via Getty Images / Getty Images)

Currently, AI can pass tests like legal bar exams but has struggled on specialized medical tests like gastroenterology.

Based on other definitions of AGI, Huang said it may be much farther away because there is still disagreement among scientists about how to describe how human minds work.

“Therefore, it’s hard to achieve as an engineer” because engineers need defined goals, Huang said.

NVIDIA’S STOCK SOARS AFTER AI BOOM LIFTS REVENUE 265%

Nvidia co-founder and CEO Jensen Huang says the timing of AGI depends on how it’s defined. (Photographer: I-Hwa Cheng/Bloomberg via Getty Images / Getty Images)

The Nvidia CEO also addressed a question about how many more chip factories, called “fabs” in the industry, are needed to support the expansion of the AI industry.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| NVDA | NVIDIA CORP. | 822.79 | +31.67 | +4.00% |

Media reports have indicated that OpenAI CEO Sam Altman thinks many more fabs will be needed, and he has pursued funding for an AI chip venture.

WHAT IS ARTIFICIAL INTELLIGENCE (AI)?

Nvidia’s role as the leading designer of AI chips has driven massive growth in its stock price. ((Photo by Jakub Porzycki/NurPhoto via Getty Images) / Getty Images)

Huang said that more fabs will be needed but noted that each chip will also get better over time, which limits the number of chips required by customers.

“We’re going to need more fabs. However, remember that we’re also improving the algorithms and the processing of (AI) tremendously over time,” Huang said. “It’s not as if the efficiency of computing is what it is today, and therefore the demand is this much. I’m improving computing by a million times over 10 years.”

Nvidia recently surpassed the threshold of $2 trillion in market capitalization, surpassing Google parent company Alphabet’s $1.71 trillion and Amazon’s $1.85 trillion to become the third-largest U.S. company by market cap – trailing only Microsoft and Apple.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Nvidia’s stock is up 70.8% so far in 2024. The AI chip giant’s share price has risen by 244% over the past year and 2,084% in the past five years.

Reuters contributed to this report.

Uncategorized

Urgent Money Miracle – $2+ EPC! Get Instant 90% Commission Bump

Product Name: Urgent Money Miracle – $2+ EPC! Get Instant 90% Commission Bump

All orders are protected by SSL encryption – the highest industry standard for online security from trusted vendors.

Urgent Money Miracle – $2+ EPC! Get Instant 90% Commission Bump is backed with a 60 Day No Questions Asked Money Back Guarantee. If within the first 60 days of receipt you are not satisfied with Wake Up Lean™, you can request a refund by sending an email to the address given inside the product and we will immediately refund your entire purchase price, with no questions asked.

Uncategorized

NEW! Christian Wealth Manifestation – Highly Targeted For Christians!

Product Name: NEW! Christian Wealth Manifestation – Highly Targeted For Christians!

All orders are protected by SSL encryption – the highest industry standard for online security from trusted vendors.

NEW! Christian Wealth Manifestation – Highly Targeted For Christians! is backed with a 60 Day No Questions Asked Money Back Guarantee. If within the first 60 days of receipt you are not satisfied with Wake Up Lean™, you can request a refund by sending an email to the address given inside the product and we will immediately refund your entire purchase price, with no questions asked.

Uncategorized

Predictions for Mortgage Rates in 2024: What to Expect

As we look ahead to 2024, many homeowners and prospective buyers are wondering what to expect when it comes to mortgage rates. The landscape of the housing market is constantly changing, so it’s important to stay informed about trends and predictions. In this blog post, we will discuss some factors that could impact mortgage rates in 2024 and what homeowners and buyers can expect.

One factor that could impact mortgage rates in 2024 is the overall state of the economy. If the economy is strong and growing, we may see higher mortgage rates as the Federal Reserve looks to combat inflation. On the other hand, if the economy is stagnant or in a recession, we may see lower mortgage rates as the Fed looks to stimulate growth. It’s important to keep an eye on economic indicators such as GDP growth, unemployment rates, and inflation to get a sense of where mortgage rates may be heading.

Another factor that could impact mortgage rates in 2024 is Federal Reserve policy. The Fed plays a key role in setting interest rates, and their decisions can have a ripple effect on mortgage rates. If the Fed decides to raise interest rates in response to inflation, we may see an increase in mortgage rates. Conversely, if the Fed decides to lower interest rates to stimulate growth, we may see a decrease in mortgage rates. Keeping up with the latest news and announcements from the Fed can give homeowners and buyers a sense of where mortgage rates may be heading.

In terms of specific cities and local mortgage companies, it’s important to note that mortgage rates can vary depending on location and lender. For example, in a city like New York City, where real estate prices are high, mortgage rates may be higher compared to a city like Indianapolis, where real estate prices are lower. Additionally, local mortgage companies may offer competitive rates and terms compared to national lenders. For example, in New York City, local lenders like Quontic Bank and CrossCountry Mortgage may offer specialized products and services tailored to the needs of local buyers.

It’s important for homeowners and buyers to shop around and compare rates from multiple lenders to ensure they are getting the best deal. Websites like Bankrate and LendingTree can be helpful resources for comparing rates and terms from multiple lenders. Homeowners and buyers should also consider working with a mortgage broker who can help them navigate the lending process and find the best mortgage product for their needs.

In conclusion, predicting mortgage rates in 2024 is not an exact science, but there are several factors that could impact rates. By staying informed about economic indicators, Federal Reserve policy, and local market trends, homeowners and buyers can make informed decisions about their mortgage. Shopping around and comparing rates from multiple lenders is key to ensuring you are getting the best deal on your mortgage. Whether you’re looking to refinance your existing mortgage or buy a new home, it’s important to stay informed and be proactive in managing your mortgage.

-

Reverse Mortgage1 year ago

Reverse Mortgage1 year agoHow Reverse Loans Can Provide Financial Relief in Retirement

-

Mortgage Rates1 year ago

Mortgage Rates1 year agoComo puedo comprar una casa a crédito si no se nada?

-

Mortgage Rates1 year ago

Mortgage Rates1 year agoNiro Loan App 2024 || Niro App Se Loan Kaise Le || New Loan App Best Instant Loan App Without Cibi

-

Reverse Mortgage1 year ago

Reverse Mortgage1 year agoExploring the Myths and Realities of Reverse Mortgages for Seniors in 2024

-

Reverse Mortgage1 year ago

Reverse Mortgage1 year agoThe Pros and Cons of Using a Reverse Mortgage for Retirement Planning

-

Reverse Mortgage8 months ago

Reverse Mortgage8 months agoThe Benefits of a HECM Loan for Seniors: Financial Freedom in Retirement

-

USDA Mortgage1 year ago

USDA Mortgage1 year agoMaking Your Dream of Country Living a Reality: FMHA Rural Home Loans in Focus

-

Auto Loans6 months ago

Auto Loans6 months agoDrive Away in Your Dream Chevy with Chevrolet’s Hassle-Free Lending Process