Uncategorized

This week’s personal loan rates rise for 3-year loans, fall for 5-year loans

Our goal here at Credible Operations, Inc., NMLS Number 1681276, referred to as “Credible” below, is to give you the tools and confidence you need to improve your finances. Although we do promote products from our partner lenders who compensate us for our services, all opinions are our own.

The latest trends in interest rates for personal loans from the Credible marketplace, updated weekly. (iStock)

Borrowers with good credit seeking personal loans during the past seven days prequalified for rates that were higher for 3-year loans and lower for 5-year loans when compared to fixed-rate loans for the seven days before.

For borrowers with credit scores of 720 or higher who used the Credible marketplace to select a lender between March 4 and March 10:

- Rates on 3-year fixed-rate loans averaged 14.40%, up from 14.02% the seven days before and from 12.04% a year ago.

- Rates on 5-year fixed-rate loans averaged 21.12%, down from 22.15% the previous seven days and up from 15.25% a year ago.

Personal loans have become a popular way to consolidate debt and pay off credit card debt and other loans. They can also be used to cover unexpected and emergency expenses like medical bills, take care of a major purchase, or fund home improvement projects.

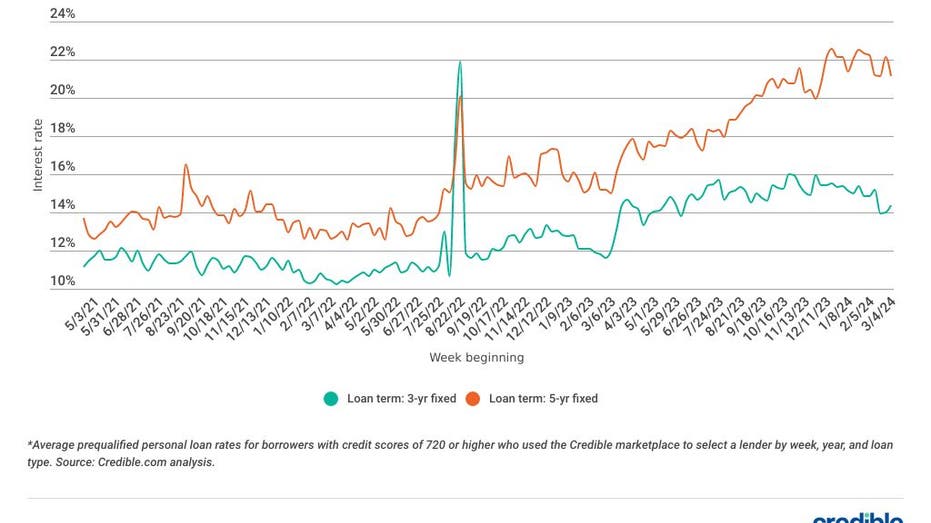

Average personal loan interest rates

Average personal loan interest rates increased over the last seven days for 3-year personal loans and decreased for 5-year personal loan rates. While 3-year loan rates rose by 0.38 percentage points, rates on 5-year loans fell by 1.03 percentage points. Interest rates for both loan terms remain significantly higher than they were this time last year, up 2.36 percentage points for 3-year loans, and 5.87 percentage points for 5-year loans.

Still, borrowers can take advantage of interest savings with a 3- or 5-year personal loan, as both loan terms offer lower interest rates on average than higher-cost borrowing options such as credit cards.

But whether a personal loan is right for you depends on multiple factors, including what rate you can qualify for, which is largely based on your credit score. Comparing multiple lenders and their rates helps ensure you get the best personal loan for your needs.

Before applying for a personal loan, use a personal loan marketplace like Credible to comparison shop.

Personal loan weekly rate trends

Here are the latest trends in personal loan interest rates from the Credible marketplace, updated weekly.

The chart above shows average prequalified rates for borrowers with credit scores of 720 or higher who used the Credible marketplace to select a lender.

For the month of February 2024:

- Rates on 3-year personal loans averaged 21.68%, down from 22.16% in January.

- Rates on 5-year personal loans averaged 24.88%, down from 25.26% in January.

Rates on personal loans vary considerably by credit score and loan term. If you’re curious about what kind of personal loan rates you may qualify for, you can use an online tool like Credible to compare options from different private lenders.

All Credible marketplace lenders offer fixed-rate loans at competitive rates. Because lenders use different methods to evaluate borrowers, it’s a good idea to request personal loan rates from multiple lenders so you can compare your options.

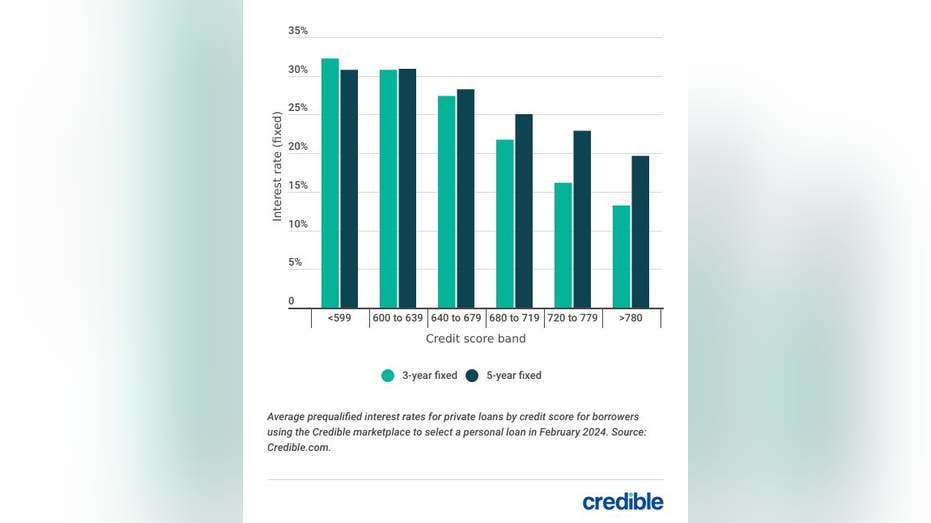

Current personal loan rates by credit score

In February, the average prequalified rate selected by borrowers was:

- 12.78% for borrowers with credit scores of 780 or above choosing a 3-year loan

- 30.11% for borrowers with credit scores below 600 choosing a 5-year loan

Depending on factors such as your credit score, which type of personal loan you’re seeking and the loan repayment term, the interest rate can differ.

As shown in the chart above, a good credit score can mean a lower interest rate, and rates tend to be higher on loans with fixed interest rates and longer repayment terms.

How to get a lower interest rate

Many factors influence the interest rate a lender might offer you on a personal loan. But you can take some steps to boost your chances of getting a lower interest rate. Here are some tactics to try.

Increase credit score

Generally, people with higher credit scores qualify for lower interest rates. Steps that can help you improve your credit score over time include:

- Pay bills on time: Payment history is the most important factor in your credit score. Pay all your bills on time for the amount due.

- Check your credit report: Look at your credit report to ensure there are no errors on it. If you find errors, dispute them with the credit bureau.

- Lower your credit utilization ratio: Paying down credit card debt can improve this important credit-scoring factor.

- Avoid opening new credit accounts: Only apply for and open credit accounts you actually need. Too many hard inquiries on your credit report in a short amount of time could lower your credit score.

Choose a shorter loan term

Personal loan repayment terms can vary from one to several years. Generally, shorter terms come with lower interest rates, since the lender’s money is at risk for a shorter period of time.

If your financial situation allows, applying for a shorter term could help you score a lower interest rate. Keep in mind the shorter term doesn’t just benefit the lender – by choosing a shorter repayment term, you’ll pay less interest over the life of the loan.

Get a cosigner

You may be familiar with the concept of a cosigner if you have student loans. If your credit isn’t good enough to qualify for the best personal loan interest rates, finding a cosigner with good credit could help you secure a lower interest rate.

Just remember, if you default on the loan, your cosigner will be on the hook to repay it. And cosigning for a loan could also affect their credit score.

Compare rates from different lenders

Before applying for a personal loan, it’s a good idea to shop around and compare offers from several different lenders to get the lowest rates. Online lenders typically offer the most competitive rates – and can be quicker to disburse your loan than a brick-and-mortar establishment.

But don’t worry, comparing rates and terms doesn’t have to be a time-consuming process.

Credible makes it easy. Just enter how much you want to borrow and you’ll be able to compare multiple lenders to choose the one that makes the most sense for you.

About Credible

Credible is a multi-lender marketplace that empowers consumers to discover financial products that are the best fit for their unique circumstances. Credible’s integrations with leading lenders and credit bureaus allow consumers to quickly compare accurate, personalized loan options – without putting their personal information at risk or affecting their credit score. The Credible marketplace provides an unrivaled customer experience, as reflected by over 6,500 positive Trustpilot reviews and a TrustScore of 4.7/5.

Uncategorized

Urgent Money Miracle – $2+ EPC! Get Instant 90% Commission Bump

Product Name: Urgent Money Miracle – $2+ EPC! Get Instant 90% Commission Bump

All orders are protected by SSL encryption – the highest industry standard for online security from trusted vendors.

Urgent Money Miracle – $2+ EPC! Get Instant 90% Commission Bump is backed with a 60 Day No Questions Asked Money Back Guarantee. If within the first 60 days of receipt you are not satisfied with Wake Up Lean™, you can request a refund by sending an email to the address given inside the product and we will immediately refund your entire purchase price, with no questions asked.

Uncategorized

NEW! Christian Wealth Manifestation – Highly Targeted For Christians!

Product Name: NEW! Christian Wealth Manifestation – Highly Targeted For Christians!

All orders are protected by SSL encryption – the highest industry standard for online security from trusted vendors.

NEW! Christian Wealth Manifestation – Highly Targeted For Christians! is backed with a 60 Day No Questions Asked Money Back Guarantee. If within the first 60 days of receipt you are not satisfied with Wake Up Lean™, you can request a refund by sending an email to the address given inside the product and we will immediately refund your entire purchase price, with no questions asked.

Uncategorized

Predictions for Mortgage Rates in 2024: What to Expect

As we look ahead to 2024, many homeowners and prospective buyers are wondering what to expect when it comes to mortgage rates. The landscape of the housing market is constantly changing, so it’s important to stay informed about trends and predictions. In this blog post, we will discuss some factors that could impact mortgage rates in 2024 and what homeowners and buyers can expect.

One factor that could impact mortgage rates in 2024 is the overall state of the economy. If the economy is strong and growing, we may see higher mortgage rates as the Federal Reserve looks to combat inflation. On the other hand, if the economy is stagnant or in a recession, we may see lower mortgage rates as the Fed looks to stimulate growth. It’s important to keep an eye on economic indicators such as GDP growth, unemployment rates, and inflation to get a sense of where mortgage rates may be heading.

Another factor that could impact mortgage rates in 2024 is Federal Reserve policy. The Fed plays a key role in setting interest rates, and their decisions can have a ripple effect on mortgage rates. If the Fed decides to raise interest rates in response to inflation, we may see an increase in mortgage rates. Conversely, if the Fed decides to lower interest rates to stimulate growth, we may see a decrease in mortgage rates. Keeping up with the latest news and announcements from the Fed can give homeowners and buyers a sense of where mortgage rates may be heading.

In terms of specific cities and local mortgage companies, it’s important to note that mortgage rates can vary depending on location and lender. For example, in a city like New York City, where real estate prices are high, mortgage rates may be higher compared to a city like Indianapolis, where real estate prices are lower. Additionally, local mortgage companies may offer competitive rates and terms compared to national lenders. For example, in New York City, local lenders like Quontic Bank and CrossCountry Mortgage may offer specialized products and services tailored to the needs of local buyers.

It’s important for homeowners and buyers to shop around and compare rates from multiple lenders to ensure they are getting the best deal. Websites like Bankrate and LendingTree can be helpful resources for comparing rates and terms from multiple lenders. Homeowners and buyers should also consider working with a mortgage broker who can help them navigate the lending process and find the best mortgage product for their needs.

In conclusion, predicting mortgage rates in 2024 is not an exact science, but there are several factors that could impact rates. By staying informed about economic indicators, Federal Reserve policy, and local market trends, homeowners and buyers can make informed decisions about their mortgage. Shopping around and comparing rates from multiple lenders is key to ensuring you are getting the best deal on your mortgage. Whether you’re looking to refinance your existing mortgage or buy a new home, it’s important to stay informed and be proactive in managing your mortgage.

-

Reverse Mortgage1 year ago

Reverse Mortgage1 year agoHow Reverse Loans Can Provide Financial Relief in Retirement

-

Mortgage Rates1 year ago

Mortgage Rates1 year agoComo puedo comprar una casa a crédito si no se nada?

-

Mortgage Rates1 year ago

Mortgage Rates1 year agoNiro Loan App 2024 || Niro App Se Loan Kaise Le || New Loan App Best Instant Loan App Without Cibi

-

Reverse Mortgage1 year ago

Reverse Mortgage1 year agoExploring the Myths and Realities of Reverse Mortgages for Seniors in 2024

-

Reverse Mortgage1 year ago

Reverse Mortgage1 year agoThe Pros and Cons of Using a Reverse Mortgage for Retirement Planning

-

Reverse Mortgage8 months ago

Reverse Mortgage8 months agoThe Benefits of a HECM Loan for Seniors: Financial Freedom in Retirement

-

USDA Mortgage1 year ago

USDA Mortgage1 year agoMaking Your Dream of Country Living a Reality: FMHA Rural Home Loans in Focus

-

Auto Loans6 months ago

Auto Loans6 months agoDrive Away in Your Dream Chevy with Chevrolet’s Hassle-Free Lending Process