Uncategorized

Nvidia’s CEO has rich real estate portfolio

Satori Fund senior portfolio manager Dan Niles analyzes the performance of the ‘Magnificent 7’ stocks and reveals some upcoming investment opportunities on ‘Making Money.’

Jensen Huang has seen major success with Nvidia and, according to the Wall Street Journal, invested some of it in properties for him and his family over the years.

The CEO of Nvidia has reportedly accumulated a reported net worth of $77.2 billion thanks to the AI chipmaker he created with Chris Malachowsky and Curtis Priem.

The real estate footprint that Huang has created with his 11-figure net worth spans two states, The Journal reported earlier this week. Nvidia declined to comment.

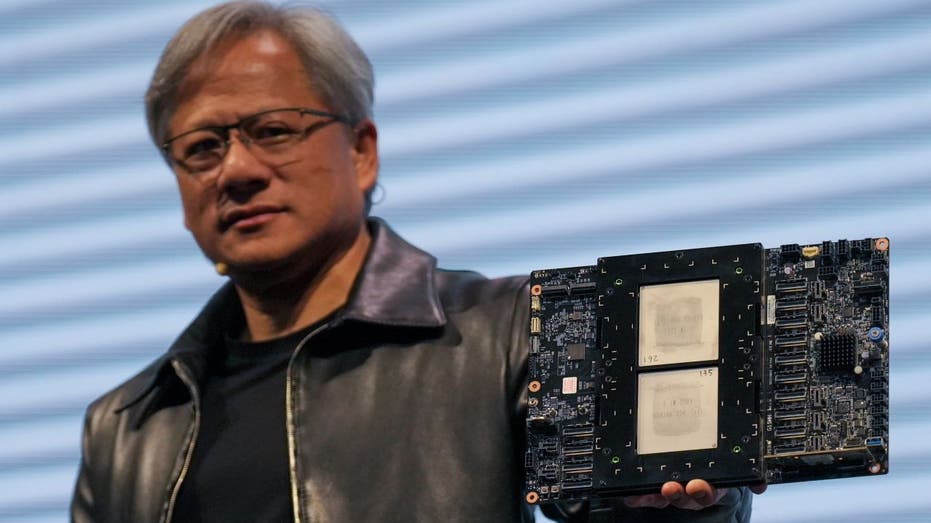

Jensen Huang, President of NVIDIA holding the Grace hopper superchip CPU used for generative AI at supermicro keynote presentation during the COMPUTEX 2023. The COMPUTEX 2023 runs from 30 May to 02 June 2023 and gathers over 1,000 exhibitors from 26 (Photo by Walid Berrazeg/SOPA Images/LightRocket via Getty Images / Getty Images)

On the Hawaiian island of Maui, the Nvidia CEO reportedly owns a large, seven-bedroom home that has beach frontage. The property, part of a luxury gated community, also features a pool in the backyard.

NVIDIA CEO IS $9.6B RICHER AS AI CHIPMAKER’S STOCK SOARS

Hawaii has become a popular destination for the wealthy to purchase property over the years.

The nearly 8,000-square-foot house has belonged to Huang since 2004, when he splashed out $7.5 million to acquire it, according to The Journal.

Huang’s other real estate is located in California, the outlet reported.

An LLC connected to the Nvidia CEO reportedly has ownership of a multi-story, 11,400-plus square foot house in the “Gold Coast” area of San Francisco known for its wealthy residents. It was bought about seven years ago at a $38 million price, according to the outlet.

An aerial view of Jensen Huang’s Gold Coast Mansion in San Francisco, California. (Google Maps / Google Maps)

The old listing for the property said there was a library, in-home fitness center, home theater, multiple fireplaces and other amenities inside the home.

The Wall Street Journal also reported Huang acquired a $6.9 million mansion two decades ago in Los Altos Hills, which is in the same county as Nvidia’s main offices.

An aerial view of Jensen Huang’s home in Los Altos Hills, California. (Google Maps / Google Maps)

JEFF BEZOS ADDS TO FLORIDA REAL ESTATE FOOTPRINT

The house sits on over an acre of land and has a pool, according to Zillow.

Huang’s past real estate holdings include a starter home he sold in the late 80s and a subsequent 2,300-square-foot home he offloaded in 2002, both in San Jose, according to The Journal.

An aerial view of Jensen Huang’s starter home in San Jose, California. (Google Maps / Google Maps)

He reportedly parted ways with the latter, which he bought before starting Nvidia, for $162,000 more than he spent to acquire it.

Huang has run Nvidia as its CEO since co-founding the tech firm in the early 90s. He reportedly once got a design resembling the company’s logo tattooed on his arm.

Jensen Huang, CEO of NVIDIA, speaks during a press conference at the Computex 2023 in Taipei on May 30, 2023. (Sam Yeh/AFP via Getty Images / Getty Images)

The company has seen massive gains recently from the increasing popularity of AI, with its shares posting an over 273% jump over 12 months.

NVIDIA’S STOCK SOARS AFTER AI BOOM LIFTS REVENUE 265%

In the fourth quarter, it brought in $22.1 billion in revenue, a massive increase of 265% from the same period a year ago. Its net income jumped 769% year-over-year.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| NVDA | NVIDIA CORP. | 875.28 | -51.41 | -5.55% |

“Demand is surging worldwide across companies, industries and nations,” Huang said in February of accelerated computing and generative AI.

Uncategorized

Urgent Money Miracle – $2+ EPC! Get Instant 90% Commission Bump

Product Name: Urgent Money Miracle – $2+ EPC! Get Instant 90% Commission Bump

All orders are protected by SSL encryption – the highest industry standard for online security from trusted vendors.

Urgent Money Miracle – $2+ EPC! Get Instant 90% Commission Bump is backed with a 60 Day No Questions Asked Money Back Guarantee. If within the first 60 days of receipt you are not satisfied with Wake Up Lean™, you can request a refund by sending an email to the address given inside the product and we will immediately refund your entire purchase price, with no questions asked.

Uncategorized

NEW! Christian Wealth Manifestation – Highly Targeted For Christians!

Product Name: NEW! Christian Wealth Manifestation – Highly Targeted For Christians!

All orders are protected by SSL encryption – the highest industry standard for online security from trusted vendors.

NEW! Christian Wealth Manifestation – Highly Targeted For Christians! is backed with a 60 Day No Questions Asked Money Back Guarantee. If within the first 60 days of receipt you are not satisfied with Wake Up Lean™, you can request a refund by sending an email to the address given inside the product and we will immediately refund your entire purchase price, with no questions asked.

Uncategorized

Predictions for Mortgage Rates in 2024: What to Expect

As we look ahead to 2024, many homeowners and prospective buyers are wondering what to expect when it comes to mortgage rates. The landscape of the housing market is constantly changing, so it’s important to stay informed about trends and predictions. In this blog post, we will discuss some factors that could impact mortgage rates in 2024 and what homeowners and buyers can expect.

One factor that could impact mortgage rates in 2024 is the overall state of the economy. If the economy is strong and growing, we may see higher mortgage rates as the Federal Reserve looks to combat inflation. On the other hand, if the economy is stagnant or in a recession, we may see lower mortgage rates as the Fed looks to stimulate growth. It’s important to keep an eye on economic indicators such as GDP growth, unemployment rates, and inflation to get a sense of where mortgage rates may be heading.

Another factor that could impact mortgage rates in 2024 is Federal Reserve policy. The Fed plays a key role in setting interest rates, and their decisions can have a ripple effect on mortgage rates. If the Fed decides to raise interest rates in response to inflation, we may see an increase in mortgage rates. Conversely, if the Fed decides to lower interest rates to stimulate growth, we may see a decrease in mortgage rates. Keeping up with the latest news and announcements from the Fed can give homeowners and buyers a sense of where mortgage rates may be heading.

In terms of specific cities and local mortgage companies, it’s important to note that mortgage rates can vary depending on location and lender. For example, in a city like New York City, where real estate prices are high, mortgage rates may be higher compared to a city like Indianapolis, where real estate prices are lower. Additionally, local mortgage companies may offer competitive rates and terms compared to national lenders. For example, in New York City, local lenders like Quontic Bank and CrossCountry Mortgage may offer specialized products and services tailored to the needs of local buyers.

It’s important for homeowners and buyers to shop around and compare rates from multiple lenders to ensure they are getting the best deal. Websites like Bankrate and LendingTree can be helpful resources for comparing rates and terms from multiple lenders. Homeowners and buyers should also consider working with a mortgage broker who can help them navigate the lending process and find the best mortgage product for their needs.

In conclusion, predicting mortgage rates in 2024 is not an exact science, but there are several factors that could impact rates. By staying informed about economic indicators, Federal Reserve policy, and local market trends, homeowners and buyers can make informed decisions about their mortgage. Shopping around and comparing rates from multiple lenders is key to ensuring you are getting the best deal on your mortgage. Whether you’re looking to refinance your existing mortgage or buy a new home, it’s important to stay informed and be proactive in managing your mortgage.

-

Reverse Mortgage1 year ago

Reverse Mortgage1 year agoHow Reverse Loans Can Provide Financial Relief in Retirement

-

Mortgage Rates1 year ago

Mortgage Rates1 year agoComo puedo comprar una casa a crédito si no se nada?

-

Mortgage Rates1 year ago

Mortgage Rates1 year agoNiro Loan App 2024 || Niro App Se Loan Kaise Le || New Loan App Best Instant Loan App Without Cibi

-

Reverse Mortgage1 year ago

Reverse Mortgage1 year agoExploring the Myths and Realities of Reverse Mortgages for Seniors in 2024

-

Reverse Mortgage1 year ago

Reverse Mortgage1 year agoThe Pros and Cons of Using a Reverse Mortgage for Retirement Planning

-

Reverse Mortgage8 months ago

Reverse Mortgage8 months agoThe Benefits of a HECM Loan for Seniors: Financial Freedom in Retirement

-

USDA Mortgage1 year ago

USDA Mortgage1 year agoMaking Your Dream of Country Living a Reality: FMHA Rural Home Loans in Focus

-

Auto Loans6 months ago

Auto Loans6 months agoDrive Away in Your Dream Chevy with Chevrolet’s Hassle-Free Lending Process