Uncategorized

President Biden says he will sign bill banning TikTok

President Joe Biden told reporters on Friday that he would sign the bipartisan Protecting Americans from Foreign Adversary Controlled Applications Act, which would federally the China-based social media app TikTok.

President Biden on Friday said that he would support a ban on TikTok if the bill to ban the controversial China-based social media app was passed in the House and Senate.

Biden was asked on Friday, the day after his State of the Union address, if he would sign a bipartisan bill that would ban TikTok if its China-based parent company ByteDance does not divest its stake in the social media platform.

“If they pass it, I’ll sign it,” Biden said.

TIKTOK FACES BAN IN BIPARTISAN BILL IF BYTEDANCE DOESN’T DIVEST OWNERSHIP

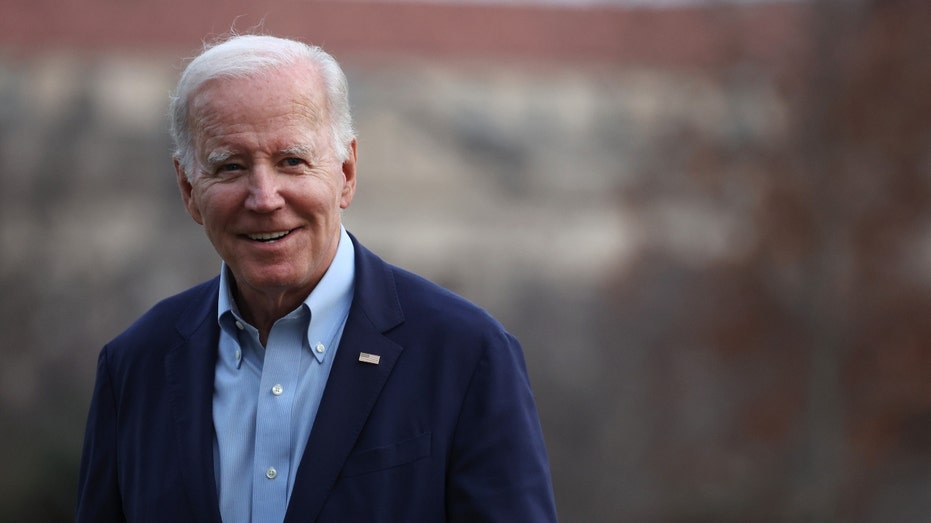

President Biden at the White House in Washington, D.C. (Kevin Dietsch/Getty Images / Getty Images)

Biden’s comments came after the Protecting Americans from Foreign Adversary Controlled Applications Act, which was introduced by Reps. Mike Gallagher, R-Wis., and Raja Krishnamoorthi, D-Ill., passed unanimously in a bipartisan committee.

“This is my message to TikTok: break up with the Chinese Communist Party or lose access to your American users,” Gallagher said in a press release. “America’s foremost adversary has no business controlling a dominant media platform in the United States. TikTok’s time in the United States is over unless it ends its relationship with CCP-controlled ByteDance.”

The bill would require TikTok’s Chinese parent company ByteDance to fully divest all of its applications within 180 days or risk a ban on those apps.

It would also establish a process for the executive branch to ban applications in the future if they are deemed a security risk.

The bill would also require designated social media apps to provide users with a copy of their data in a format that can be imported into another app when they leave the platform.

TikTok (CFOTO/Future Publishing via Getty Images / Getty Images)

Rep. Krishnamoorthi said that the bill aims to “protect” American users from digital surveillance from the Chinese Communist Party (CCP).

BILL BANNING TIKTOK APP HEADED TO HOUSE AFTER UNANIMOUS COMMITTEE VOTE

“So long as it is owned by ByteDance and thus required to collaborate with the CCP, TikTok poses critical threats to our national security,” Krishnamoorthi said. “Our bipartisan legislation would protect American social media users by driving the divestment of foreign adversary-controlled apps to ensure that Americans are protected from the digital surveillance and influence operations of regimes that could weaponize their personal data against them.”

Chairman Rep. Mike Gallagher, R-Wis., left, and ranking member Rep. Raja Krishnamoorthi, D-Ill., are seen during the Select Committee on the Strategic Competition Between the U.S. and the Chinese Communist Party organizational meeting in Washington, (Tom Williams/CQ-Roll Call, Inc via Getty Images / Getty Images)

TikTok has over 170 million users in the U.S. and the ties between parent company ByteDance and the Chinese Communist Party (CCP) have raised concerns that the massive social media platform could serve as a propaganda outlet for the CCP, as well as undermine the mental health of users by surfacing addictive or harmful content in their feeds.

A TikTok spokesperson told FOX Business in a statement, “This bill is an outright ban of TikTok, no matter how much the authors try to disguise it. This legislation will trample the First Amendment rights of 170 million Americans and deprive 5 million small businesses of a platform they rely on to grow and create jobs.”

GET FOX BUSINESS ON THE GO BY CLICKING HERE

The company has previously denied that its parent company shares user data with the CCP.

Fox News’ Eric Revell contributed to this report.

Uncategorized

Urgent Money Miracle – $2+ EPC! Get Instant 90% Commission Bump

Product Name: Urgent Money Miracle – $2+ EPC! Get Instant 90% Commission Bump

All orders are protected by SSL encryption – the highest industry standard for online security from trusted vendors.

Urgent Money Miracle – $2+ EPC! Get Instant 90% Commission Bump is backed with a 60 Day No Questions Asked Money Back Guarantee. If within the first 60 days of receipt you are not satisfied with Wake Up Lean™, you can request a refund by sending an email to the address given inside the product and we will immediately refund your entire purchase price, with no questions asked.

Uncategorized

NEW! Christian Wealth Manifestation – Highly Targeted For Christians!

Product Name: NEW! Christian Wealth Manifestation – Highly Targeted For Christians!

All orders are protected by SSL encryption – the highest industry standard for online security from trusted vendors.

NEW! Christian Wealth Manifestation – Highly Targeted For Christians! is backed with a 60 Day No Questions Asked Money Back Guarantee. If within the first 60 days of receipt you are not satisfied with Wake Up Lean™, you can request a refund by sending an email to the address given inside the product and we will immediately refund your entire purchase price, with no questions asked.

Uncategorized

Predictions for Mortgage Rates in 2024: What to Expect

As we look ahead to 2024, many homeowners and prospective buyers are wondering what to expect when it comes to mortgage rates. The landscape of the housing market is constantly changing, so it’s important to stay informed about trends and predictions. In this blog post, we will discuss some factors that could impact mortgage rates in 2024 and what homeowners and buyers can expect.

One factor that could impact mortgage rates in 2024 is the overall state of the economy. If the economy is strong and growing, we may see higher mortgage rates as the Federal Reserve looks to combat inflation. On the other hand, if the economy is stagnant or in a recession, we may see lower mortgage rates as the Fed looks to stimulate growth. It’s important to keep an eye on economic indicators such as GDP growth, unemployment rates, and inflation to get a sense of where mortgage rates may be heading.

Another factor that could impact mortgage rates in 2024 is Federal Reserve policy. The Fed plays a key role in setting interest rates, and their decisions can have a ripple effect on mortgage rates. If the Fed decides to raise interest rates in response to inflation, we may see an increase in mortgage rates. Conversely, if the Fed decides to lower interest rates to stimulate growth, we may see a decrease in mortgage rates. Keeping up with the latest news and announcements from the Fed can give homeowners and buyers a sense of where mortgage rates may be heading.

In terms of specific cities and local mortgage companies, it’s important to note that mortgage rates can vary depending on location and lender. For example, in a city like New York City, where real estate prices are high, mortgage rates may be higher compared to a city like Indianapolis, where real estate prices are lower. Additionally, local mortgage companies may offer competitive rates and terms compared to national lenders. For example, in New York City, local lenders like Quontic Bank and CrossCountry Mortgage may offer specialized products and services tailored to the needs of local buyers.

It’s important for homeowners and buyers to shop around and compare rates from multiple lenders to ensure they are getting the best deal. Websites like Bankrate and LendingTree can be helpful resources for comparing rates and terms from multiple lenders. Homeowners and buyers should also consider working with a mortgage broker who can help them navigate the lending process and find the best mortgage product for their needs.

In conclusion, predicting mortgage rates in 2024 is not an exact science, but there are several factors that could impact rates. By staying informed about economic indicators, Federal Reserve policy, and local market trends, homeowners and buyers can make informed decisions about their mortgage. Shopping around and comparing rates from multiple lenders is key to ensuring you are getting the best deal on your mortgage. Whether you’re looking to refinance your existing mortgage or buy a new home, it’s important to stay informed and be proactive in managing your mortgage.

-

Reverse Mortgage1 year ago

Reverse Mortgage1 year agoHow Reverse Loans Can Provide Financial Relief in Retirement

-

Mortgage Rates1 year ago

Mortgage Rates1 year agoComo puedo comprar una casa a crédito si no se nada?

-

Mortgage Rates1 year ago

Mortgage Rates1 year agoNiro Loan App 2024 || Niro App Se Loan Kaise Le || New Loan App Best Instant Loan App Without Cibi

-

Reverse Mortgage1 year ago

Reverse Mortgage1 year agoExploring the Myths and Realities of Reverse Mortgages for Seniors in 2024

-

Reverse Mortgage1 year ago

Reverse Mortgage1 year agoThe Pros and Cons of Using a Reverse Mortgage for Retirement Planning

-

Reverse Mortgage8 months ago

Reverse Mortgage8 months agoThe Benefits of a HECM Loan for Seniors: Financial Freedom in Retirement

-

USDA Mortgage1 year ago

USDA Mortgage1 year agoMaking Your Dream of Country Living a Reality: FMHA Rural Home Loans in Focus

-

Auto Loans6 months ago

Auto Loans6 months agoDrive Away in Your Dream Chevy with Chevrolet’s Hassle-Free Lending Process