Uncategorized

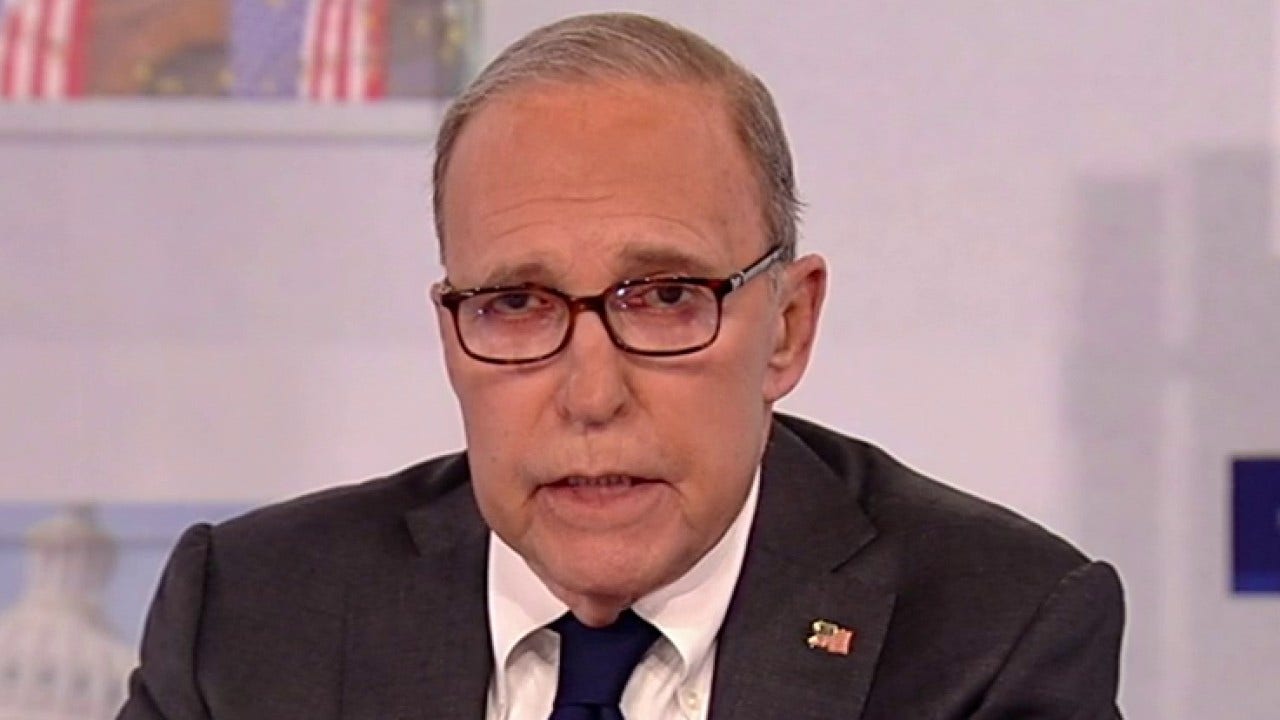

Larry Kudlow reacts to President Biden’s southern border visit

FOX Business host Larry Kudlow compares the immigration policies of former President Trump and President Biden on ‘Kudlow.’

With all the hoopla reporting of the presidential visits to the Texas border, I haven’t seen any specific references to two very important laws passed by Congress and signed by other presidents that will go a long way toward solving Joe Biden’s catastrophic open border policy, and the roughly 10 million illegals who have entered our country.

First, is section 212(f) of the Immigration and Nationality Act, which gives the president authority to “suspend the entry of all aliens or any class of aliens.” It’s actually similar to President Trump’s Title 42, but it’s broader than public health emergencies. Second, is the Illegal Immigration Reform and Immigrant Responsibility Act of 1996, which added section 287(g) to the Immigration and Nationality Act. The gist of this amendment to the Immigration and Nationality Act, is that it authorizes U.S. immigration and Customs Enforcement (ICE) to delegate to state and local law enforcement officers the authority to perform specified immigration officer functions under the agency’s direction and oversight.

What’s more, 287(g) gives ICE and local law enforcement partners to identify and remove incarcerated criminal non-citizens… to protect the Homeland through the arrest and removal of non-citizens who undermine the safety of our nation’s communities and the integrity of U.S. immigration laws.

I’m going through all this because Joe Biden, and for that matter any other president, has the legal authority to stop illegal immigrants right at the border, and the legal authority to deport illegals who are criminals. They may be in sanctuary cities, but they can still be deported.

These bills would override sanctuary cities, and they would open the door to a massive deportation of illegals, working with local police and with ICE. Now this is essentially what former President Trump wants. He couldn’t be any clearer. He wants to go back to building a wall, “Remain in Mexico,” Title 42, and the policy of “catch and deport.”

Mr. Trump wants to mount a national campaign with all the local police authorities and all of law enforcement to deport the criminals. By the way, Joe Biden’s phony border bill will not even ask if the illegals coming into this country were criminals in their own country.

Unfortunately, we’re finding out there’s plenty of that. Hence, the terrible tragedy of Laken Riley and many others. Absolute tragedies. In his visit to Brownsville, all Biden could do is attack Republicans and push his spending bill, which would solve nothing regarding illegal immigration. Biden did not announce any executive actions, actions that are fully legal, as mentioned in the legislative acts that I referenced earlier.

Mr. Trump, on the other hand, made it perfectly clear that he would use his congressionally mandated executive power to once again close the border and go after the criminals let loose inside this country.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Sen. Marsha Blackburn, R-Tenn., shreds President Biden’s failed border policies on ‘Kudlow.’

That is what the 45th president refers to when he talks about illegal migrant crimes and ironically, down there in Eagle Pass, where Mr. Trump visited, Texas Governor Greg Abbott’s razor wire fence barricades have been working and slashing the number of illegals coming across.

There’s a lesson in that and there’s a lesson in following the law. Joe Biden is a hopeless open border man. He’s wants to call them “newcomers”. What does that tell you? Maybe it tells you everything you need to know. It’s been a catastrophe for America and Donald Trump has plenty of legal executive authority to end this mess. I just tried to clarify all that. Those laws are for real.

Uncategorized

Urgent Money Miracle – $2+ EPC! Get Instant 90% Commission Bump

Product Name: Urgent Money Miracle – $2+ EPC! Get Instant 90% Commission Bump

All orders are protected by SSL encryption – the highest industry standard for online security from trusted vendors.

Urgent Money Miracle – $2+ EPC! Get Instant 90% Commission Bump is backed with a 60 Day No Questions Asked Money Back Guarantee. If within the first 60 days of receipt you are not satisfied with Wake Up Lean™, you can request a refund by sending an email to the address given inside the product and we will immediately refund your entire purchase price, with no questions asked.

Uncategorized

NEW! Christian Wealth Manifestation – Highly Targeted For Christians!

Product Name: NEW! Christian Wealth Manifestation – Highly Targeted For Christians!

All orders are protected by SSL encryption – the highest industry standard for online security from trusted vendors.

NEW! Christian Wealth Manifestation – Highly Targeted For Christians! is backed with a 60 Day No Questions Asked Money Back Guarantee. If within the first 60 days of receipt you are not satisfied with Wake Up Lean™, you can request a refund by sending an email to the address given inside the product and we will immediately refund your entire purchase price, with no questions asked.

Uncategorized

Predictions for Mortgage Rates in 2024: What to Expect

As we look ahead to 2024, many homeowners and prospective buyers are wondering what to expect when it comes to mortgage rates. The landscape of the housing market is constantly changing, so it’s important to stay informed about trends and predictions. In this blog post, we will discuss some factors that could impact mortgage rates in 2024 and what homeowners and buyers can expect.

One factor that could impact mortgage rates in 2024 is the overall state of the economy. If the economy is strong and growing, we may see higher mortgage rates as the Federal Reserve looks to combat inflation. On the other hand, if the economy is stagnant or in a recession, we may see lower mortgage rates as the Fed looks to stimulate growth. It’s important to keep an eye on economic indicators such as GDP growth, unemployment rates, and inflation to get a sense of where mortgage rates may be heading.

Another factor that could impact mortgage rates in 2024 is Federal Reserve policy. The Fed plays a key role in setting interest rates, and their decisions can have a ripple effect on mortgage rates. If the Fed decides to raise interest rates in response to inflation, we may see an increase in mortgage rates. Conversely, if the Fed decides to lower interest rates to stimulate growth, we may see a decrease in mortgage rates. Keeping up with the latest news and announcements from the Fed can give homeowners and buyers a sense of where mortgage rates may be heading.

In terms of specific cities and local mortgage companies, it’s important to note that mortgage rates can vary depending on location and lender. For example, in a city like New York City, where real estate prices are high, mortgage rates may be higher compared to a city like Indianapolis, where real estate prices are lower. Additionally, local mortgage companies may offer competitive rates and terms compared to national lenders. For example, in New York City, local lenders like Quontic Bank and CrossCountry Mortgage may offer specialized products and services tailored to the needs of local buyers.

It’s important for homeowners and buyers to shop around and compare rates from multiple lenders to ensure they are getting the best deal. Websites like Bankrate and LendingTree can be helpful resources for comparing rates and terms from multiple lenders. Homeowners and buyers should also consider working with a mortgage broker who can help them navigate the lending process and find the best mortgage product for their needs.

In conclusion, predicting mortgage rates in 2024 is not an exact science, but there are several factors that could impact rates. By staying informed about economic indicators, Federal Reserve policy, and local market trends, homeowners and buyers can make informed decisions about their mortgage. Shopping around and comparing rates from multiple lenders is key to ensuring you are getting the best deal on your mortgage. Whether you’re looking to refinance your existing mortgage or buy a new home, it’s important to stay informed and be proactive in managing your mortgage.

-

Reverse Mortgage1 year ago

Reverse Mortgage1 year agoHow Reverse Loans Can Provide Financial Relief in Retirement

-

Mortgage Rates1 year ago

Mortgage Rates1 year agoComo puedo comprar una casa a crédito si no se nada?

-

Mortgage Rates1 year ago

Mortgage Rates1 year agoNiro Loan App 2024 || Niro App Se Loan Kaise Le || New Loan App Best Instant Loan App Without Cibi

-

Reverse Mortgage1 year ago

Reverse Mortgage1 year agoExploring the Myths and Realities of Reverse Mortgages for Seniors in 2024

-

Reverse Mortgage1 year ago

Reverse Mortgage1 year agoThe Pros and Cons of Using a Reverse Mortgage for Retirement Planning

-

Reverse Mortgage8 months ago

Reverse Mortgage8 months agoThe Benefits of a HECM Loan for Seniors: Financial Freedom in Retirement

-

USDA Mortgage1 year ago

USDA Mortgage1 year agoMaking Your Dream of Country Living a Reality: FMHA Rural Home Loans in Focus

-

Auto Loans6 months ago

Auto Loans6 months agoDrive Away in Your Dream Chevy with Chevrolet’s Hassle-Free Lending Process