Uncategorized

Court rules Biden admin can’t discriminate based on race for small business loans: ‘Stake in the heart of DEI’

‘Fox & Friends’ co-host Lawrence Jones speaks to a business owner at the Golden Egg diner in Surfside Beach, South Carolina.

Three small business owners filed suit and won in court against the Biden administration for attempting to choose winners and losers solely based on race when deciding who would receive government financial support.

The Wisconsin Institute for Law & Liberty (WILL) sued the Minority Business Development Agency (MBDA), a federal agency that was expanded under the Biden administration and charged with supporting minority-owned businesses, in March 2023 on behalf of Jeffrey Nuziard, Matthew Piper and Christian Brucker.

The MBDA sought to serve “minority business enterprises (MBEs) owned and operated by African Americans, Asian Americans, Hasidic Jews, Hispanic Americans, Native Americans and Pacific Islanders.” The agency was created as part of a presidential executive order in the 1960s, and permanently authorized through the Infrastructure Act in 2021.

All three plaintiffs sought to use the MBDA to support their businesses, but were unable to do so because of their race, according to the lawsuit. In addition, the MBDA also discriminated on the type of minority eligible for aid, excluding racial groups from the Middle East, North Africa or North Asia.

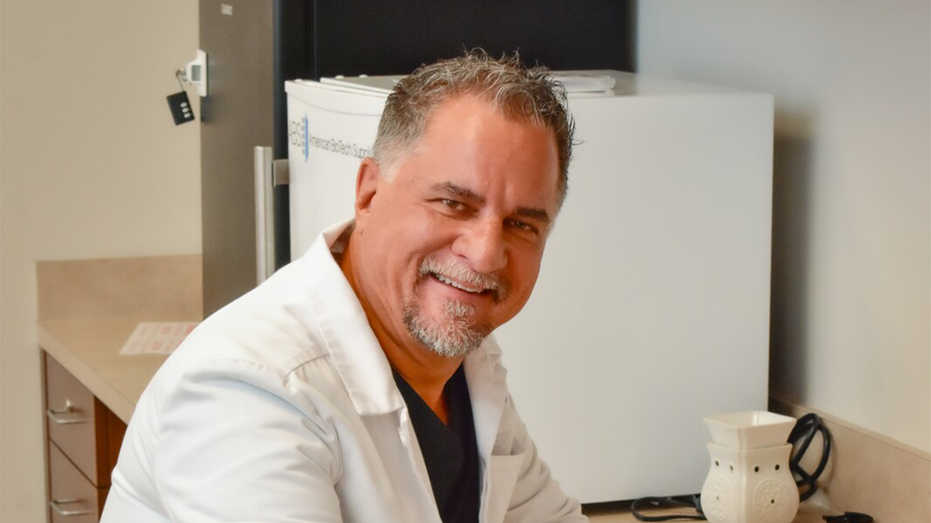

Plaintiff Christian Bruckner (WILL)

BIDEN’S LATEST ECO REGS BLASTED BY SMALL BUSINESSES, MANUFACTURERS: ‘WILL DO TERRIBLE DAMAGE’

The court ruled Wednesday that the MBDA violated the Constitution’s core requirement of equal treatment under the law and that the government agency can no longer run programs or grants based on race.

U.S. District Judge Mark Pittman noted in his decision that while the MBDA “can still operate its Business Centers, it must simply do so without vetting applicants based on race.”

He said the federal agency’s “very design” “punishes” those of certain disfavored racial groups, adding “the federal government may not flagrantly violate such rights with impunity.

“The MBDA has done so for years,” he concluded. “Time’s up.”

Christian Bruckner, a Romanian immigrant to the United States who owns a contracting company in Florida, reached out to the MBDA to inquire about federal assistance, but when he did, he was told the agency’s focus was “to help grow businesses owned by people of ethnic minorities,” according to the lawsuit. He was instead directed to a private company where he would have had to pay for assistance. Bruckner came to the U.S. in the 1970s because of the belief that America is the freest nation on Earth, which is why he originally said he wanted to pursue the lawsuit.

He told Fox News Digital that the decision gives him “great confidence in the justice system” and that he hopes “there will be equality for all American citizens regardless of race, especially in taxpayer-funded programs like this.”

Plaintiff Jeffrey Nuziard, a U.S. Army veteran from the Dallas-Ft.Worth area, wanted to expand his business, Sexual Wellness Centers of Texas, but when he looked at the grants offered by the MBDA, he discovered he was ineligible due to his race. He previously called it “just plain offensive that President Biden set up an agency devoted to helping some races, and not others.”

Plaintiff Jeff Nuziard (WILL)

ALABAMA FEDERAL JUDGE RULES BIDEN ADMIN’S SMALL BUSINESS REPORTING REQUIREMENT UNCONSTITUTIONAL

The third plaintiff, Matthew Piper, who owns an architecture agency in Wisconsin, also discovered he was ineligible for assistance through the MBDA due to his skin color. When he filed suit, Piper said “the American dream should be afforded to all Americans regardless of skin color or cultural background.”

Daniel Lennington, deputy counsel at WILL, told Fox News Digital that the decision is a great win for equality and a “stake in the heart of DEI.”

“Victory in this case means that governments and businesses who use DEI can no longer just make assumptions about people, they have to actually help people who need help, which is what we think the government should do,” Lennington said. “They should treat people as individuals and not members of racial groups.”

WILL president and general counsel, Rick Esenberg, applauded the decision that put an end to actions by “a discriminatory agency that persisted for decades.”

Plaintiff Matthew Piper (WILL)

“The Biden Administration re-invigorated it and then refused to help millions of businesses based on race,” he said. “Those days are now over. Equality must be the law of the land, and through the bravery and persistence of our clients, we are closer to fulfilling that dream.”

THIS 2024 MASS DATA COLLECTION PROGRAM HAS BEGUN AND GOVERNMENT IS TARGETING YOUR SMALL BUSINESS

Lennington explained that this case is the third win as part of the larger project by WILL, known as the Equality Under The Law Project, which takes aim at numerous programs in the Biden administration that promote a racial equity agenda, according to the organization.

WILL filed a lawsuit against the Biden Administration for its Farmer Loan-Forgiveness program that canceled certain farm loans based on race and the Restaurant Revitalization Fund, which provided COVID-19 benefits to certain restaurants using racial preference. WILL obtained injunctions against both programs.

WILL is also challenging another portion of the 2021 Infrastructure Act, which is currently pending in federal court. In the fourth case brought by WILL against the Biden administration, the lawsuit aims to open up the Disadvantaged Business Enterprise (DBE) program, a $37 billion infrastructure fund, which is currently only available to minorities.

Lennington said a decision in the case is expected in the coming weeks or months.

Uncategorized

Urgent Money Miracle – $2+ EPC! Get Instant 90% Commission Bump

Product Name: Urgent Money Miracle – $2+ EPC! Get Instant 90% Commission Bump

All orders are protected by SSL encryption – the highest industry standard for online security from trusted vendors.

Urgent Money Miracle – $2+ EPC! Get Instant 90% Commission Bump is backed with a 60 Day No Questions Asked Money Back Guarantee. If within the first 60 days of receipt you are not satisfied with Wake Up Lean™, you can request a refund by sending an email to the address given inside the product and we will immediately refund your entire purchase price, with no questions asked.

Uncategorized

NEW! Christian Wealth Manifestation – Highly Targeted For Christians!

Product Name: NEW! Christian Wealth Manifestation – Highly Targeted For Christians!

All orders are protected by SSL encryption – the highest industry standard for online security from trusted vendors.

NEW! Christian Wealth Manifestation – Highly Targeted For Christians! is backed with a 60 Day No Questions Asked Money Back Guarantee. If within the first 60 days of receipt you are not satisfied with Wake Up Lean™, you can request a refund by sending an email to the address given inside the product and we will immediately refund your entire purchase price, with no questions asked.

Uncategorized

Predictions for Mortgage Rates in 2024: What to Expect

As we look ahead to 2024, many homeowners and prospective buyers are wondering what to expect when it comes to mortgage rates. The landscape of the housing market is constantly changing, so it’s important to stay informed about trends and predictions. In this blog post, we will discuss some factors that could impact mortgage rates in 2024 and what homeowners and buyers can expect.

One factor that could impact mortgage rates in 2024 is the overall state of the economy. If the economy is strong and growing, we may see higher mortgage rates as the Federal Reserve looks to combat inflation. On the other hand, if the economy is stagnant or in a recession, we may see lower mortgage rates as the Fed looks to stimulate growth. It’s important to keep an eye on economic indicators such as GDP growth, unemployment rates, and inflation to get a sense of where mortgage rates may be heading.

Another factor that could impact mortgage rates in 2024 is Federal Reserve policy. The Fed plays a key role in setting interest rates, and their decisions can have a ripple effect on mortgage rates. If the Fed decides to raise interest rates in response to inflation, we may see an increase in mortgage rates. Conversely, if the Fed decides to lower interest rates to stimulate growth, we may see a decrease in mortgage rates. Keeping up with the latest news and announcements from the Fed can give homeowners and buyers a sense of where mortgage rates may be heading.

In terms of specific cities and local mortgage companies, it’s important to note that mortgage rates can vary depending on location and lender. For example, in a city like New York City, where real estate prices are high, mortgage rates may be higher compared to a city like Indianapolis, where real estate prices are lower. Additionally, local mortgage companies may offer competitive rates and terms compared to national lenders. For example, in New York City, local lenders like Quontic Bank and CrossCountry Mortgage may offer specialized products and services tailored to the needs of local buyers.

It’s important for homeowners and buyers to shop around and compare rates from multiple lenders to ensure they are getting the best deal. Websites like Bankrate and LendingTree can be helpful resources for comparing rates and terms from multiple lenders. Homeowners and buyers should also consider working with a mortgage broker who can help them navigate the lending process and find the best mortgage product for their needs.

In conclusion, predicting mortgage rates in 2024 is not an exact science, but there are several factors that could impact rates. By staying informed about economic indicators, Federal Reserve policy, and local market trends, homeowners and buyers can make informed decisions about their mortgage. Shopping around and comparing rates from multiple lenders is key to ensuring you are getting the best deal on your mortgage. Whether you’re looking to refinance your existing mortgage or buy a new home, it’s important to stay informed and be proactive in managing your mortgage.

-

Reverse Mortgage1 year ago

Reverse Mortgage1 year agoHow Reverse Loans Can Provide Financial Relief in Retirement

-

Mortgage Rates1 year ago

Mortgage Rates1 year agoComo puedo comprar una casa a crédito si no se nada?

-

Mortgage Rates1 year ago

Mortgage Rates1 year agoNiro Loan App 2024 || Niro App Se Loan Kaise Le || New Loan App Best Instant Loan App Without Cibi

-

Reverse Mortgage1 year ago

Reverse Mortgage1 year agoExploring the Myths and Realities of Reverse Mortgages for Seniors in 2024

-

Reverse Mortgage1 year ago

Reverse Mortgage1 year agoThe Pros and Cons of Using a Reverse Mortgage for Retirement Planning

-

Reverse Mortgage8 months ago

Reverse Mortgage8 months agoThe Benefits of a HECM Loan for Seniors: Financial Freedom in Retirement

-

USDA Mortgage1 year ago

USDA Mortgage1 year agoMaking Your Dream of Country Living a Reality: FMHA Rural Home Loans in Focus

-

Auto Loans6 months ago

Auto Loans6 months agoDrive Away in Your Dream Chevy with Chevrolet’s Hassle-Free Lending Process