Uncategorized

BlackRock says ESG advocacy is a risk factor for its bottom line

Fox News contributor Liz Peek, National Review reporter Caroline Downey and author Batya Ungar-Sargon react to President Biden claiming climate change is worse than nuclear bombs on ‘Kudlow.’

Investment management company BlackRock admitted in its annual filing to the Securities and Exchanges Commission that its CEO Larry Fink’s environmental, social, and governance policies (ESG) advocacy could harm its “reputation” and hurt its bottom line.

“BlackRock’s business, scale and investments subject it to significant media coverage and increasing attention from a broad range of stakeholders,” the filing submitted late last month said. “This heightened scrutiny has resulted in negative publicity and adverse actions for BlackRock and may continue to do so in the future.”

It continued, “Any perceived or actual action or lack thereof, or perceived lack of transparency, by BlackRock on matters subject to scrutiny, such as ESG, may be viewed differently by various stakeholders and adversely impact BlackRock’s reputation and business, including through redemptions or terminations by clients, and legal and governmental action and scrutiny.”

Fink, who has been an advocate for investing in clean energy, has faced scrutiny by conservatives, including a number of Republican attorneys general.

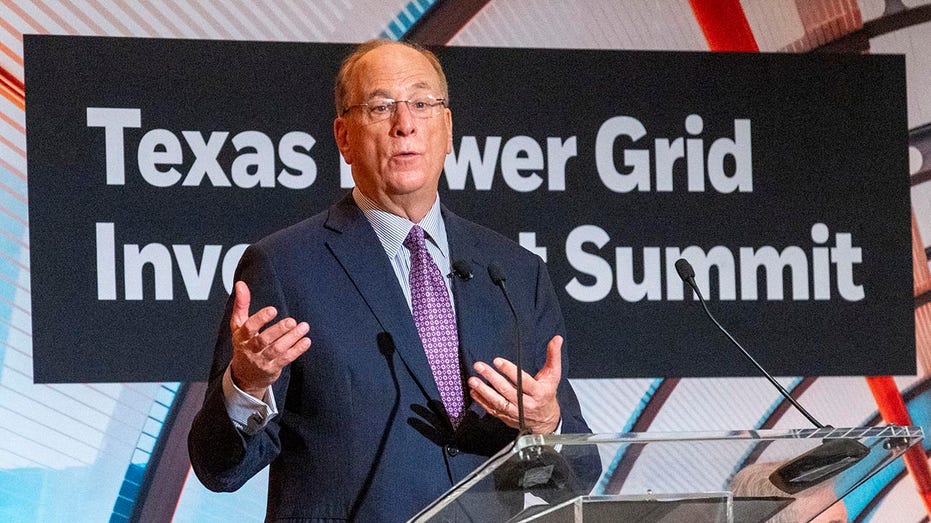

Larry Fink met with Republicans at a Houston summit last month after being blacklisted from the state over BlackRock’s ESG advocacy. (Kirk Sides/Houston Chronicle via Getty Images / Getty Images)

“The overlapping web of personal and business relationships between major mutual fund directors and BlackRock raise red flags about potential conflicts of interest, and call even further into question the misguided investment strategies done in the name of ESG,” Virginia’s Attorney General Miyares said last year in a release announcing Virginia was joining a coalition of states demanding answers from BlackRock.

Tennessee’s Attorney General Skrmetti said last year, while announcing a lawsuit against BlackRock over ESG, “[s]ome public statements show a company that focuses exclusively on return on investment, others show a company that gives special consideration to environmental factors. Ultimately, I want to make certain that corporations, no matter their size, treat Tennessee consumers fairly and honestly.”

BlackRock said it rejects the lawsuit’s claims.

BLACKROCK, STATE STREET FACE SUBPOENAS IN HOUSE ESG PROBE

And last month, Texas blacklisted the company over its ESG policies, prompting Fink to reach out to State Lieutenant Governor Dan Patrick and other Republican officials at an energy investment summit in Houston.

BlackRock has about $10 trillion in assets of which ESG accounts for around $700 billion, according to the New York Post.

As ESG becomes more controversial, it has affected other companies too.

Bank of America appeared to renege on its 2021 pledge to not fund new coal projects, saying in its end of year “Environmental and Social Risk Policy Framework” filing in December, new coal mines and plants, or Arctic oil drilling, such projects will now face “enhanced due diligence.”

Some states, like New Hampshire, Texas and West Virginia, have passed laws to prevent banks from refusing to finance coal projects, and have even sought to criminalize what is called, “environmental, social and governance” principles within companies, according to The New York Times.

The conservative backlash to environmental considerations in business has led other companies to pull back from certain eco-friendly initiatives.

Earlier this year, a coalition of 12 Republican state agriculture commissioners wrote a letter to six large U.S. banks, including Bank of America, over their net-zero ambitions, opening a new front in the pushback against what they call “woke investing,” a fight that has primarily been spearheaded by state attorneys general and financial officers.

All six banks are members of the Net-Zero Banking Alliance (NZBA).

CLICK HERE TO READ MORE ON FOX BUSINESS

Fox Business has reached out to BlackRock for comment.

Uncategorized

Urgent Money Miracle – $2+ EPC! Get Instant 90% Commission Bump

Product Name: Urgent Money Miracle – $2+ EPC! Get Instant 90% Commission Bump

All orders are protected by SSL encryption – the highest industry standard for online security from trusted vendors.

Urgent Money Miracle – $2+ EPC! Get Instant 90% Commission Bump is backed with a 60 Day No Questions Asked Money Back Guarantee. If within the first 60 days of receipt you are not satisfied with Wake Up Lean™, you can request a refund by sending an email to the address given inside the product and we will immediately refund your entire purchase price, with no questions asked.

Uncategorized

NEW! Christian Wealth Manifestation – Highly Targeted For Christians!

Product Name: NEW! Christian Wealth Manifestation – Highly Targeted For Christians!

All orders are protected by SSL encryption – the highest industry standard for online security from trusted vendors.

NEW! Christian Wealth Manifestation – Highly Targeted For Christians! is backed with a 60 Day No Questions Asked Money Back Guarantee. If within the first 60 days of receipt you are not satisfied with Wake Up Lean™, you can request a refund by sending an email to the address given inside the product and we will immediately refund your entire purchase price, with no questions asked.

Uncategorized

Predictions for Mortgage Rates in 2024: What to Expect

As we look ahead to 2024, many homeowners and prospective buyers are wondering what to expect when it comes to mortgage rates. The landscape of the housing market is constantly changing, so it’s important to stay informed about trends and predictions. In this blog post, we will discuss some factors that could impact mortgage rates in 2024 and what homeowners and buyers can expect.

One factor that could impact mortgage rates in 2024 is the overall state of the economy. If the economy is strong and growing, we may see higher mortgage rates as the Federal Reserve looks to combat inflation. On the other hand, if the economy is stagnant or in a recession, we may see lower mortgage rates as the Fed looks to stimulate growth. It’s important to keep an eye on economic indicators such as GDP growth, unemployment rates, and inflation to get a sense of where mortgage rates may be heading.

Another factor that could impact mortgage rates in 2024 is Federal Reserve policy. The Fed plays a key role in setting interest rates, and their decisions can have a ripple effect on mortgage rates. If the Fed decides to raise interest rates in response to inflation, we may see an increase in mortgage rates. Conversely, if the Fed decides to lower interest rates to stimulate growth, we may see a decrease in mortgage rates. Keeping up with the latest news and announcements from the Fed can give homeowners and buyers a sense of where mortgage rates may be heading.

In terms of specific cities and local mortgage companies, it’s important to note that mortgage rates can vary depending on location and lender. For example, in a city like New York City, where real estate prices are high, mortgage rates may be higher compared to a city like Indianapolis, where real estate prices are lower. Additionally, local mortgage companies may offer competitive rates and terms compared to national lenders. For example, in New York City, local lenders like Quontic Bank and CrossCountry Mortgage may offer specialized products and services tailored to the needs of local buyers.

It’s important for homeowners and buyers to shop around and compare rates from multiple lenders to ensure they are getting the best deal. Websites like Bankrate and LendingTree can be helpful resources for comparing rates and terms from multiple lenders. Homeowners and buyers should also consider working with a mortgage broker who can help them navigate the lending process and find the best mortgage product for their needs.

In conclusion, predicting mortgage rates in 2024 is not an exact science, but there are several factors that could impact rates. By staying informed about economic indicators, Federal Reserve policy, and local market trends, homeowners and buyers can make informed decisions about their mortgage. Shopping around and comparing rates from multiple lenders is key to ensuring you are getting the best deal on your mortgage. Whether you’re looking to refinance your existing mortgage or buy a new home, it’s important to stay informed and be proactive in managing your mortgage.

-

Reverse Mortgage1 year ago

Reverse Mortgage1 year agoHow Reverse Loans Can Provide Financial Relief in Retirement

-

Mortgage Rates1 year ago

Mortgage Rates1 year agoComo puedo comprar una casa a crédito si no se nada?

-

Mortgage Rates1 year ago

Mortgage Rates1 year agoNiro Loan App 2024 || Niro App Se Loan Kaise Le || New Loan App Best Instant Loan App Without Cibi

-

Reverse Mortgage1 year ago

Reverse Mortgage1 year agoExploring the Myths and Realities of Reverse Mortgages for Seniors in 2024

-

Reverse Mortgage1 year ago

Reverse Mortgage1 year agoThe Pros and Cons of Using a Reverse Mortgage for Retirement Planning

-

Reverse Mortgage8 months ago

Reverse Mortgage8 months agoThe Benefits of a HECM Loan for Seniors: Financial Freedom in Retirement

-

USDA Mortgage1 year ago

USDA Mortgage1 year agoMaking Your Dream of Country Living a Reality: FMHA Rural Home Loans in Focus

-

Auto Loans6 months ago

Auto Loans6 months agoDrive Away in Your Dream Chevy with Chevrolet’s Hassle-Free Lending Process