Uncategorized

Johnny Depp and Kate Moss’s former New York townhouse sells for $12 million

Check out what’s clicking on FoxBusiness.com

Johnny Depp and Kate Moss’s former New York townhouse has a new owner.

The 6,321-square-foot, four-story, five-bedroom and seven-bathroom townhouse was originally listed for $13.5 million and sold for $12 million.

Originally built in 1826, the house was renovated in the early 1900s, when the brick exterior was added, one of the home’s unique features.

The building has been updated recently with a new foundation, reinforced steel and updated plumbing and electricity throughout.

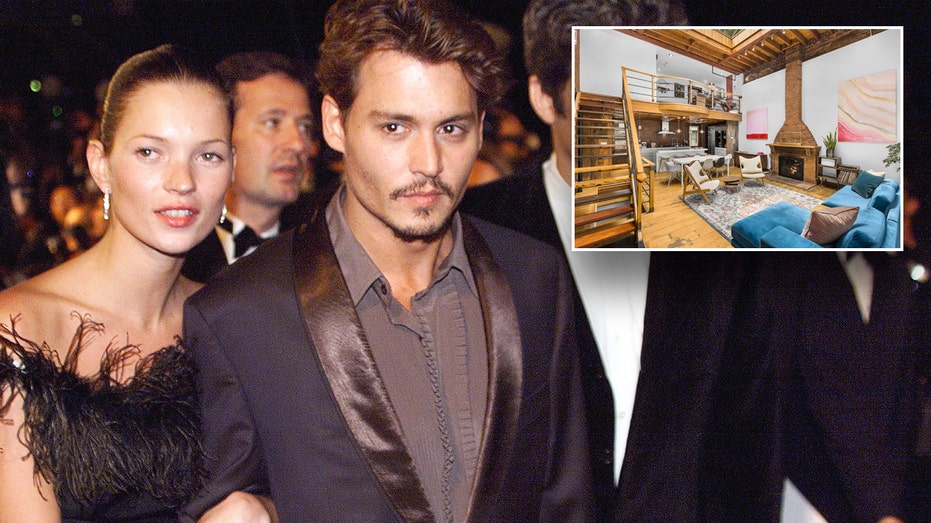

Depp and Moss’s former townhouse sold for $12 million. (Getty Images/Real Estate Production Network / Fox News)

The brick exterior is one of the unique elements of the townhouse. (Real Estate Production Network / Fox News)

While much of the house has been updated, the townhouse still maintains some of its original features, including the hardwood floors, high ceilings, exposed brick and mahogany molding, as well as large windows.

The home features many of its original features from the 1800s, including hardwood floors, exposed brick and mahogany moldings. (Real Estate Production Network / Fox News)

The home is being used as four rental units, but it can be used as a single-family home. The first floor features a spacious living room, two bathrooms, a bedroom, a wood-burning fireplace and a private outdoor terrace, which can be found on every floor.

Moss and Depp’s townhouse features five bedrooms. (Real Estate Production Network / Fox News)

Each unit of the home features a living space with a fireplace and high ceilings. (Real Estate Production Network / Fox News)

In addition to two bedrooms and a second spacious living area, the second floor features a full kitchen, dining area and a full bathroom. The top two floors make up the penthouse, which comes with its own rooftop deck with great views of the city and its landmarks, including The Empire State Building.

On top of the main living area, the townhouse comes with a separate carriage house, with two bathrooms, a spacious kitchen featuring a copper ceiling, a skylight, a private entrance and its own private outdoor area described as “an enchanting space that exudes charm and inspires creativity” in the listing.

Each unit of the home comes with its own private outdoor living space. (Real Estate Production Network / Fox News)

The penthouse takes up the final two floors. (Real Estate Production Network / Fox News)

The townhouse is situated in a prime location just half a block from Washington Square Park. It’s in close proximity to some of New York City’s hottest restaurants and is a block away from the West 4th St. train station.

The home features a full kitchen on the second floor and another kitchen in the carriage house. (Real Estate Production Network / Fox News)

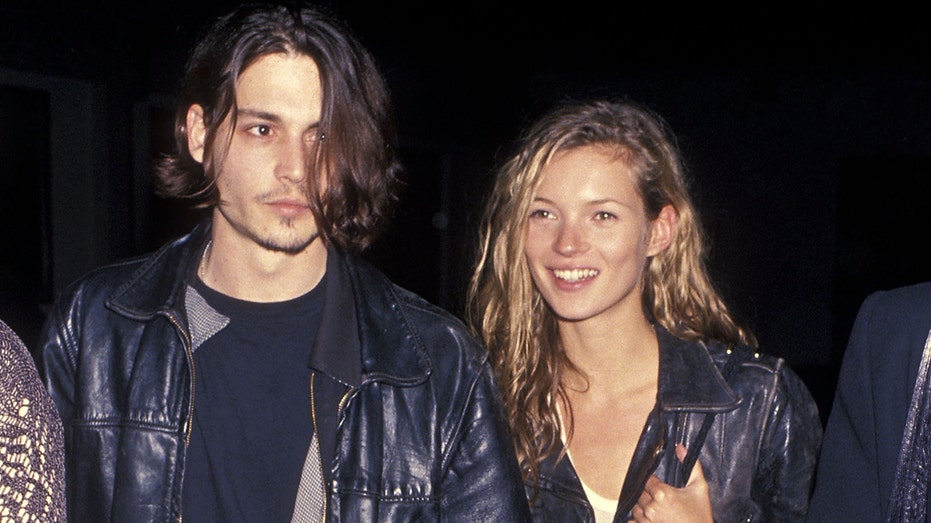

Depp and Moss dated for close to four years, from 1994 to 1997, and Moss told Vanity Fair in 2012 she cried for “years” following their breakup, explaining no one had taken care of her like he had.

The two went on to date other people, and Depp entered a 14-year relationship with French model Vanessa Paradis. They welcomed two children together, Lily-Rose and Jack.

CLICK HERE TO READ MORE ON FOX BUSINESS

Moss and Depp dated from 1994 to 1997. (Getty Images / Getty Images)

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Moss dated Jefferson Hack from 2001 to 2004, welcoming daughter Lila Moss with him in 2002. She married Jamie Hince in 2011, before finalizing their divorce in 2016, and has been in a relationship with Nikolai von Bismarck since 2015.

Uncategorized

Urgent Money Miracle – $2+ EPC! Get Instant 90% Commission Bump

Product Name: Urgent Money Miracle – $2+ EPC! Get Instant 90% Commission Bump

All orders are protected by SSL encryption – the highest industry standard for online security from trusted vendors.

Urgent Money Miracle – $2+ EPC! Get Instant 90% Commission Bump is backed with a 60 Day No Questions Asked Money Back Guarantee. If within the first 60 days of receipt you are not satisfied with Wake Up Lean™, you can request a refund by sending an email to the address given inside the product and we will immediately refund your entire purchase price, with no questions asked.

Uncategorized

NEW! Christian Wealth Manifestation – Highly Targeted For Christians!

Product Name: NEW! Christian Wealth Manifestation – Highly Targeted For Christians!

All orders are protected by SSL encryption – the highest industry standard for online security from trusted vendors.

NEW! Christian Wealth Manifestation – Highly Targeted For Christians! is backed with a 60 Day No Questions Asked Money Back Guarantee. If within the first 60 days of receipt you are not satisfied with Wake Up Lean™, you can request a refund by sending an email to the address given inside the product and we will immediately refund your entire purchase price, with no questions asked.

Uncategorized

Predictions for Mortgage Rates in 2024: What to Expect

As we look ahead to 2024, many homeowners and prospective buyers are wondering what to expect when it comes to mortgage rates. The landscape of the housing market is constantly changing, so it’s important to stay informed about trends and predictions. In this blog post, we will discuss some factors that could impact mortgage rates in 2024 and what homeowners and buyers can expect.

One factor that could impact mortgage rates in 2024 is the overall state of the economy. If the economy is strong and growing, we may see higher mortgage rates as the Federal Reserve looks to combat inflation. On the other hand, if the economy is stagnant or in a recession, we may see lower mortgage rates as the Fed looks to stimulate growth. It’s important to keep an eye on economic indicators such as GDP growth, unemployment rates, and inflation to get a sense of where mortgage rates may be heading.

Another factor that could impact mortgage rates in 2024 is Federal Reserve policy. The Fed plays a key role in setting interest rates, and their decisions can have a ripple effect on mortgage rates. If the Fed decides to raise interest rates in response to inflation, we may see an increase in mortgage rates. Conversely, if the Fed decides to lower interest rates to stimulate growth, we may see a decrease in mortgage rates. Keeping up with the latest news and announcements from the Fed can give homeowners and buyers a sense of where mortgage rates may be heading.

In terms of specific cities and local mortgage companies, it’s important to note that mortgage rates can vary depending on location and lender. For example, in a city like New York City, where real estate prices are high, mortgage rates may be higher compared to a city like Indianapolis, where real estate prices are lower. Additionally, local mortgage companies may offer competitive rates and terms compared to national lenders. For example, in New York City, local lenders like Quontic Bank and CrossCountry Mortgage may offer specialized products and services tailored to the needs of local buyers.

It’s important for homeowners and buyers to shop around and compare rates from multiple lenders to ensure they are getting the best deal. Websites like Bankrate and LendingTree can be helpful resources for comparing rates and terms from multiple lenders. Homeowners and buyers should also consider working with a mortgage broker who can help them navigate the lending process and find the best mortgage product for their needs.

In conclusion, predicting mortgage rates in 2024 is not an exact science, but there are several factors that could impact rates. By staying informed about economic indicators, Federal Reserve policy, and local market trends, homeowners and buyers can make informed decisions about their mortgage. Shopping around and comparing rates from multiple lenders is key to ensuring you are getting the best deal on your mortgage. Whether you’re looking to refinance your existing mortgage or buy a new home, it’s important to stay informed and be proactive in managing your mortgage.

-

Reverse Mortgage1 year ago

Reverse Mortgage1 year agoHow Reverse Loans Can Provide Financial Relief in Retirement

-

Mortgage Rates1 year ago

Mortgage Rates1 year agoComo puedo comprar una casa a crédito si no se nada?

-

Mortgage Rates1 year ago

Mortgage Rates1 year agoNiro Loan App 2024 || Niro App Se Loan Kaise Le || New Loan App Best Instant Loan App Without Cibi

-

Reverse Mortgage1 year ago

Reverse Mortgage1 year agoExploring the Myths and Realities of Reverse Mortgages for Seniors in 2024

-

Reverse Mortgage1 year ago

Reverse Mortgage1 year agoThe Pros and Cons of Using a Reverse Mortgage for Retirement Planning

-

Reverse Mortgage8 months ago

Reverse Mortgage8 months agoThe Benefits of a HECM Loan for Seniors: Financial Freedom in Retirement

-

USDA Mortgage1 year ago

USDA Mortgage1 year agoMaking Your Dream of Country Living a Reality: FMHA Rural Home Loans in Focus

-

Auto Loans6 months ago

Auto Loans6 months agoDrive Away in Your Dream Chevy with Chevrolet’s Hassle-Free Lending Process