Uncategorized

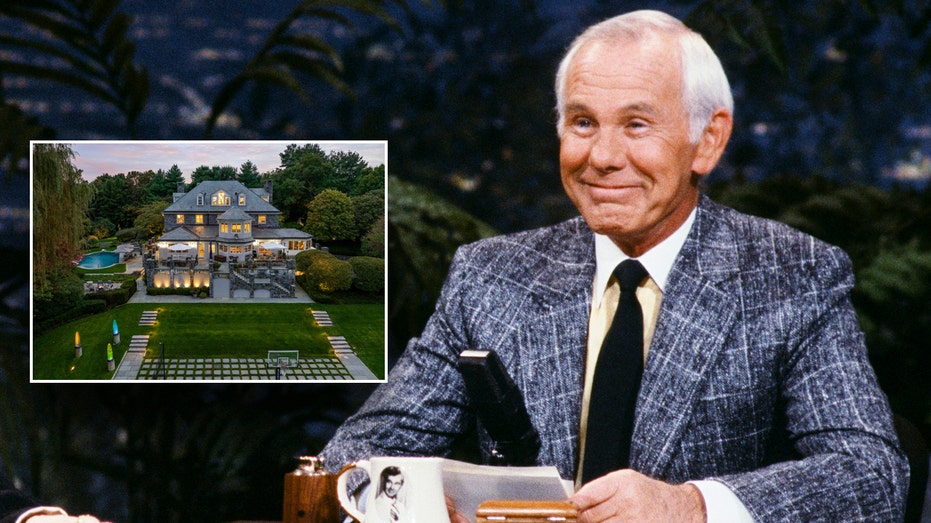

Johnny Carson’s New York mansion hits the market for over $5 million

‘Mansion Global’ host Katrina Campins showcases the gorgeous properties on ‘The Big Money Show.’

Johnny Carson’s former New York mansion is officially on the market.

The 9,923 square foot home sits on a 1.94 acre property and is for sale for $5.3 million. It features many sought-after amenities. Built in 1928, the house boasts six bedrooms, in addition to seven full bathrooms and one half-bath.

“This exceptional offering, ideal for those seeking a blend of sophistication, comfort, privacy,” the listing reads. “The grand living spaces are adorned with high ceilings and large windows which create airy inviting rooms, while 7 fireplaces add warmth and ambiance.”

Elsewhere, the home features a “custom chef’s kitchen” with plenty of counter space for chopping and other prep work, as well as three separate offices spread throughout the house, “thoughtfully designed to inspire creativity and productivity.”

ON THIS DAY IN HISTORY, MAY 22, 1992, JOHNNY CARSON MAKES HIS FINAL APPEARANCE ON ‘THE TONIGHT SHOW’

Johnny Carson’s New York mansion has been placed on the market for over $5 million. (Daniel Milstein/ Julia B. Fee Sotheby’s International Realty / Fox News)

Carson’s home features six bedrooms and seven full bathrooms. (Joe Kravetz/ Julia B. Fee Sotheby’s International Realty / Fox News)

Not only does the home come with a large workout gym, which also features a sauna and an indoor cabana bath, there’s also an ice cream bar nearby, as well as a game room with a pool table. The residence also features a three-car garage, which comes with two charging stations.

The house features three custom-built offices. (Joe Kravetz/ Julia B. Fee Sotheby’s International Realty / Fox News)

In addition to everything else, the home features a gym and a game room with a pool table. (Joe Kravetz/ Julia B. Fee Sotheby’s International Realty / Fox News)

“Custom built-ins abound throughout the home add a touch of elegance and functionality,” the listing reads. “This property is a masterpiece of design and craftsmanship, offering an unparalleled lifestyle, it promises an exceptional living experience.”

Carson’s home features a spacious kitchen with plenty of room to prep, as well as a living room with cream furniture. (Joe Kravetz/ Julia B. Fee Sotheby’s International Realty / Fox News)

The exterior of the home is just as awe-inspiring as the interior. Surrounded by greenery, the driveway leads to a blue stone walkway, which perfectly matches the stone detailing covering the entire exterior of the house.

In addition to a large grass area in the backyard, the outside of the house also features a combined basketball and tennis court, gazebo, an outdoor spa, a pool and hot tub.

The driveway to the mansion leads to a stone walkway, which matches the stone detailing of the home. (Daniel Milstein/ Julia B. Fee Sotheby’s International Realty / Getty Images)

Wraparound covered terraces, connected to the home, overlook the grassy area, gazebo and athletic courts, “offer[ing] seamless indoor-outdoor living and al fresco dining with panoramic views.”

While the greenery surrounding the home gives the illusion that it’s located away from civilization, it is actually a stone’s throw from shopping centers, towns and multiple golf courses.

The exterior of the mansion features a pool, jacuzzi, tennis and basketball court, and a gazebo. (Daniel Milstein/ Julia B. Fee Sotheby’s International Realty / Fox News)

Carson, who died in 2005, was best known as a comedian and the host of “The Tonight Show Starring Johnny Carson.” He currently holds the title of the longest running host of “The Tonight Show,” having sat behind the desk for 29 years.

Although Carson was the third host of the program, he is the one many people associate with it, and is often considered the benchmark for any late night talk show host.

“I am one of the lucky people in the world,” he said during his final “Tonight Show” sign-off. “I found something I always wanted to do, and I have enjoyed every single minute of it.”

Carson was replaced by Jay Leno, who hosted the show from 1992 to 2009 and was followed by Conan O’Brien, who only hosted for one year before handing the reins back to Leno, who hosted a second time from 2010 to 2014.

Jay Leno, center, took over for Carson when he retired in 1992, and Jimmy Fallon took over for Leno in 2014. (Getty Images / Getty Images)

The current host of the show, Jimmy Fallon, took over for Leno in February 2014, after hosting “Late Night with Jimmy Fallon” from 2009 to 2014.

Uncategorized

Urgent Money Miracle – $2+ EPC! Get Instant 90% Commission Bump

Product Name: Urgent Money Miracle – $2+ EPC! Get Instant 90% Commission Bump

All orders are protected by SSL encryption – the highest industry standard for online security from trusted vendors.

Urgent Money Miracle – $2+ EPC! Get Instant 90% Commission Bump is backed with a 60 Day No Questions Asked Money Back Guarantee. If within the first 60 days of receipt you are not satisfied with Wake Up Lean™, you can request a refund by sending an email to the address given inside the product and we will immediately refund your entire purchase price, with no questions asked.

Uncategorized

NEW! Christian Wealth Manifestation – Highly Targeted For Christians!

Product Name: NEW! Christian Wealth Manifestation – Highly Targeted For Christians!

All orders are protected by SSL encryption – the highest industry standard for online security from trusted vendors.

NEW! Christian Wealth Manifestation – Highly Targeted For Christians! is backed with a 60 Day No Questions Asked Money Back Guarantee. If within the first 60 days of receipt you are not satisfied with Wake Up Lean™, you can request a refund by sending an email to the address given inside the product and we will immediately refund your entire purchase price, with no questions asked.

Uncategorized

Predictions for Mortgage Rates in 2024: What to Expect

As we look ahead to 2024, many homeowners and prospective buyers are wondering what to expect when it comes to mortgage rates. The landscape of the housing market is constantly changing, so it’s important to stay informed about trends and predictions. In this blog post, we will discuss some factors that could impact mortgage rates in 2024 and what homeowners and buyers can expect.

One factor that could impact mortgage rates in 2024 is the overall state of the economy. If the economy is strong and growing, we may see higher mortgage rates as the Federal Reserve looks to combat inflation. On the other hand, if the economy is stagnant or in a recession, we may see lower mortgage rates as the Fed looks to stimulate growth. It’s important to keep an eye on economic indicators such as GDP growth, unemployment rates, and inflation to get a sense of where mortgage rates may be heading.

Another factor that could impact mortgage rates in 2024 is Federal Reserve policy. The Fed plays a key role in setting interest rates, and their decisions can have a ripple effect on mortgage rates. If the Fed decides to raise interest rates in response to inflation, we may see an increase in mortgage rates. Conversely, if the Fed decides to lower interest rates to stimulate growth, we may see a decrease in mortgage rates. Keeping up with the latest news and announcements from the Fed can give homeowners and buyers a sense of where mortgage rates may be heading.

In terms of specific cities and local mortgage companies, it’s important to note that mortgage rates can vary depending on location and lender. For example, in a city like New York City, where real estate prices are high, mortgage rates may be higher compared to a city like Indianapolis, where real estate prices are lower. Additionally, local mortgage companies may offer competitive rates and terms compared to national lenders. For example, in New York City, local lenders like Quontic Bank and CrossCountry Mortgage may offer specialized products and services tailored to the needs of local buyers.

It’s important for homeowners and buyers to shop around and compare rates from multiple lenders to ensure they are getting the best deal. Websites like Bankrate and LendingTree can be helpful resources for comparing rates and terms from multiple lenders. Homeowners and buyers should also consider working with a mortgage broker who can help them navigate the lending process and find the best mortgage product for their needs.

In conclusion, predicting mortgage rates in 2024 is not an exact science, but there are several factors that could impact rates. By staying informed about economic indicators, Federal Reserve policy, and local market trends, homeowners and buyers can make informed decisions about their mortgage. Shopping around and comparing rates from multiple lenders is key to ensuring you are getting the best deal on your mortgage. Whether you’re looking to refinance your existing mortgage or buy a new home, it’s important to stay informed and be proactive in managing your mortgage.

-

Reverse Mortgage1 year ago

Reverse Mortgage1 year agoHow Reverse Loans Can Provide Financial Relief in Retirement

-

Mortgage Rates1 year ago

Mortgage Rates1 year agoComo puedo comprar una casa a crédito si no se nada?

-

Mortgage Rates1 year ago

Mortgage Rates1 year agoNiro Loan App 2024 || Niro App Se Loan Kaise Le || New Loan App Best Instant Loan App Without Cibi

-

Reverse Mortgage1 year ago

Reverse Mortgage1 year agoExploring the Myths and Realities of Reverse Mortgages for Seniors in 2024

-

Reverse Mortgage1 year ago

Reverse Mortgage1 year agoThe Pros and Cons of Using a Reverse Mortgage for Retirement Planning

-

Reverse Mortgage8 months ago

Reverse Mortgage8 months agoThe Benefits of a HECM Loan for Seniors: Financial Freedom in Retirement

-

USDA Mortgage1 year ago

USDA Mortgage1 year agoMaking Your Dream of Country Living a Reality: FMHA Rural Home Loans in Focus

-

Auto Loans6 months ago

Auto Loans6 months agoDrive Away in Your Dream Chevy with Chevrolet’s Hassle-Free Lending Process