Finance News

Calculating the intrinsic value of Broadwind, Inc. (NASDAQ: BWEN)

Determining the Fair Value of Broadwind, Inc. (NASDAQ:BWEN),

Key Insights

-

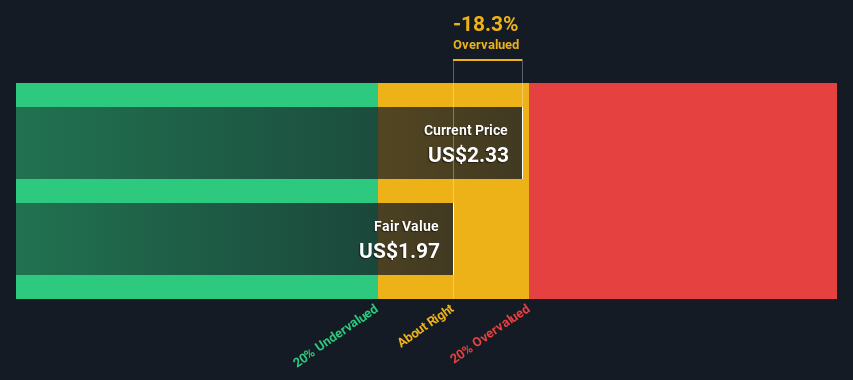

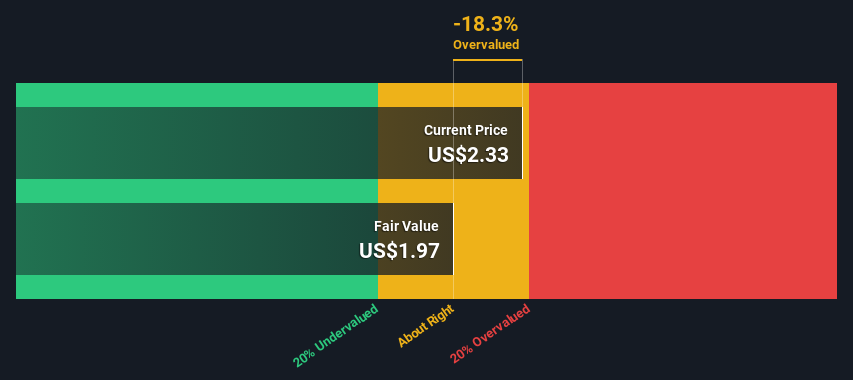

Broadwind’s estimated fair value is US$1.97 based on 2 Stage Free Cash Flow to Equity

-

Current share price of US$2.33 suggests Broadwind is potentially trading close to its fair value

-

Analyst price target for BWEN is US$5.88, which is 198% above our fair value estimate

Today we’ll do a simple run through of a valuation method used to estimate the attractiveness of Broadwind, Inc. (NASDAQ:BWEN) as an investment opportunity by taking the expected future cash flows and discounting them to today’s value. Our analysis will employ the Discounted Cash Flow (DCF) model. Believe it or not, it’s not too difficult to follow, as you’ll see from our example!

We would caution that there are many ways of valuing a company and, like the DCF, each technique has advantages and disadvantages in certain scenarios. For those who are keen learners of equity analysis, the Simply Wall St analysis model here may be something of interest to you.

View our latest analysis for Broadwind

Is Broadwind Fairly Valued?

We use what is known as a 2-stage model, which simply means we have two different periods of growth rates for the company’s cash flows. Generally the first stage is higher growth, and the second stage is a lower growth phase. In the first stage we need to estimate the cash flows to the business over the next ten years. Where possible we use analyst estimates, but when these aren’t available we extrapolate the previous free cash flow (FCF) from the last estimate or reported value. We assume companies with shrinking free cash flow will slow their rate of shrinkage, and that companies with growing free cash flow will see their growth rate slow, over this period. We do this to reflect that growth tends to slow more in the early years than it does in later years.

Generally we assume that a dollar today is more valuable than a dollar in the future, so we need to discount the sum of these future cash flows to arrive at a present value estimate:

10-year free cash flow (FCF) forecast

|

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

|

|

Levered FCF ($, Millions) |

US$8.10m |

US$3.40m |

US$3.18m |

US$3.06m |

US$3.00m |

US$2.98m |

US$2.99m |

US$3.01m |

US$3.05m |

US$3.10m |

|

Growth Rate Estimate Source |

Analyst x1 |

Analyst x2 |

Est @ -6.38% |

Est @ -3.78% |

Est @ -1.96% |

Est @ -0.68% |

Est @ 0.21% |

Est @ 0.83% |

Est @ 1.27% |

Est @ 1.58% |

|

Present Value ($, Millions) Discounted @ 9.4% |

US$7.4 |

US$2.8 |

US$2.4 |

US$2.1 |

US$1.9 |

US$1.7 |

US$1.6 |

US$1.5 |

US$1.4 |

US$1.3 |

(“Est” = FCF growth rate estimated by Simply Wall St)

Present Value of 10-year Cash Flow (PVCF) = US$24m

We now need to calculate the Terminal Value, which accounts for all the future cash flows after this ten year period. The Gordon Growth formula is used to calculate Terminal Value at a future annual growth rate equal to the 5-year average of the 10-year government bond yield of 2.3%. We discount the terminal cash flows to today’s value at a cost of equity of 9.4%.

Terminal Value (TV)= FCF2033 × (1 + g) ÷ (r – g) = US$3.1m× (1 + 2.3%) ÷ (9.4%– 2.3%) = US$45m

Present Value of Terminal Value (PVTV)= TV / (1 + r)10= US$45m÷ ( 1 + 9.4%)10= US$18m

The total value is the sum of cash flows for the next ten years plus the discounted terminal value, which results in the Total Equity Value, which in this case is US$42m. To get the intrinsic value per share, we divide this by the total number of shares outstanding. Relative to the current share price of US$2.3, the company appears around fair value at the time of writing. Remember though, that this is just an approximate valuation, and like any complex formula – garbage in, garbage out.

The Assumptions

The calculation above is very dependent on two assumptions. The first is the discount rate and the other is the cash flows. Part of investing is coming up with your own evaluation of a company’s future performance, so try the calculation yourself and check your own assumptions. The DCF also does not consider the possible cyclicality of an industry, or a company’s future capital requirements, so it does not give a full picture of a company’s potential performance. Given that we are looking at Broadwind as potential shareholders, the cost of equity is used as the discount rate, rather than the cost of capital (or weighted average cost of capital, WACC) which accounts for debt. In this calculation we’ve used 9.4%, which is based on a levered beta of 1.538. Beta is a measure of a stock’s volatility, compared to the market as a whole. We get our beta from the industry average beta of globally comparable companies, with an imposed limit between 0.8 and 2.0, which is a reasonable range for a stable business.

SWOT Analysis for Broadwind

Strength

Weakness

Opportunity

Threat

Moving On:

Valuation is only one side of the coin in terms of building your investment thesis, and it is only one of many factors that you need to assess for a company. It’s not possible to obtain a foolproof valuation with a DCF model. Preferably you’d apply different cases and assumptions and see how they would impact the company’s valuation. If a company grows at a different rate, or if its cost of equity or risk free rate changes sharply, the output can look very different. For Broadwind, there are three essential factors you should consider:

-

Risks: For example, we’ve discovered 4 warning signs for Broadwind (2 can’t be ignored!) that you should be aware of before investing here.

-

Future Earnings: How does BWEN’s growth rate compare to its peers and the wider market? Dig deeper into the analyst consensus number for the upcoming years by interacting with our free analyst growth expectation chart.

-

Other Solid Businesses: Low debt, high returns on equity and good past performance are fundamental to a strong business. Why not explore our interactive list of stocks with solid business fundamentals to see if there are other companies you may not have considered!

PS. Simply Wall St updates its DCF calculation for every American stock every day, so if you want to find the intrinsic value of any other stock just search here.

Have feedback on this article? Concerned about the content? Get in touch

with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Frequently Asked Questions

-

What is the Discounted Cash Flow (DCF) model?

The DCF model is a valuation method used to estimate the attractiveness of an investment opportunity by taking the expected future cash flows of a company and discounting them to today’s value.

-

How is the fair value of a company determined in the DCF model?

The fair value is determined by calculating the present value of all expected future cash flows and the terminal value after a specified period, then dividing by the total number of shares outstanding to get the

Finance News

JPMorgan CEO Jamie Dimon to allow Bitcoin at the bank

Bespoke Investment Group co-founder Paul Hickey breaks down the current volatility in the market and discusses his current favorite investment opportunities on ‘Making Money.’

JPMorgan CEO Jamie Dimon still isn’t a fan of Bitcoin but he’s not letting his personal feelings get in the way of business at the bank.

“When I look at the Bitcoin universe, the leverage in the system, the misuse,” he said at the company’s annual investor day Monday in New York. Noting that bad actors can use it for sex trafficking and terrorism.

“I am not a fan of it. We are going to allow you to buy it. And we’re not going to custody it. We’re going to do is put it on statements for clients. So, you know, I don’t think we should smoke, but I defend your right to smoke. I defend your right to buy Bitcoin, go at it”, he added.

JPMorgan Chase CEO Jamie Dimon Speaks at Investor Day 5/19

At JPMorgan’s Investor Day, Dimon said the bank will now allow clients to buy Bitcoin but that policy hasn’t changed his view on the cryptocurrency. (JP Morgan)

Bitcoin, the largest crypto by market value, is just shy of its all-time high of $106,734.51 reached last year.

DIMON SOUNDS OFF ON HIGH MORTGAGE RATES, LAYS BLAME

Dimon has long been a critic of Bitcoin, including these remarks from 2021:

“I personally think that Bitcoin is worthless,” Dimon said while speaking at a virtual event hosted by the Institute of International Finance. “But I don’t want to be a spokesman for that, I don’t care. It makes no difference to me.” Dimon has also likened the crypto to “fools gold.”

Shares of JPMorgan Chase are up over 10% outperforming the S&P 500 which is flat for the year.

In January 2024, the Securities and Exchange Commission greenlighted the first Bitcoin exchange-traded fund, prompting a slew of firms to launch their own, making the asset class more accessible for both institutional and retail investors.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| IBIT | ISHARES BITCOIN TRUST – USD ACC | 60.66 | +0.68 | +1.13% |

| FBTC | FIDELITY WISE ORIGIN BITCOIN FUND – USD ACC | 93.14 | +0.98 | +1.06% |

| GBTC | GRAYSCALE BITCOIN TRUST ETF – USD ACC | 84.12 | +0.88 | +1.06% |

GET FOX BUSINESS ON THE GO BY CLICKING HERE

iShares Bitcoin Trust ETF, Fidelity Wise Origin Bitcoin ETF and Grayscale Bitcoin Trust ETF are currently the largest funds by assets under management, as tracked by ETF.com.

Finance News

Credit Repair Hacking – Boost Your Credit Score

Product Name: Credit Repair Hacking – Boost Your Credit Score

All orders are protected by SSL encryption – the highest industry standard for online security from trusted vendors.

Credit Repair Hacking – Boost Your Credit Score is backed with a 60 Day No Questions Asked Money Back Guarantee. If within the first 60 days of receipt you are not satisfied with Wake Up Lean™, you can request a refund by sending an email to the address given inside the product and we will immediately refund your entire purchase price, with no questions asked.

Finance News

Bertucci’s files for Chapter 11 bankruptcy protection, closes restaurants

Hooters CEO Sal Melilli joins ‘Fox & Friends’ to discuss plans to return the brand to its roots as a ‘neighborhood restaurant.’

Italian restaurant chain Bertucci’s is closing more locations after filing for bankruptcy again to mitigate losses.

The Massachusetts-based business, which has locations along the East Coast and is best known for its brick oven pizza and pasta, filed for Chapter 11 bankruptcy protection in Florida last week. It marked the chain’s third bankruptcy since 2018.

Bertucci’s also closed seven of its underperforming locations – five in Massachusetts, one in Rhode Island and one in Maryland. It now operates 15 restaurant locations in six states, according to court documents.

RESTAURANT CHAIN BERTUCCI’S FILES FOR BANKRUPTCY PROTECTION

Italian restaurant chain Bertucci’s has filed for bankruptcy for the third time since 2018. It has also closed seven restaurants to mitigate losses, according to an April 24 bankruptcy filing. (WFXT)

The company cited the “deterioration” of the U.S. economy and “lack of consumer demand for legacy casual-dining brands” as reasons why the restaurant chain has been operating at a loss, according to the filing.

FAST-FOOD CHAIN CLOSING UP TO 200 ‘UNDERPERFORMING’ LOCATIONS

“With losses accumulating, inflationary pressures still high, and industry headwinds gusting, the proverbial final straw fell on [Bertucci’s] this year as the world saw food costs soar, consumer spending slow, and an uncertain global economy falling in (and out) of decline,” as stated in the bankruptcy documents.

Bertucci’s has assets and liabilities between $10 million and $50 million, according to the filing.

TGI FRIDAYS’ US FOOTPRINT HAS SHRUNK TO 85 RESTAURANTS ACROSS THE COUNTRY

The restaurant chain hopes bankruptcy will provide the business with a “breathing spell” so it can “determine the best path forward and formulate an overall reorganizational plan,” it said in the filing.

In April 2018, Bertucci’s filed for Chapter 11 bankruptcy protection and closed 15 restaurants. In December 2022, amid challenges caused by the COVID-19 pandemic like the closure of restaurants and inflation, it declared bankruptcy for a second time and streamlined operations down to 23 locations, according to the filing.

Bertucci’s previously filed for bankruptcy in 2018 and 2022. (WFXT)

CLICK HERE TO GET THE FOX NEWS APP

Bertucci’s did not respond to FOX Business’ request for comment.

-

Reverse Mortgage1 year ago

Reverse Mortgage1 year agoHow Reverse Loans Can Provide Financial Relief in Retirement

-

Mortgage Rates1 year ago

Mortgage Rates1 year agoComo puedo comprar una casa a crédito si no se nada?

-

Mortgage Rates1 year ago

Mortgage Rates1 year agoNiro Loan App 2024 || Niro App Se Loan Kaise Le || New Loan App Best Instant Loan App Without Cibi

-

Reverse Mortgage1 year ago

Reverse Mortgage1 year agoExploring the Myths and Realities of Reverse Mortgages for Seniors in 2024

-

Reverse Mortgage1 year ago

Reverse Mortgage1 year agoThe Pros and Cons of Using a Reverse Mortgage for Retirement Planning

-

Reverse Mortgage8 months ago

Reverse Mortgage8 months agoThe Benefits of a HECM Loan for Seniors: Financial Freedom in Retirement

-

USDA Mortgage1 year ago

USDA Mortgage1 year agoMaking Your Dream of Country Living a Reality: FMHA Rural Home Loans in Focus

-

Auto Loans6 months ago

Auto Loans6 months agoDrive Away in Your Dream Chevy with Chevrolet’s Hassle-Free Lending Process