Uncategorized

Adam Sandler, ‘Barbie’ stars Margot Robbie and Ryan Gosling top Forbes’ highest-paid actors list

Mattel CEO Ynon Kreiz discusses the toymaker’s sales on ‘The Claman Countdown’ after the ‘Barbie’ movie release.

Adam Sandler had a triumphant 2023, making him Forbes’ highest-paid actor of the year. Accruing $14 million more than the next person on the list, the funnyman proved that having your eggs in more than one basket proves lucrative.

But the Sandman wasn’t the only star to have success last year. “Barbie,” the most profitable film of 2023, had two of its stars on the long list of wealthy names.

Here’s a look at who made the top 10.

‘BARBIE’ AND ‘SUPER MARIO BROS’ LED 2023 BOX OFFICE WITH ‘THE MARVELS’ DISAPPOINTING

Adam Sandler was at the top of Forbes’ highest-paid actors list for 2023. (Rich Polk/NBC via Getty Images / Getty Images)

1. Adam Sandler

Sandler comfortably sits atop the list of affluent stars, raking in $73 million for the year. That includes funds allocated to his manager, lawyer and agent.

Much of Sandler’s success is due in part to his massive contract with Netflix, which he originally signed in 2014 for $250 million and renewed in 2020. Last year, three of Sandler’s movies had enormous success: “Murder Mystery 2” with Jennifer Aniston; “You’re So Not Invited to My Bat Mitzvah,” featuring his wife and two daughters; and the animated flick “Leo.”

Much of Sandler’s income comes from the deal he renewed with Netflix in 2020. (Getty Images / Getty Images)

According to Forbes, Netflix users streamed over 500 million hours of Sandler content last year.

2. Margot Robbie

Margot Robbie is the youngest on Forbes’ highest-paid actors list. (Michael Tran/AFP via Getty Images / Getty Images)

When you’re the star and producer of the year’s most successful movie, you’re bound to see monetary success of your own.

Margot Robbie not only landed herself at No. 2, she’s also the youngest person on the 10-person list. The Australian beauty made $59 million last year.

“Barbie” set box office records for Warner Bros., making nearly $1.5 billion.

3. Tom Cruise

Tom Cruise’s film, “Mission: Impossible Dead Reckoning Part One,” made over $567.5 million worldwide. (Lisa Maree Williams/Getty Images / Getty Images)

Tom Cruise had an exceptional 2023, earning $45 million.

The star’s success can be attributed to his latest “Mission: Impossible” installment, which will have a second part released in 2025. Part one made more than $567.5 million worldwide.

Cruise also continues to reap the benefits of his “Top Gun: Maverick,” film, which premiered in theaters in 2022 but accrued on-demand profits last year.

4. Ryan Gosling and Matt Damon

Ryan Gosling made an enormous amount of money due to the success of his film “Barbie.” (Matt Winkelmeyer/WireImage/Getty Images / Getty Images)

Two Hollywood hunks tied for fourth place, both earning a comfortable $43 million.

Smiliar to his co-star Robbie, Ryan Gosling has benefited from the success of Greta Gerwig’s “Barbie.” His memorable song from the film, “I’m Just Ken,” has streamed over 100 million times on Spotify, according to Forbes.

Matt Damon had a supporting role in the Oscar-nominated film “Oppenheimer.” (Dominique Charriau/WireImage/Getty Images / Getty Images)

CLICK HERE TO READ MORE ON FOX BUSINESS

Matt Damon was in another major movie of the year, “Oppenheimer,” which opened the same weekend as “Barbie.” Despite the film being a blockbuster, Damon earned a relatively low salary of $4 million for his supporting role in the Christopher Nolan flick. Most of Damon’s income came from an acquisition with Amazon. He and partner Ben Affleck sold the rights to their movie “Air” for $130 million.

6. Jennifer Aniston

Jennifer Aniston made $42 million in 2023. (Rich Polk/NBC via Getty Images / Getty Images)

Aniston will always reap the benefits of residuals from her time on the hit sitcom “Friends,” but her new source of income seems to be from her newer series, “The Morning Show,” for which she reportedly makes $2 million an episode.

In addition to that substantial TV deal, Aniston has partnerships with Uber Eats, Vital Proteins and Pvolve Fitness that are a healthy source of income. She made $42 million in 2023.

7. Leonardo DiCaprio and Jason Statham

Leonardo DiCaprio made his money from “Killers of the Flower Moon.” (Valerie Macon/AFP via Getty Images / Getty Images)

Two more Hollywood heartthrobs tied for seventh place, just below Aniston.

Leonardo DiCaprio can mainly thank his Oscar-nominated film, “Killers of the Flower Moon,” for the additional $41 million in his bank account.

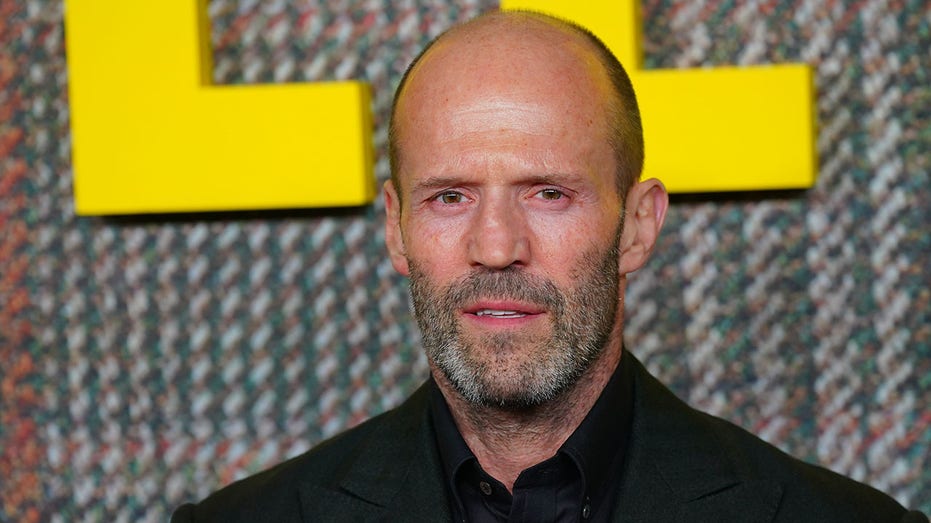

Jason Statham had three high-grossing movies at the box office in 2023. (Victoria Jones/PA Images via Getty Images / Getty Images)

Jason Statham had a busy 2023, starring in several motion pictures, including “Fast X,” “Meg 2: The Trench” and “Expend4bles,” all of which made tens or hundreds of millions of dollars at the box office.

9. Ben Affleck

Ben Affleck’s movie with Matt Damon, “Air,” was sold to Amazon for a large sum before it even began production. (Rodin Eckenroth/FilmMagic/Getty Images / Getty Images)

Like his good pal Damon, Affleck can thank his movie “Air” for the $38 million he made in 2023.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

10. Denzel Washington

Denzel Washington is the oldest on Forbes’ highest-paid actors list at 69. (Ethan Miller/Getty Images / Getty Images)

At 69 years old, Denzel Washington is the oldest actor on this list.

Washington starred in “The Equalizer 3,” which made over $190 million at the box office. He made a cool $24 million in 2023.

Uncategorized

Urgent Money Miracle – $2+ EPC! Get Instant 90% Commission Bump

Product Name: Urgent Money Miracle – $2+ EPC! Get Instant 90% Commission Bump

All orders are protected by SSL encryption – the highest industry standard for online security from trusted vendors.

Urgent Money Miracle – $2+ EPC! Get Instant 90% Commission Bump is backed with a 60 Day No Questions Asked Money Back Guarantee. If within the first 60 days of receipt you are not satisfied with Wake Up Lean™, you can request a refund by sending an email to the address given inside the product and we will immediately refund your entire purchase price, with no questions asked.

Uncategorized

NEW! Christian Wealth Manifestation – Highly Targeted For Christians!

Product Name: NEW! Christian Wealth Manifestation – Highly Targeted For Christians!

All orders are protected by SSL encryption – the highest industry standard for online security from trusted vendors.

NEW! Christian Wealth Manifestation – Highly Targeted For Christians! is backed with a 60 Day No Questions Asked Money Back Guarantee. If within the first 60 days of receipt you are not satisfied with Wake Up Lean™, you can request a refund by sending an email to the address given inside the product and we will immediately refund your entire purchase price, with no questions asked.

Uncategorized

Predictions for Mortgage Rates in 2024: What to Expect

As we look ahead to 2024, many homeowners and prospective buyers are wondering what to expect when it comes to mortgage rates. The landscape of the housing market is constantly changing, so it’s important to stay informed about trends and predictions. In this blog post, we will discuss some factors that could impact mortgage rates in 2024 and what homeowners and buyers can expect.

One factor that could impact mortgage rates in 2024 is the overall state of the economy. If the economy is strong and growing, we may see higher mortgage rates as the Federal Reserve looks to combat inflation. On the other hand, if the economy is stagnant or in a recession, we may see lower mortgage rates as the Fed looks to stimulate growth. It’s important to keep an eye on economic indicators such as GDP growth, unemployment rates, and inflation to get a sense of where mortgage rates may be heading.

Another factor that could impact mortgage rates in 2024 is Federal Reserve policy. The Fed plays a key role in setting interest rates, and their decisions can have a ripple effect on mortgage rates. If the Fed decides to raise interest rates in response to inflation, we may see an increase in mortgage rates. Conversely, if the Fed decides to lower interest rates to stimulate growth, we may see a decrease in mortgage rates. Keeping up with the latest news and announcements from the Fed can give homeowners and buyers a sense of where mortgage rates may be heading.

In terms of specific cities and local mortgage companies, it’s important to note that mortgage rates can vary depending on location and lender. For example, in a city like New York City, where real estate prices are high, mortgage rates may be higher compared to a city like Indianapolis, where real estate prices are lower. Additionally, local mortgage companies may offer competitive rates and terms compared to national lenders. For example, in New York City, local lenders like Quontic Bank and CrossCountry Mortgage may offer specialized products and services tailored to the needs of local buyers.

It’s important for homeowners and buyers to shop around and compare rates from multiple lenders to ensure they are getting the best deal. Websites like Bankrate and LendingTree can be helpful resources for comparing rates and terms from multiple lenders. Homeowners and buyers should also consider working with a mortgage broker who can help them navigate the lending process and find the best mortgage product for their needs.

In conclusion, predicting mortgage rates in 2024 is not an exact science, but there are several factors that could impact rates. By staying informed about economic indicators, Federal Reserve policy, and local market trends, homeowners and buyers can make informed decisions about their mortgage. Shopping around and comparing rates from multiple lenders is key to ensuring you are getting the best deal on your mortgage. Whether you’re looking to refinance your existing mortgage or buy a new home, it’s important to stay informed and be proactive in managing your mortgage.

-

Reverse Mortgage1 year ago

Reverse Mortgage1 year agoHow Reverse Loans Can Provide Financial Relief in Retirement

-

Mortgage Rates1 year ago

Mortgage Rates1 year agoComo puedo comprar una casa a crédito si no se nada?

-

Mortgage Rates1 year ago

Mortgage Rates1 year agoNiro Loan App 2024 || Niro App Se Loan Kaise Le || New Loan App Best Instant Loan App Without Cibi

-

Reverse Mortgage1 year ago

Reverse Mortgage1 year agoExploring the Myths and Realities of Reverse Mortgages for Seniors in 2024

-

Reverse Mortgage1 year ago

Reverse Mortgage1 year agoThe Pros and Cons of Using a Reverse Mortgage for Retirement Planning

-

Reverse Mortgage8 months ago

Reverse Mortgage8 months agoThe Benefits of a HECM Loan for Seniors: Financial Freedom in Retirement

-

USDA Mortgage1 year ago

USDA Mortgage1 year agoMaking Your Dream of Country Living a Reality: FMHA Rural Home Loans in Focus

-

Auto Loans6 months ago

Auto Loans6 months agoDrive Away in Your Dream Chevy with Chevrolet’s Hassle-Free Lending Process