Finance News

Is it time to start worrying? Analysts have recently lowered their outlook for HOOKIPA Pharma Inc. (NASDAQ:HOOK).

Is it time to be concerned? Analysts have recently lowered their outlook for HOOKIPA Pharma Inc. (NASDAQ:HOOK).,

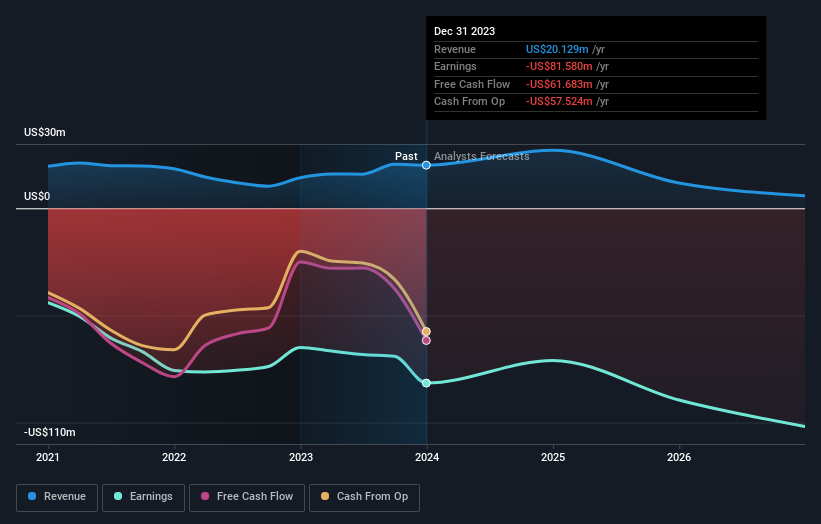

It appears that things are not looking good for HOOKIPA Pharma Inc. (NASDAQ:HOOK) shareholders, as analysts have significantly revised their forecasts for the company this year. There has been a sharp reduction in revenue estimates, indicating that previous forecasts were overly optimistic.

Following the downgrade, the four analysts covering HOOKIPA Pharma now project revenues of US$27 million in 2024. This would represent a substantial 34% increase in sales compared to the previous 12 months. Losses are expected to decrease significantly by 34% to US$0.55 per share. Prior to this consensus update, analysts were forecasting revenues of US$35 million and losses of US$0.51 per share in 2024. This shift in sentiment is evident, with analysts slashing revenue estimates for this year while simultaneously raising loss per share forecasts.

See our latest analysis for HOOKIPA Pharma

Looking at the bigger picture, one way to interpret these forecasts is to compare them with past performance and industry growth estimates. The latest estimates suggest that HOOKIPA Pharma is expected to experience a significant acceleration in growth, with a forecasted 34% annualized revenue growth through 2024, much higher than its historical growth rate of 7.6% per annum over the past five years. In comparison, other companies in the same industry are projected to grow their revenue at a rate of 17% annually. This indicates that the analysts anticipate HOOKIPA Pharma to outpace industry growth.

The Bottom Line

The key takeaway from this downgrade is the increased forecasted losses for this year, indicating potential challenges for HOOKIPA Pharma. While analysts have lowered revenue estimates, data suggests that revenues are expected to outperform the broader market. Given the significant change in sentiment, it’s reasonable for investors to approach HOOKIPA Pharma with caution.

Following such a downgrade, it is evident that previous forecasts were overly optimistic. Additionally, there are potentially concerning factors in HOOKIPA Pharma’s business, such as significant dilution from new stock issuance in the past year. For more insights, you can click here to discover this and the 3 other risks we’ve identified.

Another way to identify potentially impactful companies is to monitor insider trading activity. Our list of growing companies that insiders are buying provides valuable insights in this regard.

Have questions about this article? Confused about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

FAQ:

Q: What led to the negative revision in HOOKIPA Pharma’s forecasts?

A: The analysts made a substantial negative revision to revenue estimates, indicating a significant change in sentiment and potential challenges for the company.

Q: How do HOOKIPA Pharma’s growth forecasts compare to industry peers?

A: HOOKIPA Pharma is expected to experience accelerated growth, with a forecasted 34% annualized revenue growth through 2024, outpacing the industry average of 17% annual growth.

Q: What are some potential concerns for HOOKIPA Pharma’s business?

A: There are issues such as significant dilution from new stock issuance and increased forecasted losses, suggesting potential challenges for the company.

Q: How can investors stay informed about companies like HOOKIPA Pharma?

A: Monitoring insider trading activity can provide valuable insights into potentially impactful companies. Our list of growing companies that insiders are buying is a useful resource for investors.

Finance News

JPMorgan CEO Jamie Dimon to allow Bitcoin at the bank

Bespoke Investment Group co-founder Paul Hickey breaks down the current volatility in the market and discusses his current favorite investment opportunities on ‘Making Money.’

JPMorgan CEO Jamie Dimon still isn’t a fan of Bitcoin but he’s not letting his personal feelings get in the way of business at the bank.

“When I look at the Bitcoin universe, the leverage in the system, the misuse,” he said at the company’s annual investor day Monday in New York. Noting that bad actors can use it for sex trafficking and terrorism.

“I am not a fan of it. We are going to allow you to buy it. And we’re not going to custody it. We’re going to do is put it on statements for clients. So, you know, I don’t think we should smoke, but I defend your right to smoke. I defend your right to buy Bitcoin, go at it”, he added.

JPMorgan Chase CEO Jamie Dimon Speaks at Investor Day 5/19

At JPMorgan’s Investor Day, Dimon said the bank will now allow clients to buy Bitcoin but that policy hasn’t changed his view on the cryptocurrency. (JP Morgan)

Bitcoin, the largest crypto by market value, is just shy of its all-time high of $106,734.51 reached last year.

DIMON SOUNDS OFF ON HIGH MORTGAGE RATES, LAYS BLAME

Dimon has long been a critic of Bitcoin, including these remarks from 2021:

“I personally think that Bitcoin is worthless,” Dimon said while speaking at a virtual event hosted by the Institute of International Finance. “But I don’t want to be a spokesman for that, I don’t care. It makes no difference to me.” Dimon has also likened the crypto to “fools gold.”

Shares of JPMorgan Chase are up over 10% outperforming the S&P 500 which is flat for the year.

In January 2024, the Securities and Exchange Commission greenlighted the first Bitcoin exchange-traded fund, prompting a slew of firms to launch their own, making the asset class more accessible for both institutional and retail investors.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| IBIT | ISHARES BITCOIN TRUST – USD ACC | 60.66 | +0.68 | +1.13% |

| FBTC | FIDELITY WISE ORIGIN BITCOIN FUND – USD ACC | 93.14 | +0.98 | +1.06% |

| GBTC | GRAYSCALE BITCOIN TRUST ETF – USD ACC | 84.12 | +0.88 | +1.06% |

GET FOX BUSINESS ON THE GO BY CLICKING HERE

iShares Bitcoin Trust ETF, Fidelity Wise Origin Bitcoin ETF and Grayscale Bitcoin Trust ETF are currently the largest funds by assets under management, as tracked by ETF.com.

Finance News

Credit Repair Hacking – Boost Your Credit Score

Product Name: Credit Repair Hacking – Boost Your Credit Score

All orders are protected by SSL encryption – the highest industry standard for online security from trusted vendors.

Credit Repair Hacking – Boost Your Credit Score is backed with a 60 Day No Questions Asked Money Back Guarantee. If within the first 60 days of receipt you are not satisfied with Wake Up Lean™, you can request a refund by sending an email to the address given inside the product and we will immediately refund your entire purchase price, with no questions asked.

Finance News

Bertucci’s files for Chapter 11 bankruptcy protection, closes restaurants

Hooters CEO Sal Melilli joins ‘Fox & Friends’ to discuss plans to return the brand to its roots as a ‘neighborhood restaurant.’

Italian restaurant chain Bertucci’s is closing more locations after filing for bankruptcy again to mitigate losses.

The Massachusetts-based business, which has locations along the East Coast and is best known for its brick oven pizza and pasta, filed for Chapter 11 bankruptcy protection in Florida last week. It marked the chain’s third bankruptcy since 2018.

Bertucci’s also closed seven of its underperforming locations – five in Massachusetts, one in Rhode Island and one in Maryland. It now operates 15 restaurant locations in six states, according to court documents.

RESTAURANT CHAIN BERTUCCI’S FILES FOR BANKRUPTCY PROTECTION

Italian restaurant chain Bertucci’s has filed for bankruptcy for the third time since 2018. It has also closed seven restaurants to mitigate losses, according to an April 24 bankruptcy filing. (WFXT)

The company cited the “deterioration” of the U.S. economy and “lack of consumer demand for legacy casual-dining brands” as reasons why the restaurant chain has been operating at a loss, according to the filing.

FAST-FOOD CHAIN CLOSING UP TO 200 ‘UNDERPERFORMING’ LOCATIONS

“With losses accumulating, inflationary pressures still high, and industry headwinds gusting, the proverbial final straw fell on [Bertucci’s] this year as the world saw food costs soar, consumer spending slow, and an uncertain global economy falling in (and out) of decline,” as stated in the bankruptcy documents.

Bertucci’s has assets and liabilities between $10 million and $50 million, according to the filing.

TGI FRIDAYS’ US FOOTPRINT HAS SHRUNK TO 85 RESTAURANTS ACROSS THE COUNTRY

The restaurant chain hopes bankruptcy will provide the business with a “breathing spell” so it can “determine the best path forward and formulate an overall reorganizational plan,” it said in the filing.

In April 2018, Bertucci’s filed for Chapter 11 bankruptcy protection and closed 15 restaurants. In December 2022, amid challenges caused by the COVID-19 pandemic like the closure of restaurants and inflation, it declared bankruptcy for a second time and streamlined operations down to 23 locations, according to the filing.

Bertucci’s previously filed for bankruptcy in 2018 and 2022. (WFXT)

CLICK HERE TO GET THE FOX NEWS APP

Bertucci’s did not respond to FOX Business’ request for comment.

-

Reverse Mortgage1 year ago

Reverse Mortgage1 year agoHow Reverse Loans Can Provide Financial Relief in Retirement

-

Mortgage Rates1 year ago

Mortgage Rates1 year agoComo puedo comprar una casa a crédito si no se nada?

-

Mortgage Rates1 year ago

Mortgage Rates1 year agoNiro Loan App 2024 || Niro App Se Loan Kaise Le || New Loan App Best Instant Loan App Without Cibi

-

Reverse Mortgage1 year ago

Reverse Mortgage1 year agoExploring the Myths and Realities of Reverse Mortgages for Seniors in 2024

-

Reverse Mortgage1 year ago

Reverse Mortgage1 year agoThe Pros and Cons of Using a Reverse Mortgage for Retirement Planning

-

Reverse Mortgage8 months ago

Reverse Mortgage8 months agoThe Benefits of a HECM Loan for Seniors: Financial Freedom in Retirement

-

USDA Mortgage1 year ago

USDA Mortgage1 year agoMaking Your Dream of Country Living a Reality: FMHA Rural Home Loans in Focus

-

Auto Loans6 months ago

Auto Loans6 months agoDrive Away in Your Dream Chevy with Chevrolet’s Hassle-Free Lending Process