Uncategorized

JPMorgan’s Jamie Dimon gives support to Disney’s Bob Iger in activist fight

Bank of America’s Jessica Reif Ehrlich discusses her $130 price target for Disney, the day after earnings boosted stock 10% on ‘The Claman Countdown.’

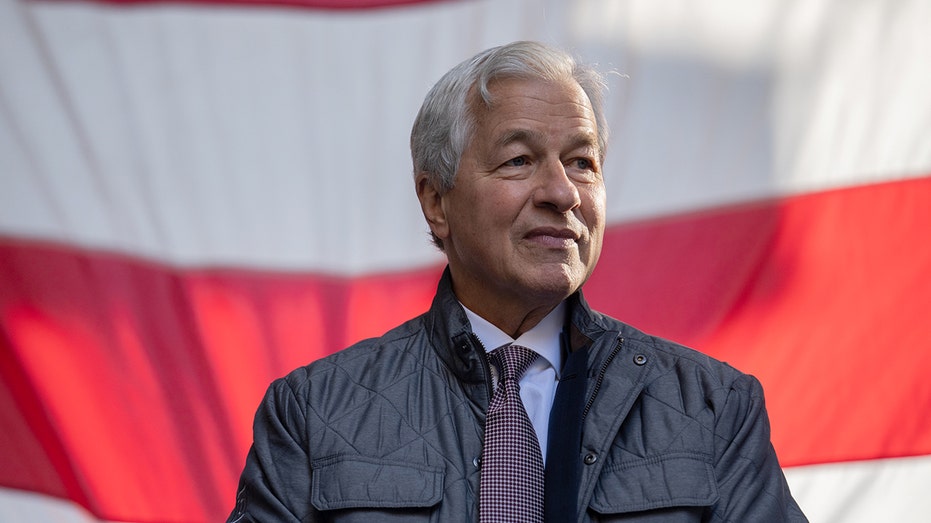

JPMorgan Chase CEO Jamie Dimon involved himself in the Disney-Trian Fund Management proxy fight by expressing his support for CEO Bob Iger.

Dimon told CNBC on Wednesday that Iger was a “first-class executive and outstanding leader” who “knows the media and entertainment business cold and has the successful track record to prove it.”

“It’s a complicated industry filled with creative talent, requiring the unique expertise and engagement skills that Bob possesses,” the bank CEO continued, according to the outlet. “Putting people on a board unnecessarily can harm a company. I don’t know why shareholders would take that risk, especially given the significant progress the company has made since Bob came back.”

JPMorgan Chase’s Jamie Dimon said Disney’s Bob Iger was a “first-class executive and outstanding leader.” (Jeenah Moon/Bloomberg via Getty Images / Getty Images)

The latest proxy fight between the entertainment giant and Trian Fund Management’s Nelson Peltz kicked off late last year. Trian and affiliates have a stake in Disney worth about $3.5 billion.

DISNEY WINS APPROVAL FROM HOME CITY TO EXPAND PARK, EYES ‘IMMERSIVE’ ATTRACTIONS

The firm has argued that Disney has experienced “chronic underperformance” in its financials and directed the blame at its board. It alleged the board has fallen short in strategy oversight, capital allocation, culture, succession planning, executive compensation and other areas in a recently released white paper.

On top of calling for changes at the company, Trian put forward Peltz and former Disney CFO James Rasulo as its nominees to Disney’s board in mid-December to help “restore the magic” at the entertainment giant. It has continued to push for seats for the duo since.

A sign near an entrance to Walt Disney World in Orlando, Florida. (Joe Raedle/Getty Images / Getty Images)

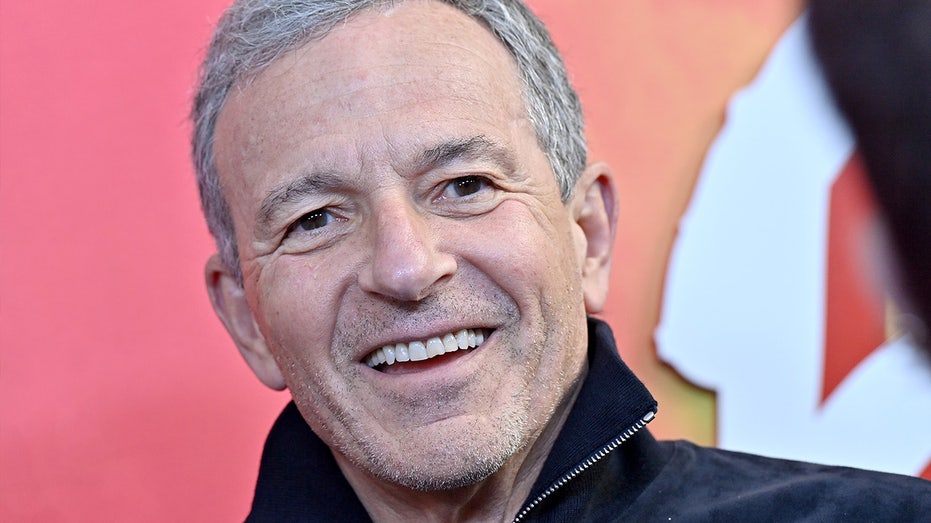

In response to Dimon’s backing of Iger, Trian said in a press release that Disney “appears to be leaning on its investment bankers and commercial partners for public endorsements, when this campaign should be focused not on statements of highly compensated bankers and service providers, but on how shareholders can ensure good governance and oversight from the Board.”

DISNEY TOPS EARNINGS FORECAST, SHARES SOAR IN EXTENDED TRADING

FOX Business also reached out to Disney regarding Dimon but did not receive a response by the time of publication.

Disney has previously pushed back on Trian’s slew of criticisms, in addition to arguing its “strategic transformation is working” and its board and management “are delivering on our commitments to create superior, sustainable shareholder value.” It has also questioned the qualifications of Trian’s nominees in comparison to its own board nominees, who it said were “best qualified” for overseeing the company.

Bob Iger attends the Los Angeles special screening of “Flamin’ Hot” at Hollywood Post 43-American Legion on June 9, 2023. (Axelle/Bauer-Griffin/FilmMagic / Getty Images)

Peltz and Trian previously engaged in a proxy fight with Disney and Iger that ended in February of last year. Its end coincided with Disney revealing plans to curb costs through layoffs and other measures and to reshuffle the company.

DISNEY CEO BOB IGER GETS MORE ACTIVIST INVESTOR HEAT AMID STOCK SLUMP

In a filing this week, Disney said it was “on track” to achieve its increased annualized savings target of $7.5 billion.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| DIS | THE WALT DISNEY CO. | 112.50 | +0.04 | +0.04% |

The shareholder meeting where the current proxy battle will come to a head is slated to take place in early April.

Disney’s board nominees for that vote include Mary Barra, Safra Catz, Amy Chang, Jeremy Carroch, Carolyn Everson, Michael Froman, James Gorman, Maria Lagomasino, Calvin McDonald, Mark Park, Derica Rice and Iger.

Uncategorized

Urgent Money Miracle – $2+ EPC! Get Instant 90% Commission Bump

Product Name: Urgent Money Miracle – $2+ EPC! Get Instant 90% Commission Bump

All orders are protected by SSL encryption – the highest industry standard for online security from trusted vendors.

Urgent Money Miracle – $2+ EPC! Get Instant 90% Commission Bump is backed with a 60 Day No Questions Asked Money Back Guarantee. If within the first 60 days of receipt you are not satisfied with Wake Up Lean™, you can request a refund by sending an email to the address given inside the product and we will immediately refund your entire purchase price, with no questions asked.

Uncategorized

NEW! Christian Wealth Manifestation – Highly Targeted For Christians!

Product Name: NEW! Christian Wealth Manifestation – Highly Targeted For Christians!

All orders are protected by SSL encryption – the highest industry standard for online security from trusted vendors.

NEW! Christian Wealth Manifestation – Highly Targeted For Christians! is backed with a 60 Day No Questions Asked Money Back Guarantee. If within the first 60 days of receipt you are not satisfied with Wake Up Lean™, you can request a refund by sending an email to the address given inside the product and we will immediately refund your entire purchase price, with no questions asked.

Uncategorized

Predictions for Mortgage Rates in 2024: What to Expect

As we look ahead to 2024, many homeowners and prospective buyers are wondering what to expect when it comes to mortgage rates. The landscape of the housing market is constantly changing, so it’s important to stay informed about trends and predictions. In this blog post, we will discuss some factors that could impact mortgage rates in 2024 and what homeowners and buyers can expect.

One factor that could impact mortgage rates in 2024 is the overall state of the economy. If the economy is strong and growing, we may see higher mortgage rates as the Federal Reserve looks to combat inflation. On the other hand, if the economy is stagnant or in a recession, we may see lower mortgage rates as the Fed looks to stimulate growth. It’s important to keep an eye on economic indicators such as GDP growth, unemployment rates, and inflation to get a sense of where mortgage rates may be heading.

Another factor that could impact mortgage rates in 2024 is Federal Reserve policy. The Fed plays a key role in setting interest rates, and their decisions can have a ripple effect on mortgage rates. If the Fed decides to raise interest rates in response to inflation, we may see an increase in mortgage rates. Conversely, if the Fed decides to lower interest rates to stimulate growth, we may see a decrease in mortgage rates. Keeping up with the latest news and announcements from the Fed can give homeowners and buyers a sense of where mortgage rates may be heading.

In terms of specific cities and local mortgage companies, it’s important to note that mortgage rates can vary depending on location and lender. For example, in a city like New York City, where real estate prices are high, mortgage rates may be higher compared to a city like Indianapolis, where real estate prices are lower. Additionally, local mortgage companies may offer competitive rates and terms compared to national lenders. For example, in New York City, local lenders like Quontic Bank and CrossCountry Mortgage may offer specialized products and services tailored to the needs of local buyers.

It’s important for homeowners and buyers to shop around and compare rates from multiple lenders to ensure they are getting the best deal. Websites like Bankrate and LendingTree can be helpful resources for comparing rates and terms from multiple lenders. Homeowners and buyers should also consider working with a mortgage broker who can help them navigate the lending process and find the best mortgage product for their needs.

In conclusion, predicting mortgage rates in 2024 is not an exact science, but there are several factors that could impact rates. By staying informed about economic indicators, Federal Reserve policy, and local market trends, homeowners and buyers can make informed decisions about their mortgage. Shopping around and comparing rates from multiple lenders is key to ensuring you are getting the best deal on your mortgage. Whether you’re looking to refinance your existing mortgage or buy a new home, it’s important to stay informed and be proactive in managing your mortgage.

-

Reverse Mortgage1 year ago

Reverse Mortgage1 year agoHow Reverse Loans Can Provide Financial Relief in Retirement

-

Mortgage Rates1 year ago

Mortgage Rates1 year agoComo puedo comprar una casa a crédito si no se nada?

-

Mortgage Rates1 year ago

Mortgage Rates1 year agoNiro Loan App 2024 || Niro App Se Loan Kaise Le || New Loan App Best Instant Loan App Without Cibi

-

Reverse Mortgage1 year ago

Reverse Mortgage1 year agoExploring the Myths and Realities of Reverse Mortgages for Seniors in 2024

-

Reverse Mortgage1 year ago

Reverse Mortgage1 year agoThe Pros and Cons of Using a Reverse Mortgage for Retirement Planning

-

Reverse Mortgage8 months ago

Reverse Mortgage8 months agoThe Benefits of a HECM Loan for Seniors: Financial Freedom in Retirement

-

USDA Mortgage1 year ago

USDA Mortgage1 year agoMaking Your Dream of Country Living a Reality: FMHA Rural Home Loans in Focus

-

Auto Loans6 months ago

Auto Loans6 months agoDrive Away in Your Dream Chevy with Chevrolet’s Hassle-Free Lending Process