Uncategorized

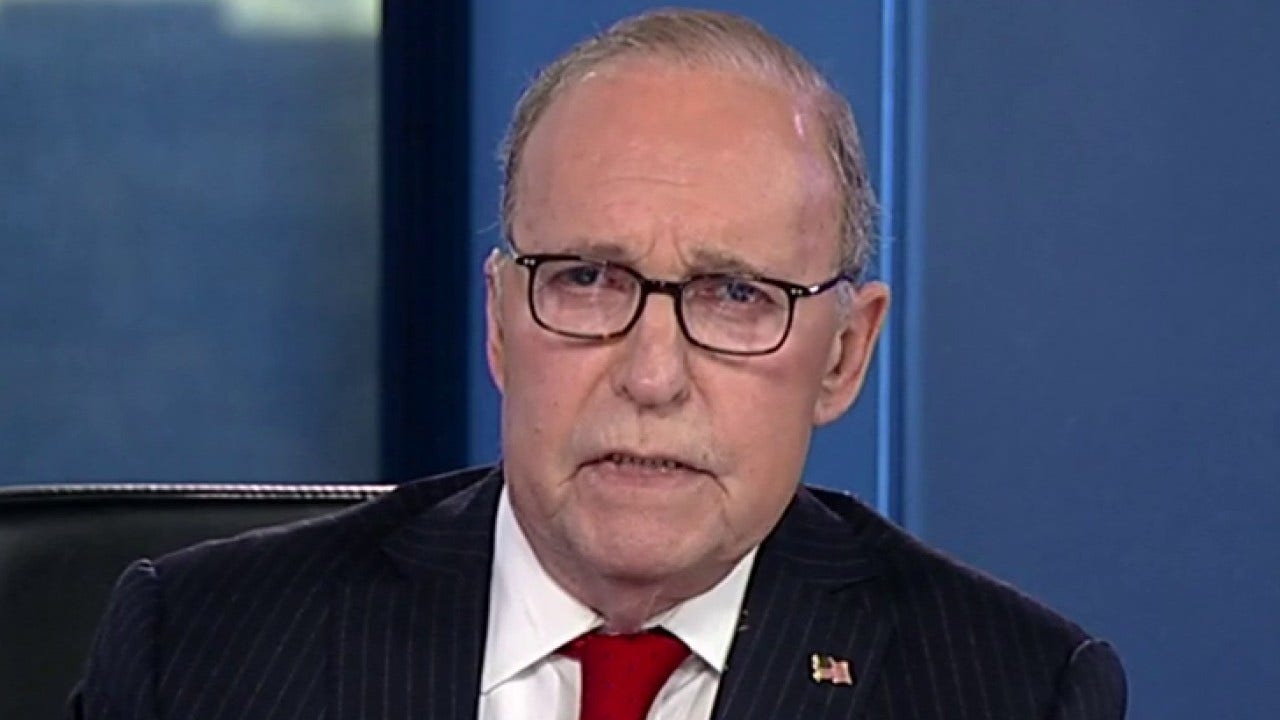

Larry Kudlow calls out Biden’s policies ahead of the State of the Union

FOX Business host Larry Kudlow reflects on the president’s leadership ahead of his State of the Union address on ‘Kudlow.’

Americans are accustomed to a prosperous, confident and happy State of the Union. All right, that’s their normal attitude, but these are not normal times. Under Joe Biden, the American condition looks like its unhappy, somewhat demoralized and even fearful.

Now, a recent poll shows 43% believe Joe Biden policies have actually hurt them and the same poll shows that the lives of working class Blacks, Latinos, Whites, women, other groups, they’re actually better off under Donald Trump than they were under Joe Biden.

Biden has spent $6 trillion of Democratic pork on climate and welfare and woke schools and student debt and other crazy boondoggles, but all that’s done is jacked up inflation. It hasn’t made people any happier. High prices for basic goods like groceries and gasoline or home mortgages, all that’s been killing off the middle class.

LAYOFFS SURGED IN FEBRUARY TO HIGHEST LEVEL SINCE 2009

Sen. Marco Rubio, R-Fla., discusses how the Biden administration will respond to the Israel-Hamas war as some Biden supporters call for a ceasefire on ‘Kudlow.’

Under Joe Biden, the workforce has taken a pay cut. Listen to this. From a real weekly wage of $399 when Joe Biden took office to a decline of $380 most recently. That is a drop of 4.9% a pay cut. Under President Trump over the same period, they had a pay hike of over 9%. Right.

Given a choice, I think folks would rather have a pay increase than a pay cut. Meanwhile, illegal immigrant crime is causing fear in the streets, towns and cities across the country. Fear is not the natural state for America, but now we’re told Mr. Biden wants to raise taxes on successful companies and entrepreneurs. That’s just more left wing, progressive, democratic pap. All it’s going to do is depress the economy.

All it’s going to do is reduce tax revenues and ironically, Donald Trump’s successful tax cuts are probably the biggest source of economic stimulus in the economy today. Go figure. Anyway, it’s all been driven by after tax profits from Trump’s tax cuts. Anyway, Joe Biden wants to squelch all that. It is just the stupidest thing I’ve ever seen and finally, how is this a business about shrinkflation and cookie monsters, this is about Biden inflation, not serious business.

That’s all there is to it, but remember, liberals always hate business, even though business creates jobs and business creates higher wages. Meanwhile, countries bombing each other all over the world right now in the U.S. looks like a helpless, powerless bystander.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Finally, Americans are sick and tired of being told what to do or what not to do, what appliances, what cars to buy or what they can’t buy, and I think they are sick of it. That’s what the collectivist government or big government socialism does to you. A bunch of overeducated, permanent bureaucrats in Washington, DC trying to dictate how ordinary working folks can live their lives in mainstream America.

People are fed up with it. They are sick of it. The question is whether Joe Biden’s going to do anything to change it. Well, folks, don’t hold your breath on that one, but there is a guy down in Mar-A-Lago, Florida, who’s just itching for a second bite out of the apple. Least that’s what I hear and that is my riff.

This article is adapted from Larry Kudlow’s opening commentary on the March 7, 2024, edition of “Kudlow.”

Uncategorized

Urgent Money Miracle – $2+ EPC! Get Instant 90% Commission Bump

Product Name: Urgent Money Miracle – $2+ EPC! Get Instant 90% Commission Bump

All orders are protected by SSL encryption – the highest industry standard for online security from trusted vendors.

Urgent Money Miracle – $2+ EPC! Get Instant 90% Commission Bump is backed with a 60 Day No Questions Asked Money Back Guarantee. If within the first 60 days of receipt you are not satisfied with Wake Up Lean™, you can request a refund by sending an email to the address given inside the product and we will immediately refund your entire purchase price, with no questions asked.

Uncategorized

NEW! Christian Wealth Manifestation – Highly Targeted For Christians!

Product Name: NEW! Christian Wealth Manifestation – Highly Targeted For Christians!

All orders are protected by SSL encryption – the highest industry standard for online security from trusted vendors.

NEW! Christian Wealth Manifestation – Highly Targeted For Christians! is backed with a 60 Day No Questions Asked Money Back Guarantee. If within the first 60 days of receipt you are not satisfied with Wake Up Lean™, you can request a refund by sending an email to the address given inside the product and we will immediately refund your entire purchase price, with no questions asked.

Uncategorized

Predictions for Mortgage Rates in 2024: What to Expect

As we look ahead to 2024, many homeowners and prospective buyers are wondering what to expect when it comes to mortgage rates. The landscape of the housing market is constantly changing, so it’s important to stay informed about trends and predictions. In this blog post, we will discuss some factors that could impact mortgage rates in 2024 and what homeowners and buyers can expect.

One factor that could impact mortgage rates in 2024 is the overall state of the economy. If the economy is strong and growing, we may see higher mortgage rates as the Federal Reserve looks to combat inflation. On the other hand, if the economy is stagnant or in a recession, we may see lower mortgage rates as the Fed looks to stimulate growth. It’s important to keep an eye on economic indicators such as GDP growth, unemployment rates, and inflation to get a sense of where mortgage rates may be heading.

Another factor that could impact mortgage rates in 2024 is Federal Reserve policy. The Fed plays a key role in setting interest rates, and their decisions can have a ripple effect on mortgage rates. If the Fed decides to raise interest rates in response to inflation, we may see an increase in mortgage rates. Conversely, if the Fed decides to lower interest rates to stimulate growth, we may see a decrease in mortgage rates. Keeping up with the latest news and announcements from the Fed can give homeowners and buyers a sense of where mortgage rates may be heading.

In terms of specific cities and local mortgage companies, it’s important to note that mortgage rates can vary depending on location and lender. For example, in a city like New York City, where real estate prices are high, mortgage rates may be higher compared to a city like Indianapolis, where real estate prices are lower. Additionally, local mortgage companies may offer competitive rates and terms compared to national lenders. For example, in New York City, local lenders like Quontic Bank and CrossCountry Mortgage may offer specialized products and services tailored to the needs of local buyers.

It’s important for homeowners and buyers to shop around and compare rates from multiple lenders to ensure they are getting the best deal. Websites like Bankrate and LendingTree can be helpful resources for comparing rates and terms from multiple lenders. Homeowners and buyers should also consider working with a mortgage broker who can help them navigate the lending process and find the best mortgage product for their needs.

In conclusion, predicting mortgage rates in 2024 is not an exact science, but there are several factors that could impact rates. By staying informed about economic indicators, Federal Reserve policy, and local market trends, homeowners and buyers can make informed decisions about their mortgage. Shopping around and comparing rates from multiple lenders is key to ensuring you are getting the best deal on your mortgage. Whether you’re looking to refinance your existing mortgage or buy a new home, it’s important to stay informed and be proactive in managing your mortgage.

-

Reverse Mortgage1 year ago

Reverse Mortgage1 year agoHow Reverse Loans Can Provide Financial Relief in Retirement

-

Mortgage Rates1 year ago

Mortgage Rates1 year agoComo puedo comprar una casa a crédito si no se nada?

-

Mortgage Rates1 year ago

Mortgage Rates1 year agoNiro Loan App 2024 || Niro App Se Loan Kaise Le || New Loan App Best Instant Loan App Without Cibi

-

Reverse Mortgage1 year ago

Reverse Mortgage1 year agoExploring the Myths and Realities of Reverse Mortgages for Seniors in 2024

-

Reverse Mortgage1 year ago

Reverse Mortgage1 year agoThe Pros and Cons of Using a Reverse Mortgage for Retirement Planning

-

Reverse Mortgage8 months ago

Reverse Mortgage8 months agoThe Benefits of a HECM Loan for Seniors: Financial Freedom in Retirement

-

USDA Mortgage1 year ago

USDA Mortgage1 year agoMaking Your Dream of Country Living a Reality: FMHA Rural Home Loans in Focus

-

Auto Loans6 months ago

Auto Loans6 months agoDrive Away in Your Dream Chevy with Chevrolet’s Hassle-Free Lending Process