Uncategorized

NYCB takes more action as CEO works a new business plan

Sheila Bair talks about the crisis at New York Community Bank on ‘The Claman Countdown.’

The incoming CEO of New York Community Bank (NYCB) said Thursday he’s working on a new business plan after the beleaguered bank received a $1 billion lifeline from investors Wednesday. He also announced its second dividend cut this year and revealed a 7% decline in deposits.

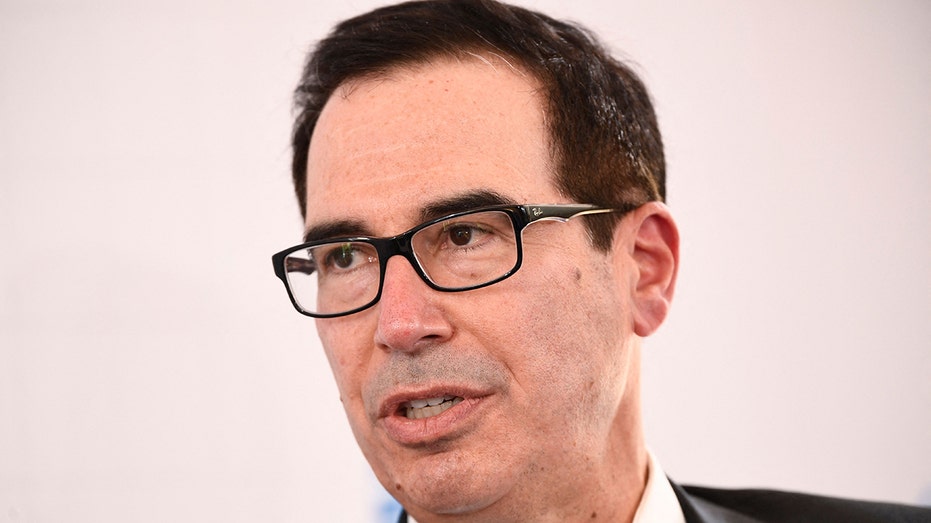

Joseph Otting, former comptroller of the currency for the Trump administration, was named NYCB’s CEO yesterday as the bank received a $1 billion equity infusion from a group of investors that included former Treasury Secretary Steven Mnuchin’s Liberty Strategic Capital and several other firms and members of the bank’s management team.

Otting and non-executive chair Alessandro DiNello said on a call with analysts Thursday they will present a new business plan for the bank in late April. Otting was previously credited with the turnaround of IndyMac, a mortgage lender Mnuchin bought out of the Federal Deposit Insurance Corporation’s (FDIC) receivership in 2009 with an investor group.

The bank reported that it had $77.2 billion in total deposits as of March 5, a decline of about 7% from a month ago when they totaled $83 billion. About 19.8% of its deposits were uninsured, a relatively low concentration compared to peers in the banking industry, and NYCB disclosed it has enough liquidity to offer customers expanded deposit insurance.

EMBATTLED BANK NYCB LANDS $1B INVESTMENT FROM GROUP INCLUDING MNUCHIN’S FIRM

New York Community Bank announced a second dividend cut and a deposit decline, though it noted it has enough liquidity to offer expanded deposit insurance. (Bing Guan/Bloomberg via Getty Images / Getty Images)

DiNello said some customers lined up to withdraw their deposits Wednesday as media reports said the bank was seeking capital, but that stabilized later in the afternoon once the company’s press release was out.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| NYCB | NEW YORK COMMUNITY BANCORP INC. | 3.66 | +0.18 | +5.17% |

NYCB has been trying to stabilize pressure on its stock after it announced a surprise quarterly loss and cut its dividend in late January as it looked to meet stricter regulatory requirements on banks with more than $100 billion in assets.

The lender passed that threshold last year following its 2022 acquisition of Flagstar Bank and its purchase of Signature Bank’s assets following its failure amid the regional banking crisis.

NEW YORK COMMUNITY BANCORP SEEKS CASH INFUSION

Former U.S. Secretary of the Treasury Steven Mnuchin’s Liberty Strategic Capital was part of the investment group that provided NYCB with a $1 billion capital infusion. (Patrick T. Fallon/AFP via Getty Images / Getty Images)

The bank also announced another cut to its quarterly dividend Thursday, reducing it to 1 cent per share rather than the 5 cents it had announced in January.

Investors have focused on NYCB’s exposure to the struggling commercial real estate sector in New York and the bank’s announcement last week that it found “material weakness in the Company’s internal controls related to internal loan review, resulting from ineffective oversight, risk assessment and monitoring activities.”

New York Community Bank’s stock rebounded following the announcement of a $1 billion lifeline from investors. (Bing Guan/Bloomberg via Getty Images / Getty Images)

GET FOX BUSINESS ON THE GO BY CLICKING HERE

NYCB’s stock rose as much as 12% in early trading Thursday, though the market has since pared back some of those gains. Its stock was trading at $3.69 a share as of mid-afternoon Thursday, a gain of 6.65%, although it’s down over 64% year to date.

Reuters contributed to this report.

Uncategorized

Urgent Money Miracle – $2+ EPC! Get Instant 90% Commission Bump

Product Name: Urgent Money Miracle – $2+ EPC! Get Instant 90% Commission Bump

All orders are protected by SSL encryption – the highest industry standard for online security from trusted vendors.

Urgent Money Miracle – $2+ EPC! Get Instant 90% Commission Bump is backed with a 60 Day No Questions Asked Money Back Guarantee. If within the first 60 days of receipt you are not satisfied with Wake Up Lean™, you can request a refund by sending an email to the address given inside the product and we will immediately refund your entire purchase price, with no questions asked.

Uncategorized

NEW! Christian Wealth Manifestation – Highly Targeted For Christians!

Product Name: NEW! Christian Wealth Manifestation – Highly Targeted For Christians!

All orders are protected by SSL encryption – the highest industry standard for online security from trusted vendors.

NEW! Christian Wealth Manifestation – Highly Targeted For Christians! is backed with a 60 Day No Questions Asked Money Back Guarantee. If within the first 60 days of receipt you are not satisfied with Wake Up Lean™, you can request a refund by sending an email to the address given inside the product and we will immediately refund your entire purchase price, with no questions asked.

Uncategorized

Predictions for Mortgage Rates in 2024: What to Expect

As we look ahead to 2024, many homeowners and prospective buyers are wondering what to expect when it comes to mortgage rates. The landscape of the housing market is constantly changing, so it’s important to stay informed about trends and predictions. In this blog post, we will discuss some factors that could impact mortgage rates in 2024 and what homeowners and buyers can expect.

One factor that could impact mortgage rates in 2024 is the overall state of the economy. If the economy is strong and growing, we may see higher mortgage rates as the Federal Reserve looks to combat inflation. On the other hand, if the economy is stagnant or in a recession, we may see lower mortgage rates as the Fed looks to stimulate growth. It’s important to keep an eye on economic indicators such as GDP growth, unemployment rates, and inflation to get a sense of where mortgage rates may be heading.

Another factor that could impact mortgage rates in 2024 is Federal Reserve policy. The Fed plays a key role in setting interest rates, and their decisions can have a ripple effect on mortgage rates. If the Fed decides to raise interest rates in response to inflation, we may see an increase in mortgage rates. Conversely, if the Fed decides to lower interest rates to stimulate growth, we may see a decrease in mortgage rates. Keeping up with the latest news and announcements from the Fed can give homeowners and buyers a sense of where mortgage rates may be heading.

In terms of specific cities and local mortgage companies, it’s important to note that mortgage rates can vary depending on location and lender. For example, in a city like New York City, where real estate prices are high, mortgage rates may be higher compared to a city like Indianapolis, where real estate prices are lower. Additionally, local mortgage companies may offer competitive rates and terms compared to national lenders. For example, in New York City, local lenders like Quontic Bank and CrossCountry Mortgage may offer specialized products and services tailored to the needs of local buyers.

It’s important for homeowners and buyers to shop around and compare rates from multiple lenders to ensure they are getting the best deal. Websites like Bankrate and LendingTree can be helpful resources for comparing rates and terms from multiple lenders. Homeowners and buyers should also consider working with a mortgage broker who can help them navigate the lending process and find the best mortgage product for their needs.

In conclusion, predicting mortgage rates in 2024 is not an exact science, but there are several factors that could impact rates. By staying informed about economic indicators, Federal Reserve policy, and local market trends, homeowners and buyers can make informed decisions about their mortgage. Shopping around and comparing rates from multiple lenders is key to ensuring you are getting the best deal on your mortgage. Whether you’re looking to refinance your existing mortgage or buy a new home, it’s important to stay informed and be proactive in managing your mortgage.

-

Reverse Mortgage1 year ago

Reverse Mortgage1 year agoHow Reverse Loans Can Provide Financial Relief in Retirement

-

Mortgage Rates1 year ago

Mortgage Rates1 year agoComo puedo comprar una casa a crédito si no se nada?

-

Mortgage Rates1 year ago

Mortgage Rates1 year agoNiro Loan App 2024 || Niro App Se Loan Kaise Le || New Loan App Best Instant Loan App Without Cibi

-

Reverse Mortgage1 year ago

Reverse Mortgage1 year agoExploring the Myths and Realities of Reverse Mortgages for Seniors in 2024

-

Reverse Mortgage1 year ago

Reverse Mortgage1 year agoThe Pros and Cons of Using a Reverse Mortgage for Retirement Planning

-

Reverse Mortgage8 months ago

Reverse Mortgage8 months agoThe Benefits of a HECM Loan for Seniors: Financial Freedom in Retirement

-

USDA Mortgage1 year ago

USDA Mortgage1 year agoMaking Your Dream of Country Living a Reality: FMHA Rural Home Loans in Focus

-

Auto Loans6 months ago

Auto Loans6 months agoDrive Away in Your Dream Chevy with Chevrolet’s Hassle-Free Lending Process