Uncategorized

Colin Firth’s famous Mr. Darcy shirt up for sale

LCG Auctions founder Mark Montero displays unique auction items on ‘Varney & Co.’

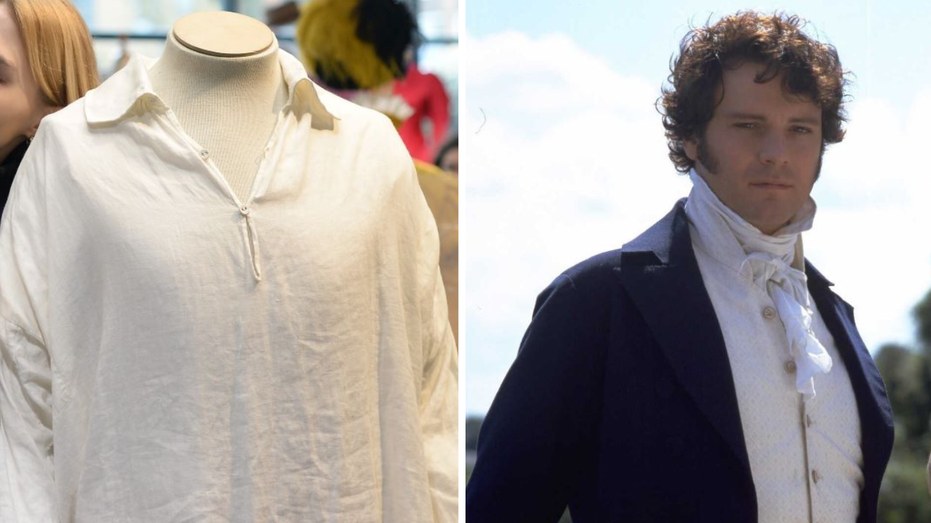

Hopeless romantics and Jane Austen fans now have the once-in-a-lifetime opportunity to own a garment from the BBC’s 1995 “Pride and Prejudice” miniseries.

Not just any garment, but the garment – Colin Firth’s infamous wet shirt from the miniseries’ lake scene.

Kerry Taylor Auctions, a British auction house, is auctioning off the piece of clothing on Tuesday. The proceeds will go to a charity that helps children and young people have access to “creative activities, visual and performance arts,” according to the business.

Other pieces of Mr. Darcy’s outfit are included in the lot, including his waistcoat and breeches.

JOHN LENNON’S MURDER: AUCTION HOUSE WITHDRAWS SALE OF BULLET FROM KILLER’S GUN

Jane Austen fans have the chance to own Colin Firth’s famous wet shirt from the 1995 “Pride and Prejudice” miniseries. (Getty Images / Getty Images)

According to the auction house’s website, the Regency-inspired piece features “pleated gathers to sleeve tops, deep collar, buttoned neck opening together with a muslin cravat.”

The other pieces that are included are Darcy’s fall front breeches, a velvet waistcoat and a gray wool tailcoat.

To top it off, the winning bidder will take home a signed photograph of Colin Firth as Mr. Darcy.

285-YEAR-OLD LEMON FROM 1739 SELLS AT AUCTION FOR NEARLY $1,800

The infamous wet shirt as worn by Colin Firth in Pride and Prejudice on display at the “Lights Camera Auction” photocall at Kerry Taylor Auctions on February 27, 2024 in London, England. (Eamonn M. McCormack/Getty Images)

In the infamous lake scene, Mr. Darcy has an awkward encounter with Elizabeth Bennet after swimming in a lake.

“In the scene Mr Darcy is spied emerging from a lake having taken a cooling swim on a hot summer’s day,” designer Dinah Collin explained in a statement on Kerry Taylor Auctions’ website.

According to Collin, producers wanted to avoid nudity and came up with the idea of Darcy wearing a white shirt instead.

CLICK HERE TO SIGN UP FOR OUR LIFESTYLE NEWSLETTER

Actors Colin Firth and Jennifer Ehle in character as Mr. Darcy and Elizabeth Bennet in period drama Pride And Prejudice, circa 1995. (Mark Lawrence/TV Times via Getty Images)

“Because on screen male nudity was not permitted… the idea of the ‘wet shirt’ was born. Our way round this was for Colin Firth to be filmed ¾ length wearing just the Irish linen shirt (copied from an antique original) which clung to the body.”

“The scene caused something of a sensation at the time and transformed Colin Firth from a respected classical actor to something of a sex symbol overnight!”

The lot is predicted to fetch anywhere from £7,000 to £10,000. In U.S. dollars, the estimate is $8,800 to $12,600.

Camilla, Duchess of Cornwall, looks at the infamous white shirt worn by Colin Firth in the BBC’s 1995 adaptation of Pride and Prejudice which forms part of the Museum’s current display on Regency underwear during a visit to Jane Austen’s House, on Ap (Photo by Finnbarr Webster-Pool/Getty Images)

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Fox Business reached out to Kerry Taylor Auctions for comment.

Uncategorized

Urgent Money Miracle – $2+ EPC! Get Instant 90% Commission Bump

Product Name: Urgent Money Miracle – $2+ EPC! Get Instant 90% Commission Bump

All orders are protected by SSL encryption – the highest industry standard for online security from trusted vendors.

Urgent Money Miracle – $2+ EPC! Get Instant 90% Commission Bump is backed with a 60 Day No Questions Asked Money Back Guarantee. If within the first 60 days of receipt you are not satisfied with Wake Up Lean™, you can request a refund by sending an email to the address given inside the product and we will immediately refund your entire purchase price, with no questions asked.

Uncategorized

NEW! Christian Wealth Manifestation – Highly Targeted For Christians!

Product Name: NEW! Christian Wealth Manifestation – Highly Targeted For Christians!

All orders are protected by SSL encryption – the highest industry standard for online security from trusted vendors.

NEW! Christian Wealth Manifestation – Highly Targeted For Christians! is backed with a 60 Day No Questions Asked Money Back Guarantee. If within the first 60 days of receipt you are not satisfied with Wake Up Lean™, you can request a refund by sending an email to the address given inside the product and we will immediately refund your entire purchase price, with no questions asked.

Uncategorized

Predictions for Mortgage Rates in 2024: What to Expect

As we look ahead to 2024, many homeowners and prospective buyers are wondering what to expect when it comes to mortgage rates. The landscape of the housing market is constantly changing, so it’s important to stay informed about trends and predictions. In this blog post, we will discuss some factors that could impact mortgage rates in 2024 and what homeowners and buyers can expect.

One factor that could impact mortgage rates in 2024 is the overall state of the economy. If the economy is strong and growing, we may see higher mortgage rates as the Federal Reserve looks to combat inflation. On the other hand, if the economy is stagnant or in a recession, we may see lower mortgage rates as the Fed looks to stimulate growth. It’s important to keep an eye on economic indicators such as GDP growth, unemployment rates, and inflation to get a sense of where mortgage rates may be heading.

Another factor that could impact mortgage rates in 2024 is Federal Reserve policy. The Fed plays a key role in setting interest rates, and their decisions can have a ripple effect on mortgage rates. If the Fed decides to raise interest rates in response to inflation, we may see an increase in mortgage rates. Conversely, if the Fed decides to lower interest rates to stimulate growth, we may see a decrease in mortgage rates. Keeping up with the latest news and announcements from the Fed can give homeowners and buyers a sense of where mortgage rates may be heading.

In terms of specific cities and local mortgage companies, it’s important to note that mortgage rates can vary depending on location and lender. For example, in a city like New York City, where real estate prices are high, mortgage rates may be higher compared to a city like Indianapolis, where real estate prices are lower. Additionally, local mortgage companies may offer competitive rates and terms compared to national lenders. For example, in New York City, local lenders like Quontic Bank and CrossCountry Mortgage may offer specialized products and services tailored to the needs of local buyers.

It’s important for homeowners and buyers to shop around and compare rates from multiple lenders to ensure they are getting the best deal. Websites like Bankrate and LendingTree can be helpful resources for comparing rates and terms from multiple lenders. Homeowners and buyers should also consider working with a mortgage broker who can help them navigate the lending process and find the best mortgage product for their needs.

In conclusion, predicting mortgage rates in 2024 is not an exact science, but there are several factors that could impact rates. By staying informed about economic indicators, Federal Reserve policy, and local market trends, homeowners and buyers can make informed decisions about their mortgage. Shopping around and comparing rates from multiple lenders is key to ensuring you are getting the best deal on your mortgage. Whether you’re looking to refinance your existing mortgage or buy a new home, it’s important to stay informed and be proactive in managing your mortgage.

-

Reverse Mortgage1 year ago

Reverse Mortgage1 year agoHow Reverse Loans Can Provide Financial Relief in Retirement

-

Mortgage Rates1 year ago

Mortgage Rates1 year agoComo puedo comprar una casa a crédito si no se nada?

-

Mortgage Rates1 year ago

Mortgage Rates1 year agoNiro Loan App 2024 || Niro App Se Loan Kaise Le || New Loan App Best Instant Loan App Without Cibi

-

Reverse Mortgage1 year ago

Reverse Mortgage1 year agoExploring the Myths and Realities of Reverse Mortgages for Seniors in 2024

-

Reverse Mortgage1 year ago

Reverse Mortgage1 year agoThe Pros and Cons of Using a Reverse Mortgage for Retirement Planning

-

Reverse Mortgage8 months ago

Reverse Mortgage8 months agoThe Benefits of a HECM Loan for Seniors: Financial Freedom in Retirement

-

USDA Mortgage1 year ago

USDA Mortgage1 year agoMaking Your Dream of Country Living a Reality: FMHA Rural Home Loans in Focus

-

Auto Loans6 months ago

Auto Loans6 months agoDrive Away in Your Dream Chevy with Chevrolet’s Hassle-Free Lending Process